FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

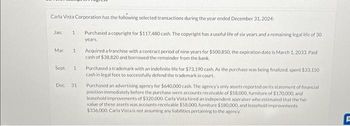

Transcribed Image Text:Carla Vista Corporation has the following selected transactions during the year ended December 31, 2024:

Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30

years.

Mar. 1

Sept. 1

Dec. 31

Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid

cash of $38,820 and borrowed the remainder from the bank.

Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150

cash in legal fees to successfully defend the trademark in court.

Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial

position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and

leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair

value of these assets was accounts receivable $58,000, furniture $180,000, and leasehold improvements

$336,000. Carla Vista is not assuming any liabilities pertaining to the agency.

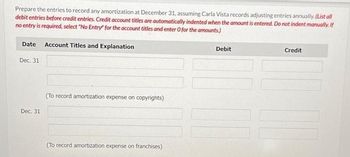

Transcribed Image Text:Prepare the entries to record any amortization at December 31, assuming Carla Vista records adjusting entries annually. (List all

debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If

no entry is required, select "No Entry" for the account titles and enter O for the amounts)

Date Account Titles and Explanation

Dec. 31

Dec. 31

(To record amortization expense on copyrights)

(To record amortization expense on franchises)

Debit

Credit

10.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the February payroll and the payment of the payroll. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Feb. 28 (To record payroll.) (To record payment of payroll.) Feb. 28arrow_forwardDo not give answer in imagearrow_forwardBoth parts pls!arrow_forward

- Newarrow_forwardIvanhoe Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual rental payments of $53,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 7%; Ivanhoe's incremental borrowing rate is 9%. Ivanhoe is unaware of the rate being used by the lessor. At the end of the lease, Ivanhoe has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Ivanhoe uses the straight-line method of depreciation on similar owned equipment. (a) Your answer is correct. Prepare the journal entries, that Ivanhoe should record on December 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round…arrow_forwardThe company determines that the interest expense on a note payable for the period ending December 31 is $490. This amount is payable on January 1. Journalize these transactions for December 31 and January 1. If an amount box does not require an entry, leave it blank.arrow_forward

- Prepare all necessary journal entries for Sheridan for 2025. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 0 decimal places e.g. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation (To record the lease) (To record the first lease payment) Debit 110 Creditarrow_forwardThe following are selected 2020 transactions of Teal Corporation. Purchased inventory from Ripken Company on account for $125,000. Teal records purchases gross and uses a periodic inventory system. Sept. 1 Issued a $125,000, 12-month, 12% note to Ripken in payment of account. Borrowed $125,000 from the Shore Bank by signing a 12-month, zero-interest-bearing $145,000 note. Oct. 1 Oct. 1 (a) Your answer has been saved. See score details after the due date. Prepare journal entries for the selected transactions above. (If no entry is required, select "NO Entry" for the account titles and enter Ofor the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record entries in the order displayed in the problem statement.) Date Account Titles and Explanation Debit Credit eptember 1 v Purchases 125,000 Accounts Payable 125,000 Ictober 1 Accounts Payable 125,000 Notes Payable 125,000 ober 1 Cash 125,000 Discount on Notes Payable 20,000 Notes…arrow_forwardComplete all part and sub part Proper solution And Do not Give solu tion in image formetarrow_forward

- At the end of 2023, Novak Corporation owns a licence with a carrying amount of $508,000. Novak expects undiscounted future cash flows from this licence to total $512,500. The licence's fair value is $404,000 and disposal costs are estimated to be nil. The licence's discounted cash flows (that is, value in use) are estimated to be $458,000. Assume that the licence was granted in perpetuity and has an indefinite life, and that Novak prepares financial statements in accordance with ASPE. Assume that the licence was granted in perpetuity and has an indefinite life. Determine if the licence is impaired at the end of 2023. The licence Prepare any related entry that is necessary. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) at the end of 2023. Account Titles and Explanation eTextbook and Media List of…arrow_forward11. Subject :- Accountingarrow_forwardit was wrong i need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education