FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

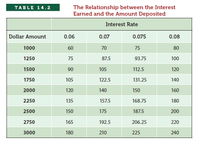

Using Excel, create a table that shows the relationship between the interest

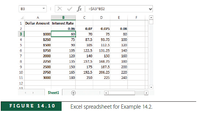

earned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.

Transcribed Image Text:The Relationship between the Interest

Earned and the Amount Deposited

TABLE 14.2

Interest Rate

Dollar Amount

0.06

0.07

0.075

0.08

1000

60

70

75

80

1250

75

87.5

93.75

100

1500

90

105

112.5

120

1750

105

122.5

131.25

140

2000

120

140

150

160

2250

135

157.5

168.75

180

2500

150

175

187.5

200

2750

165

192.5

206.25

220

3000

180

210

225

240

Transcribed Image Text:X v fr

=SA3"B$2

B3

A

D

E

F

1 Dollar Amount Interest Rate

0.06

0.07

0.075

0.08

3

1000

60

70

75

80

4

1250

75

87.5

93.75

100

1500

90

105

112.5

120

1750

105

122.5

131.25

140

7

2000

120

140

150

160

2250

135

157.5

168.75

180

2500

150

175

187.5

200

10

2750

165

192.5

206.25

220

11

3000

180

210

225

240

12

12

Sheet1

FIGURE 14.10

Excel spreadsheet for Example 14.2.

LL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- T-ACCOUNTS FORMULAS/EQUATIONS Please provide the formula/equation to find the missing amount for the following T-Accounts 1) How to find if there is a missing amount is on the DR side/ left side of the T-Account 2) How to find if there is a missing amount the CR/right side of the account 3) How to find the Beginning balance 4) How to find the Ending Balance.arrow_forwardQuestion information and the question are located in the images attached. Thank you.arrow_forwardBefore processing a batch of invoices, the accounts payable clerk sums the quantities billed. The sum obtained is best described as a(n): A. financial total B. grand total C. record count D. hash total E. cross-footing totalarrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardIf the top five accounts listed on a firm’s trial balance all represent asset accounts, then which of the following statements is MOST likely accurate? Select answer from the options below 1.The values for all five accounts will appear in the debit column. 2.All five accounts should instead be listed at the bottom of the trial balance. 3.The values for all five accounts will appear in the credit column. 4.Some of the values for these accounts will appear in the debit column, while others will appear in the credit column.arrow_forwardRefer to the accounting information for Bonnie's Batting Cages (page 2 onwards) ASSETS 1. Using the T-accounts template (see attachment from folder), set up the T-accounts with the balances from the Balance Sheet below. 2. Input the transactions below into each account. *** (Use a transaction reference number as a note) 3. Calculate the balance of each account at the end of the April transactions. Use the function feature of your spreadsheet. 4. Create a trial balance to make sure your debits = credits. Use the template provided in the 2nd tab in the spreadsheet. 5. Create a new Balance Sheet dated April 30, 2023. Use the template provided in the 3rd tab in the spreadsheet. Assets T_accounts Assets Account Bank Bonnie's Batting Cages and Softball Services BALANCE SHEET March 31, 2023 Accounts Receivable - Infield Flyers Remdal Red Sox Supplies Equipment Total Assets $ 56 450 3.300 1500 13 500 52 000 $126 750 T_accounts Trial Balance Liabilities Accounts Payable -Cannon Sports Trial…arrow_forward

- T-Accounts (All Formulas/Equations) Would you please provide me with the formula/equation used to find the missing amount in a T-Account. Please look at the example below and provide me the answers in that same type of format so that it is easy to understand. Beginning Balance is missing Transaction on debit side is missing Transaction on credit side is missing FINDING BEGINNING BALANCE EXAMPLEBeginning balance = Ending balance + right side of T-Account - Left side of T-AccountBeginning balance = $9,800 + ($4,500 +$2,200 +$3,500) - ($2,500 +$4,000 +$3,400)Beginning balance = $9,800 + $10,200 - $9,900Begining balance = $10,100arrow_forwardYour company has loaned money to an outside entity. You earned the monthly interest on the loan but did not receive the payment yet. The payment is expected to be received next month. To capture the interest expected to be received in the future you have created account #901 , Interest Receivable in your chart of accounts and booked the journal entry to DR: Interest Receivable and CR: Interest Income. While the basic journal entry was correct, your manager is questioning how you setup this new account. Based on this image of the chart of accounts below what needs to be corrected and how would you correct this?arrow_forwardI just asked this question and it was wrong. Here is what the expert said. Please help with the red fields.arrow_forward

- You have established your performance materiality for accounts payable and revenue; now you must determine the posting materiality for individual items. The materiality judgement is at 4%. What is the posting materiality? Show your work. Your work should look like: APPROPRIATE AMOUNT x MATERIALITY JUDGEMENT = POSTING MATERIALITYarrow_forwardTo calculate the withdrawal amount from an account in which you want to decrease the balance, you use the __________________ formulaarrow_forwardWould you please remind me how the debits and credits system works? Why do the assets get debit increased and the liabilities and owner’s equity get debit decreased? I know the parts must balance and clear each other out, but reviewing my notes from a previous class, I’m having a hard time getting a perspective on the principle of the T-balance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education