Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

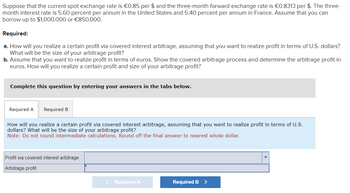

Transcribed Image Text:Suppose that the current spot exchange rate is €0.85 per $ and the three-month forward exchange rate is €0.8313 per $. The three-

month interest rate is 5.60 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can

borrow up to $1,000,000 or €850,000.

Required:

a. How will you realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars?

What will be the size of your arbitrage profit?

b. Assume that you want to realize profit in terms of euros. Show the covered arbitrage process and determine the arbitrage profit in

euros. How will you realize a certain profit and size of your arbitrage profit?

Complete this question by entering your answers in the tabs below.

Required A Required B

How will you realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S.

dollars? What will be the size of your arbitrage profit?

Note: Do not round intermediate calculations. Round off the final answer to nearest whole dollar.

Profit via covered interest arbitrage

Arbitrage profit

< Required A

Required B

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that your company will be receiving 30 million euros six months from now and the euro is currently selling for 1 euro per dollar. If you want to hedge the foreign exchange risk in this payment, what kind of forward contract would you want to enter into?arrow_forwardSuppose that the interest rates in the U.S. and Germany are equal to 5%, that the forward (one year) value of the € is F$/€ = 1$/€ and that the spot exchange rate is E$/€ = 0.75$/€. Please answer the following questions by explaining all steps of your analysis: Does the covered interest parity condition hold? Why or why not? How could you make a riskless profit without any money tied up assuming that there are no transaction costs in buying and or selling foreign exchange? PLEASE SHOW ALL STEPSarrow_forwardHan Co wishes to predict the exchange rate between the dollar ($) and the euro (€), based on the following information: Spot exchange rate $1= €1.6515 Dollar interest rate 4.5% per year Euro interest rate 6.0% per year Which of the following is the one-year forward rate, using interest rate parity theory? O $1= €1.2386 O $1= €1.6752 O $1= €2.2020 O $1= €1.6281arrow_forward

- Given: interest rates are 6% in the U.S. and 15% in the U.K. The spot exchange rate for British pounds is 1.27 $/£ and the 1-year forward rate is F1 - yr = 1.19 $/£. You wish to borrow dollars. a. How can you effectively (synthetically) borrow $100,000 for one year without using the U.S. money market? (List each transaction you would make including the amounts of each currency involved. You may use either continuous compounding or discrete compounding as long as you show your calculations.) b. What is the implied interest rate on your synthetic loan? c. Should you borrow directly or synthetically, and why? d. How could an arbitrageur make a risk-free profit?arrow_forward29) Suppose that the two-year interest rates in Australia and the United States are 4.6% and 0.4% per annum, respectively, and the spot exchange rate between the Australian dollar (AUD) and the US dollar (USD) is 1.0500 USD per one unit of AUD. What is the theoretical forward exchange rate from the perspective of an Australian investor wanting to purchase USD in two years' time? A. 1.0134 AUD per USD. B. 1.0258 AUD per USD. C. 1.0234 AUD per USD..arrow_forwardA European firm borrows MXN from a Mexico bank at a 7% interest rate. Over that same time, the Euro appreciates 2.70% against the MXN. What is the European firm's €-denominated equivalent cost of borrowing?arrow_forward

- Newstar Co. expects to pay 500,000 euro in one year. Assume the annual interest rate of borrowing or lending euro is 1% and the annual interest rate of borrowing or lending U.S. dollar is 2%. The spot rate of euro is $1.12 per euro. How much guaranteed amount of U.S. dollar does the company expect to pay after hedging the euro payable transaction in the international money market? (pick the closest answer) A. 565,545 USD. B. 554,510 USD. C. 562,786 USD. D. 576,912 USD.arrow_forwardA 141. Subject:- financearrow_forwardSuppose the current USD/EUR spot exchange rate is 1.20$/ €. At the same the euro interest rate amount to 10% per year while the dollar interest rate is 0% per year. a. What is the no-arbitrage one-year USD/EUR forward exchange? b. Suppose the one-year USD/EUR forward exchange was 1.25$/ €. How could you make money from this situation? 4arrow_forward

- Suppose exchange rates are: EUR/AUD = 1.5550 GBP/AUD = 2.8923 GBP/EUR = 1.8600 Starting with 10,000 AUD, what are the one-round-trip arbitrage profits rounded to the nearest AUD? 14,180 AUD No arbitrage profit is possible. 1,961 AUD 73,654 AUDarrow_forwardSuppose that the current EUR/GBP exchange rate is £0.86 per euro. The current 6-month interest rates are: GBP 4%, EUR 6%. There are three 6-month forward contracts available, with the following exchange rates: Contract A B C EUR/GBP 0.86 0.85 0.90 You expect to incur an expense of €50,000 in six months. Can you identify any relevant risk in terms of the EUR/GBP exchange rate? Would you use any of the available forward contracts to hedge against this risk? Explain and provide an example.arrow_forwardSuppose the spot price of a euro in dollars is $0.932. The U.S. interest rate for 90 days is 6.875% and the euro rate for 90 days is 4.450%. All interest calculations are done as rate times (#days/360). a. What is the rate for a 90-day forward contract on the euro? b. Suppose the euro forward contract is currently quoted at $0.95. What type of transaction(s) should an arbitrageur conduct to take advantage of the apparent mispricing Only typed answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education