Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

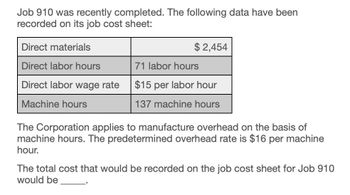

Transcribed Image Text:Job 910 was recently completed. The following data have been

recorded on its job cost sheet:

Direct materials

Direct labor hours

$ 2,454

71 labor hours

Direct labor wage rate

$15 per labor hour

137 machine hours

Machine hours

The Corporation applies to manufacture overhead on the basis of

machine hours. The predetermined overhead rate is $16 per machine

hour.

The total cost that would be recorded on the job cost sheet for Job 910

would be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Exotic Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: The average shop direct labor rate is 37.50 per hour. Determine the predetermined shop overhead rate per direct labor hour.arrow_forwardCompute the total job cost for each of the following scenarios: a. If the direct labor cost method is used in applying factory overhead and the predetermined rate is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct materials used totaled 5,000 and that the direct labor cost totaled 3,200. b. If the direct labor hour method is used in applying factory overhead and the predetermined rate is 10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, and the number of direct labor hours totaled 250. c. If the machine hour method is used in applying factory overhead and the predetermined rate is 12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, the direct labor hours were 250 hours, and the machine hours were 295 hours.arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forward

- Inez has the following information relating to Job AA5. Direct material cost was $200,000, direct labor was $36,550, and overhead applied on the basis of direct labor hours was $73,100. What was the predetermined overhead rate using the labor rate of $17 per hour?arrow_forwardJob 19AB required 10,000 for direct materials, 4,000 for direct labor, 300 direct labor hours, 150 machine hours, three material moves, and five component parts. The cost pools and overhead rates for each pool follow: Determine the cost of Job 19AB using the ABC method.arrow_forwardYork Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forward

- Job order cost sheets show the following costs assigned to each job: The company assigns overhead at $1.25 for each direct labor dollar spent. What is the total cost for each of the jobs?arrow_forwardChester Company provided information on overhead for its three producing departments as follows: Overhead is applied on the basis of machine hours in Fabricating and direct labor hours in Assembly and in Finishing. Job #13-198 had total prime cost of 6,700. The job took 40 machine hours in Fabricating, 100 direct labor hours in Assembly, and 20 direct labor hours in Finishing. What is the total cost of Job# 13-198? a. 6,700.00 b. 1,523.20 c. 8,223.20 d. 7,383.20arrow_forwardThe following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forward

- A company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forwardQueen Bees Honey, Inc., estimated its annual overhead to be $110,000 and based its predetermined overhead rate on 27,500 direct labor hours. At the end of the year, actual overhead was $106,000 and the total direct labor hours were 29,000. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardLeen Production Co. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of May: a. Compute the total production cost of each job. b. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. c. Compute the selling price per unit for each job, assuming a mark-on percentage of 40%. d. Prepare the journal entries to record the sale of Job 1065.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,