Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi can you please help me verify my answers for this problem. For each blank please help. Thank you.

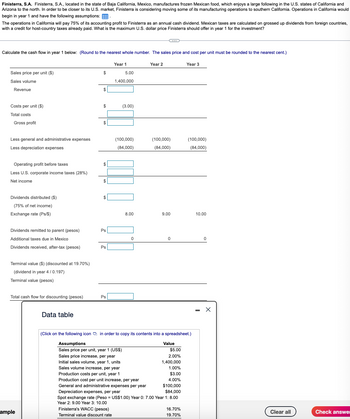

Transcribed Image Text:Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexican food, which enjoys a large following in the U.S. states of California and

Arizona to the north. In order to be closer to its U.S. market, Finisterra is considering moving some of its manufacturing operations to southern California. Operations in California would

begin in year 1 and have the following assumptions:

The operations in California will pay 75% of its accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed up dividends from foreign countries,

with a credit for host-country taxes already paid. What is the maximum U.S. dollar price Finisterra should offer in year 1 for the investment?

Calculate the cash flow in year 1 below: (Round to the nearest whole number. The sales price and cost per unit must be rounded to the nearest cent.)

Sales price per unit ($)

Sales volume

Revenue

Costs per unit ($)

Total costs

Gross profit

Year 1

5.00

1,400,000

(3.00)

Year 2

Year 3

Less general and administrative expenses

(100,000)

(100,000)

(100,000)

Less depreciation expenses

(84,000)

(84,000)

(84,000)

Operating profit before taxes

Less U.S. corporate income taxes (28%)

Net income

Dividends distributed ($)

(75% of net income)

Exchange rate (Ps/$)

8.00

9.00

10.00

Dividends remitted to parent (pesos)

Ps

Additional taxes due in Mexico

0

0

0

Dividends received, after-tax (pesos)

Ps

Terminal value ($) (discounted at 19.70%)

(dividend in year 4 / 0.197)

Terminal value (pesos)

Total cash flow for discounting (pesos)

Ps

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Assumptions

Sales price per unit, year 1 (US$)

Sales price increase, per year

Initial sales volume, year 1, units

Sales volume increase, per year

Production costs per unit, year 1

Value

$5.00

2.00%

1,400,000

1.00%

$3.00

4.00%

$100,000

$84,000

Production cost per unit increase, per year

General and administrative expenses per year

Depreciation expenses, per year

Spot exchange rate (Peso = US$1.00) Year 0: 7.00 Year 1: 8.00

Year 2: 9.00 Year 3: 10.00

ample

Finisterra's WACC (pesos)

Terminal value discount rate

16.70%

Clear all

Check answe

19.70%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Dick Smith Foods. is a U.S. company that is considering expanding its operations into Japan. The company supplies processed foods to storefront delicatessens in large cities. This requires Dick Smith Foods to have a centralized production and warehousing facility in each of these cities. Dick Smith Foods has located a possible site for a Japanese subsidiary in Tokyo. The cost to purchase and equip the facility is ¥885,000,000. Perform an NPV analysis to determine whether this is a good investment, under the following assumptions: a. The average per-unit sales price will initially be ¥510. b. First-year sales will be 17 million units, and physical sales will then grow at 10% per annum for the next 3 years. c. First-year variable costs of production will be ¥325 per unit of labor and $1.85 per unit of imported semi-finished goods. Administrative costs will be ¥200 million. d. Retail prices, labor costs, and administrative expenses are expected to rise at the Japanese…arrow_forwardYour firm and 2 competitors share a niche market producing outdoor heaters. You are considering launching a new model called "Pretty darn hot" in addition to your two existing products, Cozy I and Cozy II. Your competitors currently sell the "Not too warm, not too cold" and "Australian Winter" models. Current sales (which are assumed to continue in the absence of new product launches) and expected sales when the new product enters the market are depicted in the table below (numbers in thousands $): Product Current Period Sales Expected Period Sales "Cozy I" 14.6 14.0 "Cozy II" 23.8 19.9 "Pretty darn hot" 26.2 "Not too warm, not too cold" 96.8 83.6 "Australian Winter" 40.5 37.0 What are the incremental sales that you should consider when evaluating the new model (in $'000)? (Give your answer in thousands accurate to 2 decimal places)arrow_forwardThe Ayayal Inc, a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Ayayai has decided to locate a new factory in the Panama City area. Ayayai will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $610,000, useful life 27 years Building B: Lease for 27 years with annual lease payments of $71.570 being made at the beginning of the year. Building C: Purchase for $650.800 cash. This building is larger than needed: however, the excess space can be sublet for 27 years at a net annual rental of $6,890. Rental payments will be received at the end of each year. The Ayayal Inc has no aversion to being a landlord. Click here to view factor tables In which building would you recommend that The Ayayal Inc…arrow_forward

