Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

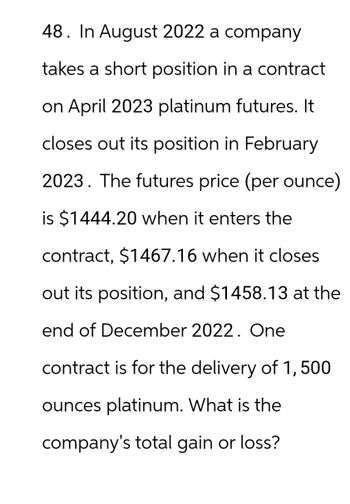

Transcribed Image Text:48. In August 2022 a company

takes a short position in a contract

on April 2023 platinum futures. It

closes out its position in February

2023. The futures price (per ounce)

is $1444.20 when it enters the

contract, $1467.16 when it closes

out its position, and $1458.13 at the

end of December 2022. One

contract is for the delivery of 1,500

ounces platinum. What is the

company's total gain or loss?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following prices, volume and open interest for gold futures contracts. Contract size: 100 oz Price units: $/oz (a) Which contract reached the highest price on this trading day? What was its contract value at that price? (b) Why is the high price equal to the low price for the contract expiring in October 2022?arrow_forwardOn June 6, 2021, firm ABC has a contract to sell 1,000 barrels of crude oil on November 17, 2021. ABC uses a hedge with one WTI NYMEX DEC futures. The DEC Futures traded on June 6, 2021 for $89/barrel. A. What type of hedge will company ABC open? B. On November 17, 2021 the crude spot price is $82/barrel and the DEC Futures is trading for $83.50/barrel. ABC sells the 1,000 barrels in the spot market and closes its hedge. Calculate the price per barrel ABC receives.arrow_forward= An investor enters a short position in the S&P 500 E-mini futures contract that will expire in three months. The S&P 500 index currently trades at St $4,538.43. (As of 3-Dec-21.) Regarding contract specifications, the contract corresponds to 50 times the S&P 500 index. Additionally, the initial and maintenance margins are, respectively, $12,100 and $11,000. Finally, the futures contract is currently trading at Fț(T) = $4,531.25 (actual settlement price for the Mar-22 contract on 3-Dec-21). Given this information, address the following two questions. 12. Suppose that the annual dividend yield is q = 2%, what is the implied annual risk-free rate r? (a) -0.012 (b) 0.012 (c) 0.014 (d) -0.0370 12arrow_forward

- You placed $120,000 in your future trading account have just bought your first HSI June 2023 futures contract today @ 19,652, at market close the HSI June 2023 future closed at 19,534. Currently the initial margin for HSI is $101,944, the maintenance margin is $81,555. HSI futures is $50 per index point. What is you margin account balance as of market closed today? Please write out the detailed calculation stepsarrow_forwardIt is now January. The current annual interest rate is 6.4%. The June futures price for gold is $1485.80, while the December futures price is $1,494. Assume the June contract expires in exactly 6 months and the December contract expires in exactly 12 months. Required: a. Calculate the appropriate price for December futures using the parity relationship? (Do not round intermediate calculations. Round your answer to 2 decimal places.) x Answer is complete but not entirely correct. $ 1,529.86 Price for December futuresarrow_forwardYou are long 10 gold futures contracts, established at an initial settle price of $1,580 per ounce, where each contract represents 100 ounces. Over the subsequent four trading days, gold settles at $1,584, $1,581, $1,589, and $1,597, respectively. a. Calculate the profit or loss for each trading day. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) b. Compute your total profit or loss at the end of the trading period. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. Day 1 a. Day 2 a. Day 3 a. Day 4 b. Total profit/lossarrow_forward

- Consider the following prices, volume and open interest for gold futures contracts. Contract size: 100 oz Price units: $/oz (a) What was the value of the contract that expires in February 2022 when the market closed? (b) Which futures contracts had a higher settle price on the previous trading day? (c) Would a speculator prefer to go short at the daily high price or the daily low price?arrow_forwardAn investor holds a short position in four July crude palm oil futures contracts. When the contract was entered into on day zero, the futures price was RM 2200 per metric tonne. The initial margin is RM 2750 per contract, and the maintenance margin is RM 1500 per contract. The following table gives information on the price of CPO for July delivery over a 3-day period. Day 1 Closing futures Price (RM) 2150 2300 3 2350 Assess what will the variation margin be on the first day a margin call is received? A. RM 11,000 B. RM 10,000 C. RM 5,000arrow_forwardAm. 113.arrow_forward

- Norwegian Krone (CME) - 2,000,000 Kroner; $ per contract. MONTH CHART LAST CHANGE PRIOR SETTLE OPEN HIGH LOW VOLUME JUN 2023 NOKM3 0.09586 -0.00064 (-0.66%) 0.09650 0.09662 0.09662 0.09581 67 3. Given the above information, calculate the dollar value of a Norwegian Krone SEP 2022 futures contract. 4. You hold securities in Australia valued at AUD (Australian Dollar) 55 million. How many SEP AUD futures should be bought or sold to hedge the foreign exchange risk. SEP AUD futures contracts (AUD 100,000 per contract) settled most recently at AUD 1.4202/$.arrow_forwardOn 1 July 2023, Molly Ltd holds a well-diversified portfolio of shares that is valued at $1.55 million. On this date it enters into 60 futures contracts on All Ordinaries Share Price Index futures in which it takes a sell position. The All Ordinaries Index on 1 July 2023 is 2500 with $10 per index point. So the total price of the futures contract is calculated as 2500 × 60 × $10 contracts = $1,500,000. A total deposit of $100,000 is paid on the futures contracts. On 29 July 2023 Molly Ltd decides to sell its portfolio of shares and to close out its futures contracts. On this date, the market value of the share portfolio is $1.725 million and the All Ordinaries Index is 2720. Required: Prepare the entries of Molly Ltd for any financial assets or financial liabilities that arise in each case and show your working process.arrow_forwardUsing Figure 14.1 You are long 60 July 2022 corn futures contracts. Calculate your dollar profit or liss from this trading day. Note: A negative value should be indicated by a minus sign. Do not round intermediate calculations. What is the Gain or Loss by?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education