FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

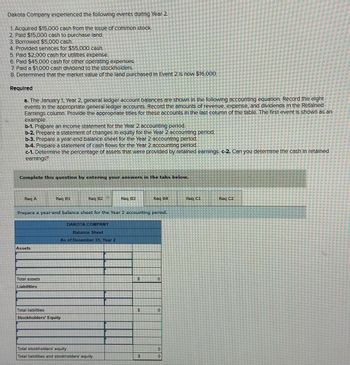

Transcribed Image Text:Dakota Company experienced the following events during Year 2

1. Acquired $15,000 cash from the issue of common stock.

2. Paid $15,000 cash to purchase land.

3. Borrowed $5,000 cash.

4. Provided services for $55,000 cash.

5. Paid $2,000 cash for utilities expense.

6. Pald $45,000 cash for other operating expenses.

7. Paid a $1,000 cash dividend to the stockholders.

8. Determined that the market value of the land purchased in Event 2 is now $16,000.

Required

a. The January 1. Year 2, general ledger account balances are shown in the following accounting equation. Record the eight

events in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the Retained

Earnings column. Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an

example.

b-1. Prepare an Income statement for the Year 2 accounting period.

b-2. Prepare a statement of changes in equity for the Year 2 accounting period.

b-3. Prepare a year-end balance sheet for the Year 2 accounting period.

b-4. Prepare a statement of cash flows for the Year 2 accounting period.

c-1. Determine the percentage of assets that were provided by retained earnings. c-2. Can you determine the cash in retained

earnings?

Complete this question by entering your answers in the tabs below.

Reg A

Rec B1

Reg E2

Reg B3

Reg B4

Reg CL

Req 02

Prepare a year-end balance sheet for the Year 2 accounting period.

DAKOTA COMPANY

Assets

Total assets

Liabilities

Balance Sheet

As of December 21 Year 2

Total liabilities

Stockholders' Equity

Total stockholders' equity

Total liabilities and stockholders' equity

19

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Ace Co. issued 1,000 shares of its $10 par value common stock for $15 per share in cash. How should this transaction be reported in Ace's statement of cash flows for the year of issuance? A. $15,000 cash inflow from financing activities. B. $10,000 cash inflow from financing activities and $5,000 adjustment to arrive at cash flows from operating activities. C. $15,000 cash flow from investing activities. D. $10,000 cash flow from investing activities and $5,000 adjustment to arrive at cash flows from operating activitiesarrow_forwardMaben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: Acquired $32,000 cash from the issue of common stock. Borrowed $44,000 cash from National Bank. Earned cash revenues of $60,000 for performing services. Paid cash expenses of $51,000. Paid a $2,200 cash dividend to the stockholders. Acquired an additional $32,000 cash from the issue of common stock. Paid $11,000 cash to reduce the principal balance of the bank note. Paid $49,000 cash to purchase land. Determined that the market value of the land is $69,000. Required Record the preceding transactions in the horizontal statements model. Also, in the Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). If the element is not affected by the event, leave the cell blank. The first event is shown as an example. (Enter any decreases to account balances and cash outflows with a minus sign. Not all…arrow_forwardMaben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $45,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. f. Determine the percentage of assets that were provided by investors, creditors, and earnings. Note: Round your answers to 2 decimal places. Assets Investors % Creditors % Earnings %arrow_forward

- Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $45,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. e. Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financing activitiesarrow_forwardMaben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $30,000 cash from the issue of common stock. 2. Borrowed $40,000 cash from National Bank. 3. Earned cash revenues of $48,000 for performing services. 4. Paid cash expenses of $25,000. 5. Paid a $1,000 cash dividend to the stockholders. 6. Acquired an additional $20,000 cash from the issue of common stock. 7. Paid $10,000 cash to reduce the principal balance of the bank note. 8. Paid $53,000 cash to purchase land. 9. Determined that the market value of the land is $75,000. e. Determine the net cash flows from operating activities, investing activities, and financing activities that Maben would report on the Year 1 statement of cash flows. Note: Enter cash outflows as negative amounts. Accounting Equation Net cash flows from investing activities Net cash flows from financing activitiesarrow_forwardMaben Company was started on January 1, Year 1, and experienced the following events during its first year of operation: 1. Acquired $35,000 cash from the issue of common stock. 2. Borrowed $35,000 cash from National Bank. 3. Earned cash revenues of $53,000 for performing services. 4. Paid cash expenses of $47,500. 5. Paid a $1,500 cash dividend to the stockholders. 6. Acquired an additional $25,000 cash from the issue of common stock. 7. Paid $9,000 cash to reduce the principal balance of the bank note. 8. Paid $58,000 cash to purchase land. 9. Determined that the market value of the land is $81,000. b. Determine the amount of total assets that Maben would report on the December 31, Year 1, balance sheet. Total assetsarrow_forward

- Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable Inventory Total current assets. Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable Income taxes payable Total current liabilities. Equity Common stock, $2 par value GOLDEN CORPORATION Comparative Balance Sheets December 31 Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity GOLDEN CORPORATION Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses (excluding…arrow_forwarda. Purchased 16,000 common shares of Heller Co. at $16 cash per share. b. Received a cash dividend of $1.25 per common share from Heller. c. Year-end market price of Heller common stock is $17.50 per share. d. Sold all 16,000 common shares of Heller for $252,480 cash. Note: For each account catégory, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Balance Sheet Transaction Cash Asset Noncash Assets Liabilities Contrib. Capital Earned Capital Income Statement Revenues Expenses Net Income (256,000)✔ 256,000 0 ✓ Cash = Investment = ✓ N/A ✔ N/A = N/A M/A N/A (b) 20,000 ▼ 20,000✓ 20,000 ✔ 0✓ = 20,000 ✓ Cash ✓ N/A ÷ N/A ÷ ✓ N/A = Retained earnings Dividend income = ✓ N/A = (c) 0✓ 24,000 ✔ 0✓ 0✓ 24,000 ▼ 24,000 く 24,000 Cash = Investment ✓ N/A = N/A Retained earnings nrealized gain ÷ (d) 252,480✔ (2.240,000) x- 28,480 x Cash ÷ ✓…arrow_forwardCordell Inc. experienced the following events in Year 1, its first year of operation: Received $53,000 cash from the issue of common stock. Performed services on account for $75,000. Paid a $5,300 cash dividend to the stockholders. Collected $59,000 of the accounts receivable. Paid $53,000 cash for other operating expenses. Performed services for $18,000 cash. Recognized $2,300 of accrued utilities expense at the end of the year. a. & c. Identify the events that result in revenue or expense recognition and those which affect the statement of cash flows. In the Statement of Cash Flows column, use OA to designate operating activity, FA for financing activity, or IA for investing activity. If the element is not affected by the event, leave the cell blank. b. Based on your response to Requirement a, determine the amount of net income reported on the Year 1 income statement. d. Based on your response to Requirement c, determine the amount of cash flow from operating…arrow_forward

- Identify any non-cash transactions that occurred during the year, and show how they would be reported in the non-cash investing and financing activities section of the statement of cash flows. a. Issued 750shares of $3 par common stock for cash of $17,000. b. Issued 5,100 shares of $3 par common stock for a building with a fair market value of $96,000. c. Purchased new truck with a fair market value of $29,000. Financed it 100% with a long-term note. d. Retired short-term notes of $28,000 by issuing 1,900 shares of $3 par common stock. e. Paid long-term note of $10,500 to Bank of Tallahassee. Issued new long-term note of $23,000 to Bank of Trust. Dirtbikes, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2024 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activitiesarrow_forwardThe following information was taken from the financial records of the XYZ Company. a) Net income was $189,500 for the period. b) Purchased 10,000 shares of common stock at $15 per share for the treasury. c) Sold equipment with a carrying value of $32,500 at a gain of $6,000. d) Purchased land and a building worth $450,000 by signing a ten-year note. e) Issued $1,000,000 in bonds at par. f) The beginning and ending retained earnings account balances were $418,000 and $534,000, respectively. There were no prior period adjustments. g) Wrote a check for $648,000 for the purchase of machinery. h) Sold long-term investments in stocks with a cost of$50,000 at a loss of $17,500. i) Cash dividends were declared and paid during the period. Required: Prepare the net cash flows from investing activities.arrow_forwardCordell Inc. experienced the following events in Year 1, its first year of operation: Received $51,000 cash from the issue of common stock. Performed services on account for $79,000. Paid a $5,100 cash dividend to the stockholders. Collected $57,000 of the accounts receivable. Paid $51,000 cash for other operating expenses. Performed services for $12,000 cash. Recognized $2,100 of accrued utilities expense at the end of the year. Required a. & c. Identify the events that result in revenue or expense recognition and those which affect the statement of cash flows. In the Statement of Cash Flows column, use OA to designate operating activity, FA for financing activity, or IA for investing activity. If the element is not affected by the event, leave the cell blank. b. Based on your response to Requirement a, determine the amount of net income reported on the Year 1 income statement. d. Based on your response to Requirement c, determine the amount of cash flow…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education