Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Account

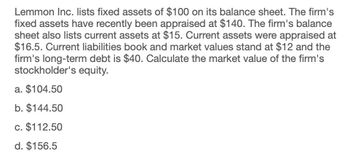

Transcribed Image Text:Lemmon Inc. lists fixed assets of $100 on its balance sheet. The firm's

fixed assets have recently been appraised at $140. The firm's balance

sheet also lists current assets at $15. Current assets were appraised at

$16.5. Current liabilities book and market values stand at $12 and the

firm's long-term debt is $40. Calculate the market value of the firm's

stockholder's equity.

a. $104.50

b. $144.50

c. $112.50

d. $156.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lemmon Incorporated lists fixed assets of $100 on its balance sheet. The firm's fixed assets have recently been appraised at $140. The firm's balance sheet also lists current assets at $15. Current assets were appraised at $16.50. Current liabilities book and market values stand at $12 and the firm's long-term debt is $40. Calculate the market value of the firm's stockholders' equityarrow_forwardCalculate the market value of the firm's stockholder's equityarrow_forwardLawson Corporation lists fixed assets of $250 on its balance sheet. The firm's fixed assets have recently been appraised at $390. The firm's balance sheet also lists current assets at $85. Current assets were appraised at $97.5. Current liabilities book and market values stand at $72 and the firm's long-term debt is $165. Calculate the market value of the firm's stockholder's equity. a. $104.50 b. $244.5 c. $250.5 d. $128.30 solve this Accounting problemarrow_forward

- Lawson Corporation lists fixed assets of $250 on its balance sheet. The firm's fixed assets have recently been appraised at $390. The firm's balance sheet also lists current assets at $85. Current assets were appraised at $97.5. Current liabilities book and market values stand at $72 and the firm's long-term debt is $165. Calculate the market value of the firm's stockholder's equity. a. $104.50 b. $244.5 c. $250.5 d. $128.30 provide answerarrow_forwardFinancial Accountingarrow_forwardGeneral Accountingarrow_forward

- Ava’s SpinBall Corp. lists fixed assets of $31 million on its balance sheet. The firm’s fixed assets have recently been appraised at $54 million. Ava’s SpinBall Corp.’s balance sheet also lists current assets at $24 million. Current assets were appraised at $44 million. Current liabilities’ book and market values stand at $6 million, and the firm’s book and market values of long-term debt are $26 million. Calculate the book and market values of the firm’s stockholders’ equity. Construct the book value and market value balance sheets for Ava’s SpinBall Corp. (Enter your answers in millions of dollars.) BOOK VALUE MARKET VALUE (in millions of dollars) Assets Current assets Fixed assets Total $0 $0 Liabilities and Equity Current liabilities Long-term debt Stockholders' equity Total $0 $0arrow_forwardAperture science has net working capital ofarrow_forwardAva’s SpinBall Corp. lists fixed assets of $12 million on its balance sheet. The firm’s fixed assets have recently been appraised at $16 million. Ava’s SpinBall Corp.’s balance sheet also lists current assets at $5 million. Current assets were appraised at $6 million. Current liabilities’ book and market values stand at $3 million and the firm’s book and market values of long-term debt are $7 million. Calculate the book and market values of the firm’s stockholders’ equity. Construct the book value and market value balance sheets for Ava’s SpinBall Corp.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning