Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

The question is how do I make the Excel Tables correctly before trying to plot the remaining units and get by solving those in the spreadsheet?

![PROJECT STEPS

Ricardo and Miranda Ramos are considering whether to buy their first home, and have

spoken to three lenders about taking out a mortgage for the house purchase. They now

pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage.

Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She

asks you to help her complete the analysis of their loan options.

1.

2.

3.

Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined

names, but one is incomplete and could be confusing. Cell A2 also has a defined name,

which is unnecessary for a cell that will not be used in a formula.

Update the defined names in the worksheet as follows:

Delete the Loan_Payment_Calculator defined name.

For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint:

Delete the existing defined name "Loan_Am" and add the new defined name.]

a.

b.

In cell B7, calculate the loan amount by entering a formula without using a function that

subtracts the Down Payment from the Price.

Miranda also wants to use defined names in other calculations to help her interpret the

formulas.

In the range D3:D7, create defined names based on the values in the range C3:C7.](https://content.bartleby.com/qna-images/question/b7b9bc12-9bec-475d-bc99-e13d2a9b76e2/bc15de9f-271f-4bcd-b4be-7dc22c30cdd2/cn32nz8_thumbnail.jpeg)

Transcribed Image Text:PROJECT STEPS

Ricardo and Miranda Ramos are considering whether to buy their first home, and have

spoken to three lenders about taking out a mortgage for the house purchase. They now

pay $1,500 per month in rent and can pay up to $1,600 per month for a mortgage.

Miranda has created an Excel spreadsheet to compare the terms of the mortgage. She

asks you to help her complete the analysis of their loan options.

1.

2.

3.

Go to the Mortgage Calculator worksheet. The cells in the range B5:B7 have defined

names, but one is incomplete and could be confusing. Cell A2 also has a defined name,

which is unnecessary for a cell that will not be used in a formula.

Update the defined names in the worksheet as follows:

Delete the Loan_Payment_Calculator defined name.

For cell B7, edit the defined name to use Loan_Amt as the name. [Mac Hint:

Delete the existing defined name "Loan_Am" and add the new defined name.]

a.

b.

In cell B7, calculate the loan amount by entering a formula without using a function that

subtracts the Down Payment from the Price.

Miranda also wants to use defined names in other calculations to help her interpret the

formulas.

In the range D3:D7, create defined names based on the values in the range C3:C7.

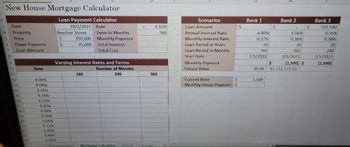

Transcribed Image Text:New House Mortgage Calculator

Loan Payment Calculator

10/1/2021

2

3 Date

4

5 Price

6 Down Payment

7

Loan Amount

8

9

Property

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

Rate

Beecher Street

4.00%

4.08%

4.16%

4.24%

4.32%

4.40%

4.48%

4.56%

4.64%

4.72%

4.80%

4.88%

4.96%

Ś

$

350,000

35,000

Rate

Term in Months

Varying Interest Rates and Terms

Number of Months

240

180

Monthly Payment

Total Interest

Total Cost

4.32%

360

360

Documentation Mortgage Calculator Listings Car Loan

4

E

Scenarios

Loan Amount

Annual Interest Rate

Monthly Interest Rate

Loan Period in Years

Loan Period in Months

Start Date

Monthly Payment

Future Value

Current Rent

$

Monthly House Payment S

$

Bank 1

4.40%

0.37%

30

360

1/5/2022

$

1,500

S

H

Bank 2

4.56%

0.38%

30

360

1/5/2022)

(1,500) $

$0.00 $1,151,573.10

$

Bank 3

337,500

4.56%

0.38%

20

240

1/5/2022)

(1,500)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- POS stands for Point of Sale. List the benefits they have over traditional data collecting methods.arrow_forwardEducate these stakeholders on the advantages of utilizing a spreadsheet solution and how simple it was to process data in order to generate the information provided in the report in Excelarrow_forwardPlease model the following decision in a spreadsheet, optimize it using MS-Excel Solver, and then upload that spreadsheet by attaching it to this question. I will grade this question on the accuracy of your () spreadsheet model (decision variables, objective, and constraints), (i) Solver parameters, (i optimal solution. Partial credit is available. The personnel-planning problem of Lexington Bank. The main branch of Lexington Bank is open for retail business from 8:00 AM to 4:00 PM on weekdays. The staffing requires from 8 to 15 tellers on duty depending on the time of day, as indicated in the following table. Time Period Minimum No. of Tellers 8:00 AM - 10:00 AM 10:00 AM - 12:00 PM 12:00 PM - 2:00 PM 10 15 2:00 PM - 4:00 PM 12 Full-time tellers work 8 consecutive hours (from 8:00 AM to 4:00 PM) at $15 per hour. Part-time workers work 4 consecutive hours at $8 per hour starting at 8:00 AM, 10:00 AM, or 12:00 noon. Assume workers never take breaks. Union regulations require that all…arrow_forward

- Create a SQL table using your name with the following features: the columns of your table must include, at least the data types (in this order) and one more of your choice NOTE: You need to specify a 2 column (i.e 2 attribute 1. varchar (n), // where n covers the string length you want to enter 2. Int, 3. decimal, (precision = 8, scale = 3 4. date. 5. ??? your choice here ??? Table constraints: 1. It has a two column primary key 2. a check constraint on 2 columns, on the decimal and the date field 3. Use '2024-02-18' date as the default on the date field 5. write down your relational schema 5. Create the table, insert at least 4 rows, and do a Select * to show them example don't just copy these, change the constraint namesarrow_forwardcan you show the steps on a calculator ?arrow_forwardExplain the steps in setting a new business in QuickBooks. What data do you need in order to successfully complete the set-up?arrow_forward

- Can you further explain this to me to better understand the concept on what I'm supposed to do and what formulas I need to apply.arrow_forwardFill out the missing columns and show the calculation and formulasarrow_forwardDuring the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forward

- Will you please provide the formulas (explanation) to understand the results or numbers that were added in the solution?arrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education