Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

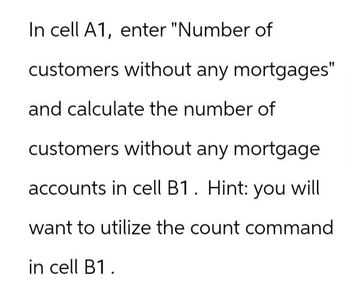

Transcribed Image Text:In cell A1, enter "Number of

customers without any mortgages"

and calculate the number of

customers without any mortgage

accounts in cell B1. Hint: you will

want to utilize the count command

in cell B1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How do you create a loan in Quickbooks? A. Select Banking > Create Loan B. Use the loan manager C. Create the loan account D. Create a liability accountarrow_forwardThe question is how do I make the Excel Tables correctly before trying to plot the remaining units and get by solving those in the spreadsheet?arrow_forwardYou have the following two mortgage choices on the table attached. Please show how to calculate teh APR for each choice using an Excel spreadsheetarrow_forward

- Using Excel, create a table that shows the relationship between the interestearned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.arrow_forwardDiscuss the basics of loan amortization and develop a loan amortization schedulethat you might use when considering an auto loan or home mortgage loan.arrow_forwardGo to the Loan Calculator The cells in the range B6:B8 have defined names, but one is incomplete and could be confusing. Cell A2 also has a defined name, which is unnecessary for a cell that will not be used in a formula.Update the defined names in the worksheet as follows: a)Delete the Loan_Calculator defined name. b)For cell B8, edit the defined name to use Loan_Amount as the name. 2. In cell B8, calculate the loan amount by entering a formula without using a function that subtracts the Down_Payment from the Price. 3.Liam also wants to use defined names in other calculations to help him interpret the formulas.a) In the range D4:D8, create defined names based on the values in the range C4:C8.arrow_forward

- Why did you select those customer accounts? also how to use a cell reference to enterthe answer for the 1st question? ( Whatis the dollar amount of total receivables? Use a cell reference to input your answer)arrow_forwardX + A https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F326%5Bdata-uuid-ab153a0624d544c282287e02 5. Calculating Monthly Mortgage Payments. Based on U Exhibit 9-9, or using a financial calculator, what would be the monthly mortgage payments for each of the following situations? a. $120,000, 15-year loan at 4.5 percent. b. $86,000, 30-year loan at 5 percent. c. $105,000, 20-year loan at 6 percent. d. What relationship exists between the length of the loan and the monthly payment? How does the mortgage rate affect the monthly payment?arrow_forwardIn cell B12, create a formula using the PMT function to calculate the monthly payments for loan Option A. Use the values in cells B8, B10, and B5 for the Rate, Nper, and Pv arguments, respectively, and do not enter any values for the optional arguments. Copy the formula you created in cell B12 into the range C12:D12.arrow_forward

- (please type answer).arrow_forwardMy question is How do I find the formula for Cell A11 and where do I need to calculate those so that I can work on that easily before putting in Excel?arrow_forwardA https://player-ui.mheducation.com/#/epub/sn_7cac#epubcfi(%2F6%2F326%5Bdata-uuid-ab153a0624d544c282287e025cfd7f. -> 2. Calculating Security Deposit Interest. Many locations require that renters be paid interest on their security deposits. If you have a security deposit of $1,800, how much would you expect a year at 3 percent?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT