FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

General accounting

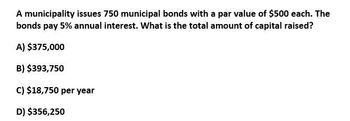

Transcribed Image Text:A municipality issues 750 municipal bonds with a par value of $500 each. The

bonds pay 5% annual interest. What is the total amount of capital raised?

A) $375,000

B) $393,750

c) $18,750 per year

D) $356,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that a city issues a $5,250,000 bond at par. The city, subsequently, pays $262,500 in interest on the bond and $1,050,000 of the principal. Prepare the journal entries to record the issuance of the bond and the subsequent payments.arrow_forwardCity Slicker Corporation pays $55,000 into a bond sinking fund each year for the future redemption of bonds. During the first year, the fund earns $1,475. When the bonds mature, there is a sinking fund balance of $612,000, and $600,000 is needed to redeem the bonds. Required:Prepare the following general journal entries. a. The initial sinking fund deposit. b. The first year's earnings. c. The redemption of the bonds. d. The return of excess cash to the corporation.arrow_forwardA utility district has issued bonds totaling $4.7 Million with a fixed annual coupon rate of 4.00% and a term of 30 years. In addition to making the annual coupon payment, the district must deposit an additional annual amount (an equal amount each year beginning one year from the date of issuance) into a sinking fund so that the principle balance of $4.7 million will be on hand when the bonds come due. The district can earn 3.50% on its invested funds. What is the combined amount of money required for each year’s coupon payment and sinking fund payment? Submit whole number with no commas and no currency signarrow_forward

- Assume that a city issues a $1,200,000 bond at par. The city, subsequently, pays $72,000 in interest on the bond and $1,200,000 of the principal. Required: Prepare the journal entries to record the issuance of the bond and the subsequent payments.arrow_forward3.) The Village of Hawksbill issued $4,000,000 in 5 percent general obligation, tax-supported bonds on July 1, 2023, at a premium of 1.5 percent. A fiscal agent is not used. Resources for principal and interest payments are to come from the General Fund. Interest payment dates are December 31 and June 30. The first of 20 annual principal payments will be made on June 30, 2024. Hawksbill has a calendar fiscal year. A capital projects fund transferred the premium to the debt service fund. On December 31, 2023, funds in the amount of $100,000 were received from the General Fund, and the first interest payment was made. The books were closed for 2023. On June 30, 2024, funds in the amount of $240,000 were received from the General Fund, and the second interest payment ($100,000) was made along with the first principal payment ($200,000). On December 31, 2024, funds in the amount of $95,000 were received from the General Fund, and the third interest payment was made (also in the amount of…arrow_forward5. 2. The City of Paradise issued Bonds of $1,250,000 for the Construction of a City Hall. The City Hall’s bonds are sold at a premium of $150,000; therefore the estimated cost of the Hall is $1,100,000. Required: a. Prepare general journal entries to record the issue of the bonds by General Fund. b. Prepare general journal entries to transfer the premium amount to the debt service fund.arrow_forward

- Journal entries regarding a bond issue and accounting for a premiumArchambault Township authorized a bond issue for a parking garage with an estimated cost of $4,000,000.The garage would be financed through a $2,500,000 bond issue and a $1,500,000 contribution from the General Fund.The General Fund made its contribution, and the bonds were sold for $2,700,000, which included a $200,000 premium over the face amount of the bonds.Prepare journal entries to record (1) the budget for the parking garage, (2) the payment and receipt of the General Fund’s contribution, and (3) the issuance of the bonds, assuming the premium remained in the Capital Projects Fund.arrow_forward2. Accounting for a Debt Service fund Sun City has a fiscal year beginning January 1, 2012. Established a DSF for the payment of debt on bonds issued by the CPF. The series bonds with a face value of $ 600,000 were sold at 101 on January 3. The bond contract indicates an interest rate of 8% per year, payable every semester. The debt will be paid in 6 payments of $ 100,000 each December 31. The premium was transferred by CPF to DSF. The government approved a special tax levy on property with an estimated income of $ 50,000. For the DSF. In addition, he received a transfer from the GF of $ 100,000. to. Register the budget in the DSF b. Record contributions receivable of $ 55,000, assuming 2% is uncollectible. c. Register the collection of contributions d. It is estimated that the "allowance for uncollectible" is very high and should be reduced by $ 2,000 and increase the "revenue" and. Eliminate $ 1,000 of "property tax" that will be uncollectible F. Register the transfer you…arrow_forwardOn 1/1/2019, the city of San Francisco issued at par $2,000,000 of 5% term bonds to renovate the Golden Gate Bridge. The bonds mature in five years on 1/1/2024 with semiannual interest payments on 6/30 and 12/31. A debt service fund is created to manage the payment of principals and interests of this bond. As illustrated below, a sinking fund is to be established with equal semiannual additions made on 6/30 and 12/31. General fund transfers to the debt service fund the cash for sinking fund additions and semiannual interest payments a few days before the due dates. Year Period Required additions 2019 1 $174,461 2 174,461 2020 3 174,461 4 174,461 2021 5 174,461 6 174,461 2022 7 174,461 8 174,461 2023 9 174,461 10 174,461 Prepare journal entries for the following transactions for the debt service fund. Show your calculations. 1. Record the budget for the year 2019. 2. Record the transfer of cash from the general fund to the debt…arrow_forward

- The City of Fremont's fiscal year ends June 30. The city issued the following general obligation bonds: 1. On July 1, 2017, the city issued 4 percent, $100,000 face value, 10-year bonds for $108,531, to yield 3 percent. Interest is payable on June 30 of each year. 2. On january 1, 2019, the city issued 2 percent, $100,000 face value, 10-year bonds for $91,470, to yield 3 percent. Interest is payable on December 31 of each year. a. Determine the amounts reported in the government-wide statement of activities and statement of net position for fiscal year 2020, related to the bonds. b. Determine the amounts reported in the governmental funds statement of revenues, expenditures, and changes in fund balances and balance sheet for fiscal year 2020, related to the bonds.arrow_forwardFalmouth City owns and operates a mini-bus system which it accounts for in an enterprise fund. Prepare journal entries to record the following transactions, which occurred in a recent year. a) The mini-bus system issued $5 million of 8 percent revenue bonds at par and used the proceeds to acquire new mini-buses. b) As required by the bond covenant, the system set aside 1 percent of the gross bond proceeds for repair contingencies. c) The system accrued 6 months interest on the revenue bonds at year-end. d) The system incurred $30,000 of repair costs and paid for them with cash set aside for repair contingenciesarrow_forwardAs of December 31, 2022, Sandy Beach had $9,600,000 in 5.5 percent serial bonds outstanding. Cash of $541,000 is the debt service fund's only asset as of December 31, 2022, and there are no liabilities. The serial bonds pay interest semiannually on January 1 and July 1, with $500,000 in bonds being retired on each interest payment date. Resources for payment of interest are transferred from the General Fund, and the debt service fund levies property taxes in an amount sufficient to cover principal payments. C. Prepare a balance sheet for the debt service fund as of December 31, 2023.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education