EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

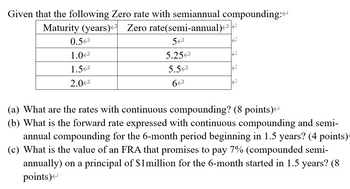

Transcribed Image Text:Given that the following Zero rate with semiannual compounding:<

Zero rate(semi-annual)<

Maturity (years)

0.50

1.0<

1.5

2.0<

5

5.250

5.5

67

(a) What are the rates with continuous compounding? (8 points)<

(b) What is the forward rate expressed with continuous compounding and semi-

annual compounding for the 6-month period beginning in 1.5 years? (4 points)

(c) What is the value of an FRA that promises to pay 7% (compounded semi-

annually) on a principal of $1 million for the 6-month started in 1.5 years? (8

points)<

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The F/G factor values can be derived by multiplying: (P/F ) and ( A/G ) factor values (F/P) and ( P/G ) factor values (P/F ) and ( P/G ) factor values (F/P) and ( A/G ) factor valuesarrow_forwardHow can we obtain an equal-payment series equivalent to the gradient series?arrow_forwardWhat is the reason P/E Ratio become lower and higher?arrow_forward

- 7. Given the following marginal revenue functions, R' (Q) terms of R(0). Hint: Lets say u=1+Q Oa. R(Q) 40 11Q O b. R(Q)=R(0)+40 40(1+Q), find total revenue function in O c. R(Q) 40 +R(0) 11Q 40 O d. R(Q) R(0) +40 14Q O e. R(Q) +R(0) 1+Qarrow_forwardIf two mutually exclusive alternatives have B/C ratios of 1.5 and 1.4 for the lower first-cost and higher first-cost alternatives, respectively: (a) The B/C ratio on the increment between them is greater than 1.4 (b) The B/C ratio on the increment between them is between 1.4 and 1.5 (c) The B/C ratio on the increment between them is less than 1.4 (d) The lower-cost alternative is the better onearrow_forwardSHOW YOUR WORK IN THE SPACES PROVIDED BELOW FOR FULL CREDIT. 1) Understanding Normal Distribution (2p) a. Which normal curve has a greater mean? b. Which normal curve has a greater standard deviation?arrow_forward

- • Use the below information to fill out the income statement and answer the questions 4-10 below: Selling Price per Unit Number of Units Total Dollars Sales Revenue $40.00 Variable Costs |600,000 Contribution Margin Fixed Costs 240,000 Net Income If OPEARATING LEVERAGE is 5 4. What is Net Income ?arrow_forwardDefine each of the following terms: d. Modified internal rate of return (MIRR) methodarrow_forwardHow do you calculate the value at a node in a binomial tree? A. As a present value of the two possible values from the next period В. Average of the present value of the possible values from the next period OC. Sum of the present values of the two possible values from the next period D. Average of the future values of the two possible values from the next periodarrow_forward

- In performing horizontal analysis, why is it important to look at both the amount and the percentage change?arrow_forwardNonearrow_forwardWhich of the following describes the behavior of the fixed cost per unit? a.remains constant with changes in production b.decreases with decreasing production c.decreases with increasing production d.increases with increasing productionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning