Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What was the cost of goods sold for 2018 general accounting

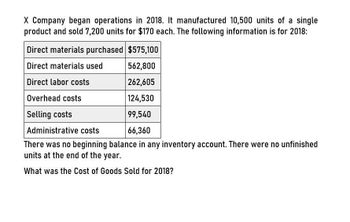

Transcribed Image Text:X Company began operations in 2018. It manufactured 10,500 units of a single

product and sold 7,200 units for $170 each. The following information is for 2018:

Direct materials purchased $575,100

Direct materials used

Direct labor costs

Overhead costs

Selling costs

Administrative costs

562,800

262,605

124,530

99,540

66,360

There was no beginning balance in any inventory account. There were no unfinished

units at the end of the year.

What was the Cost of Goods Sold for 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Inventory Accounts for a Manufacturing Company Fujita Company produces a single product. Costs accumulated at the end of the period are as follows: Assume the beginning raw materials inventory was 62,800, the beginning finished goods inventory was 118,400, and there was no beginning work-in-process inventory. Required: Compute the closing account balances of each of the three inventory accounts: Raw Materials, Work in Process, and Finished Goods.arrow_forwardRenfro, Inc. was franchised on January 1, 2016. At the end of its third year of operations, December 31, 2018, management requested a study to determine what effect different materials inventory costing methods would have had on its reported net income over the three-year period. The materials inventory account, using LIFO, FIFO, and weighted average, would have had the following ending balances: a. Assuming the same number of units in ending inventory at the end of each year, were material costs rising or falling from 2016 to 2018? b. Which costing method would show the highest net income for 2017? c. Which method would show the lowest net income for 2018? d. Which method would show the highest net income for the three years combined?arrow_forwardWhat was the cost of goods sold for the year?arrow_forward

- Inventory balances for the Jameson Company in October 2018 are as follows: October 1, 2018 October 31, 2018 Raw materials $ 20,000 $21,000 Work in process 48,000 37,200 Finished goods 108,000 90,000 During October, purchases of direct materials were $36,000. Direct labor and factory overhead costs were $60,000 and $84,000, respectively. What is the cost of materials used in production?arrow_forwardBoston Company has the following balances as of the year ended December 31, 2018. Direct Materials Inventory=$15,000 Dr WIP Inventory =34,500 Dr Finished Goods Inventory=49,500 Dr Cost of Goods Sold = 74,500 Dr Additional information is as follows: Cost of direct materials purchased during 2018 = $41,000 Cost of direct materials requisitioned in 2018= 47,000 Cost of goods completed during 2018= 102,000 Factory overhead applied (120% of direct labour) = 48,000 Underapplied factory overhead = 4,000 Required: Compute beginning direct materials inventory. Compute beginning WIP inventory.arrow_forwardprovide correct answer pleasearrow_forward

- Dale Corporation began fiscal year 2014 with the following balances in its inventory accounts. Raw Materials $ 54,100 Work in Process 82,100 Finished Goods 26,400 During the accounting period, Dale purchased $238,400 of raw materials and issued $249,000 of materials to the production department. Direct labor costs for the period amounted to $323,800, and manufacturing overhead of $46,900 was applied to Work in Process Inventory. Assume that there was no over- or underapplied overhead. Goods costing $610,300 to produce were completed and transferred to Finished Goods Inventory. Goods costing $601,700 were sold for $801,300 during the period. Selling and administrative expenses amounted to $70,200. Required: a. Determine the ending balance of each of the three inventory accounts that would appear on the year-end balance sheet. Ending Balance Raw materials Work in process Finished goods b. Prepare a…arrow_forwardZaria Inc. provides the following cost information for producing 10,000 units of inventory during the current period: Cost Information Accounts Amounts Direct materials costs $30,000 Direct labor costs 55,000 Variable manufacturing overhead costs 20,000 Fixed manufacturing overhead costs 25,000 Variable Selling and Administrative expenses 15,000 Fixed Selling and Administrative expenses 10,000 There was no inventory at the beginning of the period. If 1,500 units of inventory remain unsold at the end of the period, compute the amount of inventory to be reported in the balance sheet at the end of the current month under absorption costing. Group of answer choices $15,750 $19,500 $23,250 $18,000arrow_forwardGIGRIC314 company provided the following data for the end of the year (all raw materials are used in production as direct materials): Selling expenses Purchases of raw materials Direct labor Administrative expenses $211,000 $257,000 $ 20,000 $153,000 Manufacturing overhead applied to work in process $365,000 $342,000 Actual manufacturing overhead cost GIGRIC314's inventory balances at the beginning and end of the year were as follows: ID#18929) Beginning End of of Year Year Raw materials Work in process Finished goods $ 60,000 $ 25,000 $ 38,000 $ 33,000 $ 44,000 For the year, the cost of goods available for sale was $718,000 and the net operating income as reported in its income statement income was $44,000. The GIGRIC314 company's underapplied or overapplied overhead was closed to Cost of Goods Sold. Q.) How much was the GIGRIC314 company's sales revenue for the year? Multinle Choice Next > < Prev 21 of 25 MacBook Air %24arrow_forward

- What was the balance in the Finished Goods Inventory on January 1, 2018?arrow_forwardRenka’s Heaters selected data for October 2017 are presented here (in millions):Direct materials inventory 10/1/2017 $ 105 Direct materials purchased $365 Direct materials used $385 Total manufacturing overhead costs $450 Variable manufacturing overhead costs$ 265 Total manufacturing costs incurred during October 2017 $1,610 Work-in-process inventory 10/1/2017 $230 Cost of goods manufactured $1,660 Finished-goods inventory 10/1/2017 $130 Cost of goods sold $1,770Calculate the following costs: 1. Direct materials inventory 10/31/2017 2. Fixed manufacturing overhead costs for October 2017 3. Direct manufacturing labor costs for October 2017 4. Work-in-process inventory 10/31/2017 5. Cost of finished goods available for sale in October 2017 6. Finished goods inventory 10/31/2017arrow_forwardPrepare the necessary journal entrles from the following Information for Welsh Company, which uses a perpetual Inventory system. Purchased raw material on account, P56,700. b. Requisitioned raw materials for production as follows: a. Direct materials: 80 percent of purchases: Indirect materials: 15 percent of purchases. Direct labor wages of P33,100 are accrued as are indirect labor wages of P12,500. d. Overhead incurred and pald for is P66,900. Overhead is applied to production based on 110 percent of direct labor cost. Goods costing P97,600 were completed during the period. Goods costing P51,320 were sold on account. C. e. f. g. What is the journal entry for transaction (c)? 45,600 a. Work In process Wages payable 45,600 b. 45,600 Wages expense Wages payable 45,600 Work in process inventory Wages expense Wages payable 33,100 12,500 45,600 Work in process inventory Manufacturing overhead Wages payable 33.100 12,500 d. 45-600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning