Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:17

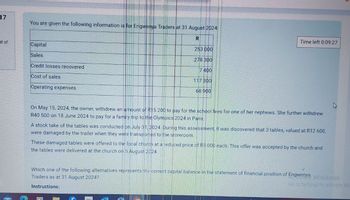

You are given the following information is for Engwenya Traders at 31 August 2024

R

ut of

Capital

Sales

Credit losses recovered

Cost of sales

Operating expenses

253 000

278 300

7 400

117 300

68 900

Time left 0:09:27

On May 15, 2024, the owner, withdrew an amount of R15 200 to pay for the school fees for one of her nephews. She further withdrew

R40 500 on 18 June 2024 to pay for a family trip to the Olympics 2024 in Paris.

A stock take of the tables was conducted on July 31, 2024. During this assessment, it was discovered that 3 tables, valued at R12 600,

were damaged by the trailer when they were transported to the storeroom.

These damaged tables were offered to the local church at a reduced price of R3 000 each. This offer was accepted by the church and

the tables were delivered at the church on 5 August 2024.

Which one of the following alternatives represents the correct capital balance in the statement of financial position of Engwenya Windows

Traders as at 31 August 2024?

Instructions:

Go to Settings to activate Wi

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need help to do this question for Accounting.arrow_forwardYE3tcuBfirwShOSzu2prZ7nd44k0L-w/formResponse?pli=1 e following to answer the five questions below: owing accounts are extracted from the worksheet of X Company on ber 31, 2020 Sales Retums and Allowances S 410,000 Sales Discount 140,000 Sales 1,500,000 Salaries Expenses - Sales 52,000 Rent Revenue 22,000 Purchases Retums and Allowances 120,000 Purchases 600,000 Loss from write down of Inventory 17,000 Inventory, January 1, 2020 460,000 Interest Expense A 55,000 Gain from Sale of Building 23,000 Freight-out 14,000 Freight-in 30,000 Depreciation Expense - Sales 22,000 Cost of Goods Sold 600,000 n the data above, the inventory account sho ed a holonarrow_forwardI need help in BE 7.3. in Accounting.arrow_forward

- Chapter : Adjustment financial statementsarrow_forwardUsing T accounts can you please explain the answer and why each entry goes where please the answe is 937050arrow_forward9 tori mont beloetxa a John Trading is in the business of importing footwear for resale. The following balances were extracted from his books on 30 June 2019: 008 ast Sales Revenue Sales Returns Cost of Sales Discounts Commission Income Wages and Salaries Rent and Rates Interest on Loan Motor Vehicle Accumulated Depreciation on Motor Vehicle Equipment Accumulated Depreciation on Equipment Inventory Trade Receivables Allowance for impairment of Trade Receivables 000 Trade Payables 081 Cash at Bank Long Term Loan Capital, 1 July 2018 Drawings 8.b Additional information: 1. 2. 3. Dr ($) REQUIRED (a) 6 600 122 370 820 nolleisige sob 30 200 24 900 1 375 50 000 15 000 13 800 24 800 4 600 Cr ($) 206 000 5 900 300 365 aba Ist 1 060 900 10 000 3 000 1 240 13 570 30 000 34 595 300 365 * itul e not soliqques of 02T 12 suparto s bouaal Owner took goods worth $700 for his own use. No records were made. Partial repayment of loan, $10 000 due on 31 December 2019. to rifillon The business issue a…arrow_forward

- At the end of 2019, Framber Company received 8,000 as a prepayment for renting a building to a tenant during 2020. The company erroneously recorded the transaction by debiting Cash and crediting Rent Revenue in 2019 instead of 2020. Upon discovery of this error in 2020, what correcting journal entry will Framber make? Ignore income taxes.arrow_forwardA seller sells $800 worth of goods on credit to a customer, with a cost to the seller of $300. Shipping charges are $100. The terms of the sale are 2/10, n/30, FOB Destination. What, if any, journal entry or entries will the seller record for these transactions?arrow_forwardxamus - cdn.student.uae.examus.net/?rldbqn=1&sessi... ACCT101_FEX_2021_2_Male A company purchased merchandise on credit with terms Ac Payable if the company pays SR485 cash on this account within ten days? e18 3/15, n/3O. How much will be debited to 33 - 34 abe18ce33 b. Accounts Payable should be credited in а. 485 113:22 9 కోల С. 470.45 95abe18ce 33 d. 500 95abe18ce 95abe18ce33 95aber8ce33 95abe18ce33 95abe18ce33 95abe18ce33 MacBook Pro F3 888 F4 FS E 5 F7 67 7 V T. 8 A 9 Y 6. U 11 9.arrow_forward

- Alth busin Raffles Retail buys and sells on credit. During the month of June 2020, the business had the following transactions with Tan. NUTIN 2020 Description of transaction Jun 1 (f) 7 9 Tan owed Raffles Retail $300. Sold goods to Tan for a list price of $500, less 10% trade discount. 90% × 500 Tan returned damaged goods previously purchased on 7 June, with a list price of $100. 18 Received a cheque of $285 from Tan, in full settlement of amount owed on 1 June 2020. REQUIRED Prepare Tan's account in Raffles Retail's ledger for the month of June 2020. NI N 07 1901 of 1931 agt 2100Marrow_forwardAfrica Traders is a registered VAT vendor and uses the periodic inventory system. Africa Traders buys and sells furniture and equipment for cash or on credit. On 1 March 2021, Africa Traders sold furniture on credit to Mrs A South to the amount of R14 875. On 27 April 2021, Mrs South settled her account and received R685 discount for early settlement. On the same day Mrs South purchased a new coffee table and paid R1 360 cash after receiving a cash discount of R260. Required: What amount will be recorded in the trade receivables column of the cash receipts journal of Africa Traders on 27 April 2021? NB: Instructions 1. Do not type the amount with any spaces as separators for thousands (eg: 12141.72) 2. Use a full stop to indicate any decimals (eg: 1000.01) 3. You must enter cents even if it is 0 (eg .00) 4. Only show the amount, do not show the R (eg: 12141.72) Answer:arrow_forwarddont give answer in image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning