Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with this question

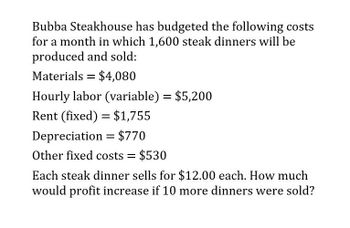

Transcribed Image Text:Bubba Steakhouse has budgeted the following costs

for a month in which 1,600 steak dinners will be

produced and sold:

Materials = $4,080

Hourly labor (variable) = $5,200

Rent (fixed) = $1,755

Depreciation = $770

Other fixed costs = $530

Each steak dinner sells for $12.00 each. How much

would profit increase if 10 more dinners were sold?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give me answer ✅arrow_forwardSuper Clinics offers one service that has the following annual cost and volume estimates: Variable cost per visit = $10 Annual direct fixed costs = $50,000 Allocation of overhead costs = $20,000 Expected volume = 1,000 visits What price per visit must be set if the clinic wants to make an annual profit of $10,000 on the full cost of the service?arrow_forwardItems purchased from a vendor cost $20 each, and the forecast for next year’s demand is 1,000 units. If it costs $5 every time an order is placed for more units and the storage cost is $4 per unit per year, a. What quantity should be ordered each time? b. What is the total ordering cost for a year? c. What is the total storage cost for a year?arrow_forward

- Lawrence Industries produces kitchen knives. The selling price is $25 per unit, and the variable costs are $10 per knife. Fixed costs per month are $6,000. If Lawrence Industries sells 30 more units beyond breakeven, how much does profit increase as a result? Answerarrow_forwardYou are selling a new line of T-shirts on the boardwalk. The selling price will be $25 per shirt The labor cost is $5 per shirt. Additionally, the cost of materials will be $10 per shirt. The administrative costs of operating the company are estimated to be $60,000 annually, and the sales and marketing expenses are $20,000 a year. What is the break-even in units and BEP in dollars? Formulas: Contribution Margin = Unit Selling Price-Unit Variable Cost Profit - Total Revenue - Total Cost or Profit - Quantity Sold (Selling Price per unit - Variable Cost per unit) - Fixed Cost Fixed Cost Break-even (quantity) = Unit Selling Price - Unit Variable Cost Break-even ($) = Break-even (quantity). X Quantity Sold Fixed Cost + Profit Desired Unit Selling Price - Unit Variable Cost Target Quantity for certain profit =arrow_forward"Disk City, Inc., is a retailer for digital video disks. The projected net income for the current year is $200,000 based on a sales volume of 200,000 video disks. Disk City has been selling the disks for $16 each. The variable costs consist of the $10 unit purchase price of the disks and a handling cost of $2 per disk. Disk City’s annual fixed costs are $600,000. Management is planning for the coming year, when it expects that the unit purchase price of the video disks will increase 30 percent. (Ignore income taxes.). "Required: 1.Calculate Disk City’s break-even point for the current year in number of video disks. 2.What will be the company’s net income for the current year if there is a 10 percent increase in projected unit sales volume? 3.What volume of sales (in dollars) must Disk City achieve in the coming year to maintain the same net income as projected for the current year if the unit selling price remains at $16? 4.In order to cover a 30 percent increase in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning