Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

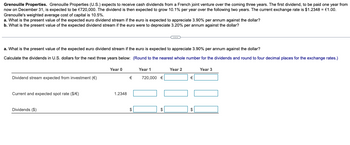

Transcribed Image Text:Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three years. The first dividend, to be paid one year from

now on December 31, is expected to be €720,000. The dividend is then expected to grow 10.1% per year over the following two years. The current exchange rate is $1.2348 = €1.00.

Grenouille's weighted average cost of capital is 10.5%.

a. What is the present value of the expected euro dividend stream if the euro is expected to appreciate 3.90% per annum against the dollar?

b. What is the present value of the expected dividend stream if the euro were to depreciate 3.20% per annum against the dollar?

a. What is the present value of the expected euro dividend stream if the euro is expected to appreciate 3.90% per annum against the dollar?

Calculate the dividends in U.S. dollars for the next three years below: (Round to the nearest whole number for the dividends and round to four decimal places for the exchange rates.)

Dividend stream expected from investment (€)

Current and expected spot rate ($/€)

Dividends ($)

Year 0

1.2348

€

$

Year 1

Year 2

720,000 €

Year 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- McDougan Associates (USA). McDougan Associates, a U.S.-based investment partnership, borrows €80,000,000 at a time when the exchange rate is $1.3460 = €1.00. The entire principal is to be repaid in three years, and interest is 6.250% per annum, paid annually in euros. The euro is expected to depreciate vis-à-vis the dollar at 3% per annum. What is the effective cost of this loan for McDougan?arrow_forwardSuppose that the current spot exchange rate is €0.830/S and the three-month forward exchange rate is €o.815/S. The three-month interest rate is 6.00 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €830,000. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit.arrow_forwardBK Inc. has $100,000 that can be used for arbitrage in the forex market. The interest rate is US is 4% and in Europe is 5%. The current exchange rate USD to EUR is 0.87. The company expects that after a year, the exchange rate may not be favourable and executes a forward contract at EUR to USD 1.23. Calculate the net profit or loss of this covered interest arbitrage if the investment is made in Europe. Answer Choices: a. The net profit is $8,360.50 The net loss is $4,000.00 b. c. The net profit is $5,360.50 d. The net loss is $1,000.00arrow_forward

- You have $ 10 million to invest. If you invest the money in the US for six months, you can earn 2%/year. Alternatively, you can invest in Switzerland and earn 4%/year. The spot exchange rate is CHF 0.9188/$. The forward exchange rate for delivery six months hence is CHF 0.9188/$. Which method of investing do you prefer and what will be the value of your investment at maturity? Assume no transaction cost. O Invest in the US; $10,373,610 Invest in Switzerland; $10,202,013 O None of these O Invest in Switzerland; CHF 10,373,610 O Invest in the US; $10,100,502arrow_forwardSuppose that the current spot exchange rate is €0.85 per $ and the three-month forward exchange rate is €0.8313 per $. The three- month interest rate is 5.60 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €850,000. Required: a. How will you realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars? What will be the size of your arbitrage profit? b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros. How will you realize a certain profit and size of your arbitrage profit? Complete this question by entering your answers in the tabs below. Required A Required B How will you realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars? What will be the size of your arbitrage profit? Note: Do not round…arrow_forwardSuppose that the current spot exchange rate is €0.80/$ and the three-month forward exchange rate is €0.7813/$. The three-month interest rate is 5.60 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or €800,000. a. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit. b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in euros. 2. ATech has fixed costs of $7 million and profits of $4 million. Its competitor, ZTech, is roughly the same size and this year earned the same profits, $4 million. But it operates with fixed costs of $5 million and lower variable costs. a. Which firm has higher operating leverage? Hint: Use Degree of Operating Leverage (DOL), b. Which firm will likely have higher profits if the…arrow_forward

- Suppose that the U.S. firm Halliburton buys construction equipment from the Japanese firm Komatsu at a price of ¥300 million. The equipment is to be delivered to the United States and paid for in one year. The current exchange rate is ¥100 = $1. The current interest rate on one-year U.S. Treasury bills is 6%, and on one-year Japanese government bonds the interest rate is 4%. a. If Halliburton exchanges dollars for yen today and invests the yen in Japan for one year, it will need $ to exchange today in order to have ¥300 million in one year. (Round your response to the nearest dollar)arrow_forward18.3 Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three years. The first dividend, to be paid one year from now on December 31, is expected to be €720,000. The dividend is then expected to grow 10.0% per year over the following two years. The current exchange rate is $1.1940 = €1.00. Grenouille's weighted average cost of capital is 12%. a. What is the present value of the expected euro dividend stream if the euro is expected to appreciate 4.00% per annum against the dollar? b. What is the present value of the expected dividend stream if the euro were to depreciate 3.00% per annum against the dollar?arrow_forwardCopper International is a U.S. based company that would like to invest in a project in Europe. The initial cost of the project is €12 million. It is expected to generate a cash flow of €5.4 million each year in the next three years. The current spot exchange rate is €0.8/$. The current risk-free rates in the United States and Europe are 3 percent and 5 percent, respectively. The cost of capital for Copper on U.S. dollar investments is estimated to be 9 percent. (a) Calculate the projected exchange rate each year over the life of the project. Do you expect the U.S. dollar to appreciate or depreciate relative to the Euro during this period? (b) Calculate the NPV of the project using the home currency approach. (c) Assume that the international Fisher effect holds. Calculate the NPV of the project using the foreign currency approach. (d) You notice that the spot exchange rate for the Swiss franc is SF per $1 = 1.7, and the cross-rate is € per SF = 0.40. Do you think this is a fair rate?…arrow_forward

- Required: Suppose a U.S. investor wishes to invest in a British firm currently selling for £90 per share. The investor has $36,000 to invest, and the current exchange rate is $2/£. Consider three possible prices per share at £88, £93, and £98 after 1 year. Also, consider three possible exchange rates at $1.80/£, $2/£, and $2.20/£ after 1 year. Calculate the standard deviation of both the pound- and dollar-denominated rates of return if each of the nine outcomes (three possible prices per share in pounds times three possible exchange ates) is equally likely. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places.) Standard deviation of pound-denominated return Standard deviation of dollar-denominated return %arrow_forwardA British bank issues a $130 million, three-year Eurodollar CD at a fixed annual rate of 8 percent. The proceeds of the CD are lent to a British company for three years at a fixed rate of 10 percent. The spot exchange rate of pounds for U.S. dollars is £1.50/US$. a-1. Is this expected to be a profitable transaction ex ante? Yes No a-2. What are the cash flows if exchange rates are unchanged over the next three years? (Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places. (e.g., 32.16)) Eurodollar CD British Loan t Cash Outflow (U.S.$) (£) Cash Inflow (£) Spread (£) 1 million million million million 2 million million million million 3 million million million million b. If the U.S. dollar is expected to appreciate against the pound to £1.65/$1, £1.815/$1, and £2.00/$1 over the next three years, respectively, what will be the cash flows on this transaction? (Negative amount should be indicated by a minus sign. Do not round intermediate…arrow_forward(C) US Bank is considering investing in a three years' project in Europe country. The project would require an initial investment of $750,000 and it is expected to generate €80,000, €100,000 and €150,000 in year one until three, respectively. The business risk will be identical to the firm's existing line of business in the euro-zone, the required rate of return in the euro-zone is 18 percent. The exchange rate is $1.20/€ where the dollar also shows appreciating by one percent for every year. Determine the Net Present Value (NPV) in dollar currency for this project and justify.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education