FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

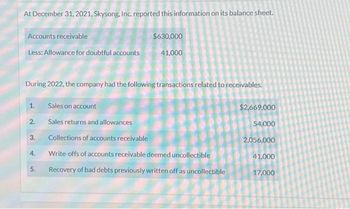

Transcribed Image Text:At December 31, 2021, Skysong, Inc. reported this information on its balance sheet.

Accounts receivable

Less: Allowance for doubtful accounts

During 2022, the company had the following transactions related to receivables.

1.

2.

3.

4.

5.

$630,000

41,000

Sales on account

Sales returns and allowances

Collections of accounts receivable

Write-offs of accounts receivable deemed uncollectible

Recovery of bad debts previously written off as uncollectible

$2,669.000

54,000

2,056,000

41,000

17,000

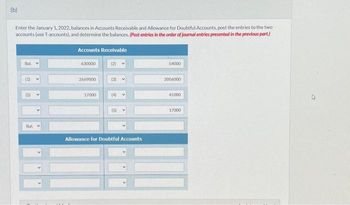

Transcribed Image Text:(b)

Enter the January 1, 2022, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two

accounts (use T-accounts), and determine the balances. (Post entries in the order of journal entries presented in the previous part.)

Bal

(1)

(5)

Bal

Accounts Receivable

630000

2669000

17000

(2)

(3)

(4) V

(5)

Allowance for Doubtful Accounts

54000

2056000

41000

17000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Harlan Company uses the Allowance method for accounting for receivables. They had the following information as of December 31, 2022: Net Credit Sales, year 2022 6,867,750 Accounts Receivable, December 31, 2021 655,000 Accounts Receivable, December 31, 2022 745,000 Allowance for Doubtful Accounts, December 31, 2022 4,350 Credit Harlan Company estimates that 2% of the Accounts Receivable will become uncollectible. What are some things that a company can do to improve the collection of its Accounts Receivable? On January 7, 2023 it was determined that Bundy Company’s account in the amount of $3,800 will be uncollectible. Prepare the entry to write off the Bundy Company account. What is the Cash Realizable Value of the receivables after the write-off of the Bundy Company account?arrow_forwardGive me correct answer with explanation.vkarrow_forwardCurrent Attempt in Progress * Your answer is incorrect. Crane Inc. has evaluated its process of calculating estimates of uncollectible accounts receivable. In the past, Crane calculated the Bad Debt Expense as a percentage of sales. It recorded Bad Debt Expense at 1% of sales. Due to changes in the economic conditions, Crane will increase that percentage to 3%. The change is made on January 1, 2025. Salles in 2023 were $1630000 and $3130000 in 2024. Sales in 2025 total $4130000. What is the Bad Debt Expense that Crane will record for 2025? $159100 Ⓒ $217800 O $41300 O $123900 e Textbook and Media Save for Later Attempts: 1 of 2 used Submit Answerarrow_forward

- The annual report for Fabeck Finishing Corporation contained the following information: (in millions) Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net 2021 $673 32 $641 Assume that accounts receivable write-offs amounted to $13 during 2021 and $3 during 2020, and that Fabeck Finishing did not record any recoveries. Bad Debt Expense 2020 $735 31 $704 Required: Determine the Bad Debt Expense for 2021 based on the above facts. (Enter your answer in millions.) millionarrow_forwardS&R Company uses the aging of accounts receivable approach to estimate bad debt expense. On December 31, an analysis of accounts receivable revealed the following: Schedule of Accounts Receivable by Age December 31, 2022 Accounts Receivable Age of Accounts Receivable Expected Percentage Uncollect 130,000 50,000 18,000 3,000 9,000 210,000 Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Required: (a) Calculate the amount of allowance for doubtful accounts that should be reported on the balance sheet at December 31, 2022. (b) Calculate the amount of bad debts expense that should be reported on the 2022 income statement, assuming that the balance of Allowance for Doubtful Accounts on January 1 was $46,000 (credit balance) and accounts receivable written off during the year totaled $49,000 (c) Present the appropriate general journal entry to record bad debts expense on December 31, 2022. (d) Show how accounts receivable will appear on the balance…arrow_forwardFDNACCT Co. has the following balances on December 31, 2021 before any adjustments: Accounts Receivable = P920,000 Allowance for Doubtful Accounts = P3,250 Total credit sales = P3,000,000 Provision for doubtful accounts is estimated at 5% of Accounts Receivable. How much should be credited to the Allowance for Doubtful Accounts as adjustment?arrow_forward

- Pharoah Ltd. prepared an aging of its accounts receivable at December 31, 2023 and determined that the net realizable value of the receivables was $324800. Additional information for calendar 2023 follows: Allowance for expected credit losses, beginning $38080 Uncollectible account written off during year 25760 Accounts receivable, ending 358400 Uncollectible accounts recovered during year 5600 For the year ended December 31, 2023, Pharoah's loss on impairment should be $20000. $15680. ○ $17920. $25760.arrow_forwardHogenson Company estimates bad debt expense at 0.60% of credit sales. The company reported accounts receivable and allowance for uncollectible accounts of $481,000 and $1,480 respectively on December 31, 2018. During 2019, Hogenson Company's credit sales and collections were $325,000 and $316,000, respectively, and $1,870 in accounts receivable were written off. Determine the company’s net realizable value of accounts receivable on December 31, 2019. A. $488,440.B. $484,700.C. $486,570. D. $469,020.arrow_forwardAt January 1, 2024, Kennel Inc. reported the following information on its statement of financial position: Accounts receivable Allowance for expected credit losses During 2024, the company had the following summary transactions for receivables: 1. 2. 3. 4. 5. 6. Show Transcribed Text Sales on account, $1.670,000; cost of goods sold, $935.200; return rate of 7% Selling price of goods returned, $83.000: cost of goods returned to inventory, $46,480 Collections of accounts receivable, $1,600,000 Write-offs of accounts receivable deemed uncollectible, $47,000 Collection of accounts previously written off as uncollectible, $13,000 After considering all of the above transactions, total estimated uncollectible accounts, $29,000 (1) Bal v (4) $500,000 46,000 Your answer is partially correct. (1) Prepare T accounts for Accounts Receivable and Allowance for Expected Credit Losses, (2) enter the opening balances, (3) post the above summary entries, and (4) determine the ending balances. (Post…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education