Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

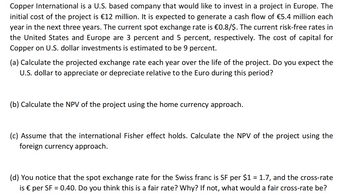

Transcribed Image Text:Copper International is a U.S. based company that would like to invest in a project in Europe. The

initial cost of the project is €12 million. It is expected to generate a cash flow of €5.4 million each

year in the next three years. The current spot exchange rate is €0.8/$. The current risk-free rates in

the United States and Europe are 3 percent and 5 percent, respectively. The cost of capital for

Copper on U.S. dollar investments is estimated to be 9 percent.

(a) Calculate the projected exchange rate each year over the life of the project. Do you expect the

U.S. dollar to appreciate or depreciate relative to the Euro during this period?

(b) Calculate the NPV of the project using the home currency approach.

(c) Assume that the international Fisher effect holds. Calculate the NPV of the project using the

foreign currency approach.

(d) You notice that the spot exchange rate for the Swiss franc is SF per $1 = 1.7, and the cross-rate

is € per SF = 0.40. Do you think this is a fair rate? Why? If not, what would a fair cross-rate be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider this case: Sebrele Enterprises Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project: The project requires an investment of AU$915,000 today and is expected to generate cash flows of AU$900,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7823 per Australian dollar (AUS). The one-year forward exchange rate is $0.8102 / AU$, and the two-year forward exchange rate is $0.8412 / AU$. The firm's weighted average cost of capital (WACC) is 9.5%, and the project is of average risk. What is the dollar-denominated net present value (NPV) of this project? $610,602 $726,908 $581,526 $639,679arrow_forward1.arrow_forwardLufthansa Airlines, headquartered in Cologne, Germany, needs US$13,500,000 for two years to finance working capital. The airline has two alternatives for borrowing: Borrow $13,500,000 in New York at 6.00% per annum. Borrow €10,000,000 in Cologne at 3.00% per annum, and exchange these euro at the present exchange rate of $1.35/€ for U.S. dollars. For both loans, Luftansa will make no payments until the end of two years, when principal and accumulated interest will be paid. At what ending exchange rate would Lufthansa be indifferent between borrowing U.S. dollars and borrowing euro?arrow_forward

- Consider the following international investment opportunity. It involves a gold mine that can be opened at a cost, then produces a positive cash flow, but then requires environmental clean-up. Year 0 + -€64,000 Year 1 Year 2 €160,000 -€100,000 The current exchange rate is $1.60 = €1.00. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent. Find the euro-zone cost of capital. Write it down in percent with two decimals places.arrow_forwardBoeing just signed a contract to sell a Boeing 737 aircraft to Air France. Air France will be billed €10.14 million payable in one year. The current spot exchange rate is $1.07 per euro and the one-year forward rate is $1.12 per euro. The annual interest rate is 8 percent in the United States and 7 percent in France. Boeing is concerned with the volatile exchange rate between the dollar and the euro and would like to hedge exchange exposure. Required: a. It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Crédit Lyonnaise against the euro receivable. Which alternative would you recommend? b. Other things being equal, at what forward exchange rate would Boeing be indifferent between the two hedging methods? Complete this question by entering your answers in the tabs below. Required A Required B It is considering two hedging alternatives: sell the euro proceeds from the sale forward or borrow euros from Crédit Lyonnaise against…arrow_forwardIt is the year 2021 and Pork Barrels, Inc., is considering construction of a new barrel plant in Spain. The forecasted cash flows in millions of euros are as follows: C0 C1 C2 C3 C4 C5 –95 +25 +35 +38 +42 +40 The spot exchange rate is $1.35 = €1. The interest rate in the United States is 8%, and the euro interest rate is 6%. You can assume that pork barrel production is effectively risk-free. a-1. Calculate the NPV of the euro cash flows from the project. a-2. What is the NPV in dollars? b. What are the dollar cash flows from the project if the company hedges against exchange rate changes?arrow_forward

- Lakonishok Equipment has an investment opportunity in Europe. The project costs €18,406,730 and is expected to produce cash flows of €3,681,369 in Year 1, €4,992,682 in Year 2, and €6,337,782 in Year 3. The current spot exchange rate is $1.23/€ and the current risk-free rate in the United States is 3.71%, compared to that in Europe of 3.03%. The appropriate discount rate for the project is estimated to be 10.55%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €12,529,609. What is the NPV of the project?arrow_forwardBhupatbhaiarrow_forwardYou work for a firm whose home currency is the British Pound (GBP) and that is considering a foreign investment. The investment yields expected after-tax Russian Ruble (RUB) cash flows (in millions) as follows: -RUB1170 in Year 0, and RUB521 in each of the 3 years of the life of the project. The expected rates of inflation in each country are constant per year: 4.30% in Russia, and 9.10% in the UK. From the project's perspective the required return is 6.63%, while from the parent's perspective, the required rate of return is 11.56%. The spot exchange rate is GBP0.008314/RUB. What is the NPV of the project from the parent company's perspective? O a. GBP1.713 million O b. GBP2.779 million O c. GBP24,779.23 million O d. GBP40,209.27 million O e. None of the options in this question are correct.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education