CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

Do not use chatgpt.

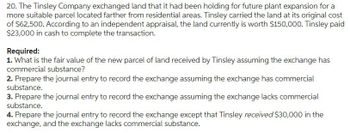

Transcribed Image Text:20. The Tinsley Company exchanged land that it had been holding for future plant expansion for a

more suitable parcel located farther from residential areas. Tinsley carried the land at its original cost

of $62,500. According to an independent appraisal, the land currently is worth $150,000. Tinsley paid

$23,000 in cash to complete the transaction.

Required:

1. What is the fair value of the new parcel of land received by Tinsley assuming the exchange has

commercial substance?

2. Prepare the journal entry to record the exchange assuming the exchange has commercial

substance.

3. Prepare the journal entry to record the exchange assuming the exchange lacks commercial

substance.

4. Prepare the journal entry to record the exchange except that Tinsley received $30,000 in the

exchange, and the exchange lacks commercial substance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Salad Express exchanged land it had been holding for future plant expansion for a more suitable parcel of land along distribution routes. Salad Express reported the old land on the previously issued balance sheet at its original cost of $70,000. According to an independent appraisal, the old land currently is worth $132,000. Salad Express paid $19,000 in cash to complete the transaction.Required:1. What is the fair value of the new parcel of land received by Salad Express?2. Record the exchange.arrow_forwardSalad Express exchanged land it had been holding for future plant expansion for a more suitable parcel of land along distribution routes. Salad Express reported the old land on the previously issued balance sheet at its original cost of $77,000. According to an independent appraisal, the old land currently is worth $146,000. Salad Express paid $22,500 in cash to complete the transaction. Required: 1. What is the fair value of the new parcel of land received by Salad Express? Fair value of the new landarrow_forwardThe Bronco Corporation exchanged land for equipment. The land had a book value of $120,000 and a fair value of $150,000. Bronco received $10,000 from the owner of the equipment to complete the exchange which has commercial substance. Required:1. What is the fair value of the equipment?2. Prepare the journal entry to record the exchange.arrow_forward

- Two construction companies, Harglo and Kalman, are in the construction business. Each owns a tract of land being held for development, but each company would prefer to build on the other's land. Accordingly, they agree to exchange their land, and have the following information: Harglo's Kalman's Land Land Cost and book value $150,000 $100,000Fair value based upon appraisal $200,000 $160,000 The exchange of land was made, and, based on the difference in appraised fair value, Kalman paid $40,000 cash to Harglo. 3. For financial reporting purposes, Harglo would recognize a gain on this exchange in the amount ofa. $0b. $6,000c. $10,000d. $40,000 4. For financial reporting purposes, Kalman would recognize a gain on this exchange…arrow_forwardTwo construction companies, Harglo and Kalman, are in the construction business. Each owns a tract of land being held for development, but each company would prefer to build on the other's land. Accordingly, they agree to exchange their land, and have the following information: Harglo's Kalman's Land Land Cost and book value $150,000 $100,000Fair value based upon appraisal $200,000 $160,000 The exchange of land was made, and, based on the difference in appraised fair value, Kalman paid $40,000 cash to Harglo. For financial reporting purposes, Harglo would recognize a gain on this exchange in the amount of $6,000 After the exchange, Harglo would record its newly acquired land on its books ata. $120,000b. $102,000c. $136,000d. $166,000arrow_forwardThe Bronco Corporation exchanged land for equipment. The land had a book value of $120,000 and a fair value of $150,000. Bronco paid the owner of the equipment $10,000 to complete the exchange which has commercial substance. Required: 1. What is the fair value of the equipment? 2. Prepare the journal entry to record the exchange.arrow_forward

- The Bronco Corporation exchanged land for equipment. The land had a book value of $136,000 and a fair value of $182,000. Bronco paid the owner of the equipment $26,000 to complete the exchange which has commercial substance. Required: 1. What is the fair value of the equipment? 2. Prepare the journal entry to record the exchange. Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the fair value of the equipment? Fair valuearrow_forwardThe Bronco Corporation exchanged land for equipment. The land had a book value of $138,000 and a fair value of $186,000. Bronco pald the owner of the equipment $28,000 to complete the exchange whlch has commercial substance. Required: 1. What Is the falr value of the equipment? 2. Prepere the Journal entry to record the exchange. Answer Is complete but not entirely correct. Complete thls question by entering your answers In the tabs below. Required 1 Required 2 Prepare the journal entry to record the exchange. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Transaction General Journal Debit Credit Equipment - new Land - new 1 214,000 138,000 Cash 28,000 Gain on exchange of assets 48,000arrow_forwardCase A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $16,500 (original cost of $37,000 less accumulated depreciation of $20,500) and a fair value of $9,900. Kapono paid $29,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $545,000 and a fair value of $790,000. Kapono paid $59,000 cash to complete the exchange. The exchange has commercial substance. Required: What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the fair value of the farmland given is $436,000 instead of $790,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss that…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $14,500 (original cost of $33,000 less accumulated depreciation of $18,500) and a fair value of $9,500. Kapono paid $25,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $525,000 and a fair value of $750,000. Kapono paid $55,000 cash to complete the exchange. The exchange has commercial substance. Required: 1.What is the amount of gain or loss that Kapono would recognize on the exchange of the tractor? 2. Assume the fair value of the old tractor is $19,000 instead of $9,50O. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new tractor?arrow_forwardRequired information [The following information applies to the questions displayed below] Case A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $20,500 (original cost of $45,000 less accumulated depreciation of $24,500) and a fair value of $10,700. Kapono paid $37,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had a book value of $585,000 and a fair value of $870,000. Kapono paid $67,000 cash to complete the exchange. The exchange has commercial substance. Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $468,000 instead of $870,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as…arrow_forwardCase A. Kapono Farms exchanged an old tractor for a newer model. The old tractor had a book value of $14,000 (original cost of $32,000 less accumulated depreciation of $18,000) and a fair value of $9,400. Kapono paid $24,000 cash to complete the exchange. The exchange has commercial substance. Case B. Kapono Farms exchanged 100 acres of farmland for similar land. The farmland given had book value of $520,000 and a fair value of $740,000. Kapono paid $54,000 cash to complete the exchange. The exchange has commercial substance. Required: 1. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 2. Assume the fair value of the farmland given is $416,000 instead of $740,000. What is the amount of gain or loss that Kapono would recognize on the exchange? What is the initial value of the new land? 3. Assume the same facts as Requirement 1 and that the exchange lacked commercial substance. What is the amount of gain or loss…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you