Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

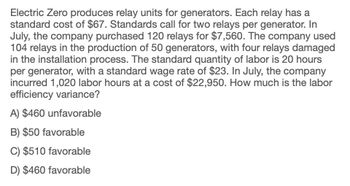

Transcribed Image Text:Electric Zero produces relay units for generators. Each relay has a

standard cost of $67. Standards call for two relays per generator. In

July, the company purchased 120 relays for $7,560. The company used

104 relays in the production of 50 generators, with four relays damaged

in the installation process. The standard quantity of labor is 20 hours

per generator, with a standard wage rate of $23. In July, the company

incurred 1,020 labor hours at a cost of $22,950. How much is the labor

efficiency variance?

A) $460 unfavorable

B) $50 favorable

C) $510 favorable

D) $460 favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forwardMarkson and Sons leases a copy machine with terms that include a fixed fee each month plus acharge for each copy made. Markson made 9,000 copies and paid a total of $480 in January. In April, they paid $320 for 5,000 copies. What is the variable cost per copy if Markson uses the high-low method to analyze costs?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Beat Company manufactures 8,000 units of a certain component per year. This component is used in the production of the main product. The following are the costs to make the component per unit: Direct materials $4 Direct labor $4 Variable overhead $3 Fixed overhead $5 If Beat Company buys the component from an outside supplier, the company can rent out the released facilities for P12,360 a year. The cost of the component per unit as quoted by the supplier is P15. 25% of fixed overhead applied in the manufacture of the component will continue regardless of what decision is made. For all purchase made by the company, freight and handling costs are applied at 2% of the purchase price. The direct materials cost presented above is exclusive of such freight and handling cost. What is the advantage or disadvantage of buying the component?A. P12,240 advantage B. 24,600 advantage C. 5,400 disadvantage D. 8,600 advantagearrow_forwardDuring its first year of operations, Connor Company paid $37,510 for direct materials and $18,900 in wages for production workers. Lease payments and utilities on the production facilities amounted to $7,900. General, selling, and administrative expenses were $8,900. The company produced 5,900 units and sold 4,900 units for $15.90 a unit. The average cost to produce one unit is which of the following amounts? Multiple Choice O O O $9.27 $13.12 $12.41 $10.90arrow_forwardVintage Audio Inc. manufactures audio speakers. Each speaker requires $96 per unit of direct materials. The speaker manufacturing assembly cell includes the following estimated costs for the period: Speaker assembly cell, estimated costs: Labor Depreciation Supplies Power Total cell costs for the period The operating plan calls for 195 operating hours for the period. Each speaker requires 12 minutes of cell process time. The unit selling price for ach speaker is $260. During the period, the following transactions occurred: 1. Purchased materials to produce 650 speaker units. 2. Applied conversion costs to production of 620 speaker units. 3. Completed and transferred 590 speaker units to finished goods. 4. Sold 565 speaker units. There were no inventories at the beginning of the period. a. Journalize the summary transactions (1)-(4) for the period. Round the per unit cost to the nearest cent and use in subsequent computations. If an amount box does not require an entry, leave it blank.…arrow_forward

- Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,800 units, and monthly production costs for the production of 1,400 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costs Direct materials Direct labor Utilities ($110 fixed) Supervisor's salary Maintenance ($350 fixed) Depreciation Required: 1. Identify each cost as variable, fixed, or mixed, and express each cost as a rate per month or per unit (or combination thereof). 2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove. 3. State Morning Dove's linear cost equation for a production level of 0 to1,800 units. Enter answer as an equation in the form of y= a + bx. 4. Calculate Morning Dove's expected total cost if production increased to 1,600 units per month. Enter answer as an equation in the form of y= a…arrow_forwardBeta makes a component used in its engine. Monthly production costs for 1,000 component units are as follows: Direct materials $46,000 Direct labor 11,500 Variable overhead costs 34,500 Fixed overhead costs 23,000 Total costs $115,000 It is estimated that 8% of the fixed overhead costs will no longer be incurred if the company purchases the component from an outside supplier. Beta has the option of purchasing the component from an outside supplier at $97.75 per unit. 22) If Beta accepts the offer from the outside supplier, the monthly avoidable costs (costs that will no longer be incurred) total 23) If Beta purchases 1,000 units from the outside supplier per month, then what would be the change in operating income?arrow_forwardRodeo Jeans are stonewashed under a contract with independent USA Denim Company. USA Denim purchased two semiautomatic machinesthat cost $19,000 each at (t = 0). Annual operating and maintenance costs are $15,000 per machine. Two years after purchasing the machines, USA Denim made them fully automatic at a cost of $12,000 per machine. In the fully automatic mode, the operating and maintenance costs are $6,000 the first year, increasing by $1,000 each year thereafter. The contract with Rodeo Company is for 8 years. Draw the cash flow diagram for all of USA Denim’s investment and other costs assuming the contract will not be extended beyond 8 years.arrow_forward

- Sheridan Company purchases sails and produces sailboats. It currently produces 1,270 sailboats per year, operating at normal capacity, which is about 80% of full capacity. Sheridan purchases sails at $268 each, but the company is considering using the excess capacity to manufacture the sails instead. The manufacturing cost per sail would be $98 for direct materials, $86 for direct labor, and $90 for total manufacturing overhead. The $90 total manufacturing overhead includes $78,740 of annual fixed overhead that is allocated using normal capacity. The president of Sheridan has come to you for advice. "It would cost me $274 to make the sails," she says, "but only $268 to buy them. Should I continue buying them, or have I missed something?" (a) Prepare a per unit analysis of the differential costs. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Make Sails Direct material $ Direct labor Variable overhead Purchase price Total…arrow_forwardEvery year Riverbed Industries manufactures 7,300 units of part 231 for use in its production cycle. The per unit costs of part 231 are as follows: Direct materials $ 5.00 Direct labor 11.00 Variable manufacturing overhead 6.00 Fixed manufacturing overhead 10.00 Total $32.00 Ivanhoe, Inc., has offered to sell 7,300 units of part 231 to Riverbed for $34 per unit. If Riverbed accepts Ivanhoe’s offer, its freed-up facilities could be used to earn $10,500 in contribution margin by manufacturing part 240. In addition, Riverbed would eliminate 40% of the fixed overhead applied to part 231.(a) Calculate total relevant cost to make and net cost to buy. Total relevant cost to make $enter a dollar amount Net relevant cost to buy $enter a dollar amount (b) Should Riverbed accept Ivanhoe’s offer?arrow_forwardDamon Industries manufactures 29,000 components per year. The manufacturing costs of the components was determined as follows: Direct materials $ 145,000 Direct labor 169,000 Variable manufacturing overhead 69,000 Fixed manufacturing overhead 89,000 An outside supplier has offered to sell the component for $14. If Damon purchases the component from the outside supplier, the manufacturing facilities would be unused and could be rented out for $10,900. If Damon purchases the component from the supplier instead of manufacturing it, the effect on operating profits would be a: $81,100 increase. $12,100 decrease. $33,900 increase. $55,100 decrease.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College