Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

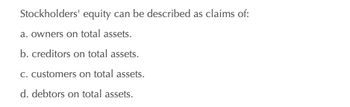

Transcribed Image Text:Stockholders' equity can be described as claims of:

a. owners on total assets.

b. creditors on total assets.

c. customers on total assets.

d. debtors on total assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Explain how the following items affect equity: revenue, expenses, investments by owners, and distributions to owners.arrow_forwardComprehensive income: includes transactions that affect stockholders equity with the exception of those transactions that involve owners. is considered an appropriation of retained earnings. includes all transactions that are under managements control. is the result of all events and transactions reported on the income statement.arrow_forwardClassification of Financial Statement Items Classify each of the following items according to (1) whether it belongs on the income statement (IS) or balance sheet (BS) and (2) whether it is a revenue (R), expense (E), asset (A), liability (L), or stockholders equity (SE) item.arrow_forward

- Under IFRS, liabilities and shareholders' equity on the balance sheet usually appear in which order? Equity, noncurrent liabilities, and current liabilities O Equity, current liabilities, and noncurrent liabilities Current liabilities, noncurrent liabilities, and equity Noncurrent liabilities, current abilities, and equityarrow_forwardAssets, liabilities, and stockholders' equity are all found within which of the following financial statements? Select one: a. Income Statement. b. Balance Sheet / Statement of Financial Position. c. Statement of Shareholders' equity. d. Retained earnings statement.arrow_forwardDefine each of the following terms:b. Common stockholders’ equity, or net worth; retained earningsarrow_forward

- The type of account and normal balance of retained earnings is stockholders equity, credit contra asset, credit asset, debit liabilty, creditarrow_forwardThe numerator in the calculation of the ratio of liabilities to stockholders' equity is O a. Total Assets. O b. Total Liabilities minus Total Stockholders' Equity. O c. Total Liabilities. O d. Total Stockholders' Equity.arrow_forwardStockholder's equity can best be defined as the right of a. Creditors b. Owners c. Either owners or creditors d. Both owners and creditorsarrow_forward

- are items owed to a creditor. company. resources. are items owned by a represents owners' claims to company a. Expenses; Revenues; Net income b. Expenses; Revenues; Stockholders' equity c. Liabilities; Assets; Stockholders' equity d. Liabilities; Assets; Net incomearrow_forwardOrganize the following under Income Statement, Share Holder's Equity, and Balance Sheet. a. Interest Receivable b. Interest Revenue c. Accounts Payable d. Accumulated Depreciation e. Wage Payablearrow_forwardFor each item below, indicate to which category of elements of financial statements it belongs. a. Retained earnings. b. Sales. c. Additional paid-in capital. d. Inventory. e. Depreciation. f. Loss on sale of equipment. g. Interest payable. h. Dividends. i. Gain on sale of investment. j. Issuance of common stock.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning - Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College