- Individual ActivityMarbles Inc. is a start- up Company manufacturing marbles andelastic bands. The Company imports its raw materials from France,but based on its business model expects that within the next 6 monthsit will be able to manufacture its own products. These will be soldlocally in Grenada, with further plans for export to the wider Caribbeanand Latin America. As such, a lot of Marketing and promotion will berequired to get the product off the ground to meet this business target.Also, due to this projected expansion, machinery will have to bepurchased to create the products.The Financial Controller decides that the first step in creating heraccounting system is to create a Chart of Accounts.Before creating the Chart, she is contemplating the accounts whichshe will need for her Chart of Accounts. She knows that Cash, Sales,Purchases and Staff Costs are some of the accounts that will beneeded. You are assisting her to build this tool and she requires yourhelp. Advise her on the…arrow_forwardvtarrow_forwardGlobal Reach, Inc., is considering opening a new warehouse to serve the Southwest region. Darnell Moore, controller for Global Reach, has been reading about the advantages of foreign trade zones. He wonders if locating in one would be of benefit to his company, which imports about 90 percent of its merchandise (e.g., chess sets from the Philippines, jewelry from Thailand, pottery from Mexico, etc.). Darnell estimates that the new warehouse will store imported merchandise costing about 16.78 million per year. Inventory shrinkage at the warehouse (due to breakage and mishandling) is about 8 percent of the total. The average tariff rate on these imports is 5.5 percent. Required: 1. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in tariffs? Why? (Round your answer to the nearest dollar.) 2. Suppose that, on average, the merchandise stays in a Global Reach warehouse for nine months before shipment to retailers. Carrying cost for Global Reach is 6 percent per year. If Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.) 3. Suppose that the shifting economic situation leads to a new tariff rate of 13 percent, and a new carrying cost of 6.5 percent per year. To combat these increases, Global Reach has instituted a total quality program emphasizing reducing shrinkage. The new shrinkage rate is 7 percent. Given this new information, if Global Reach locates the warehouse in a foreign trade zone, how much will be saved in carrying costs? What will the total tariff-related savings be? (Round your answers to the nearest dollar.)arrow_forward

- The Crane Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Crane has decided to locate a new factory in the Panama City area. Crane will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $610,000, useful life 27 years. Building B: Lease for 27 years with annual lease payments of $70,500 being made at the beginning of the year. Building C: Purchase for $656,700 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $6,570. Rental payments will be received at the end of each year. The Crane Inc. has no aversion to being a landlord. Click here to view factor tables. In which building would you recommend that The Crane Inc.…arrow_forwardThe Novak Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Novak has decided to locate a new factory in the Panama City area. Novak will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $618,100, useful life 26 years.Building B: Lease for 26 years with annual lease payments of $70,340 being made at the beginning of the year.Building C: Purchase for $653,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,540. Rental payments will be received at the end of each year. The Novak Inc. has no aversion to being a landlord.arrow_forwardBundbasher Inc., a manufacturer of high-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Bundbasher has decided to locate a new factory in the Panama City area. Bundbasher will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three buildings. Building A: Purchase for a cash price of $610,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $70,000 being made at the beginning of the year. Building C: Purchase for $650,000 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,000. Rental payments will be received at the end of each year. The Bundbasher Inc. has no aversion to being a landlord. In which building would you recommend that Brubaker Inc. locate, assuming a 12% cost of funds?arrow_forward

- - Your answer is partially correct. The Pronghorn Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Pronghorn has decided to locate a new factory in the Panama City area. Pronghorn will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $618,100, useful life 26 years. Building B: Lease for 26 years with annual lease payments of $70,340 being made at the beginning of the year. Building C: Purchase for $653,200 cash. This building is larger than needed; however, the excess space can be sublet for 26 years at a net annual rental of $6,540. Rental payments will be received at the end of each year. The Pronghorn Inc. has no aversion to being a landlord. Click here to view factor tables. In which…arrow_forwardThe Monty Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Monty has decided to locate a new factory in the Panama City area. Monty will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs.Building A: Purchase for a cash price of $617,900, useful life 27 years.Building B: Lease for 27 years with annual lease payments of $70,330 being made at the beginning of the year.Building C: Purchase for $655,700 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $6,700. Rental payments will be received at the end of each year. The Monty Inc. has no aversion to being a landlord.In which building would you recommend that The Monty Inc. locate, assuming a 12% cost of funds?…arrow_forwardThe Bridgeport Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Bridgeport has decided to locate a new factory in the Panama City area. Bridgeport will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $611,000, useful life 25 years. Building B: Lease for 25 years with annual lease payments of $71,370 being made at the beginning of the year. Building C: Purchase for $657,400 cash. This building is larger than needed; however, the excess space can be sublet for 25 years at a net annual rental of $6,800. Rental payments will be received at the end of each year. The Bridgeport Inc. has no aversion to being a landlord. Click here to view factor tables. In which building would you recommend…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning