EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

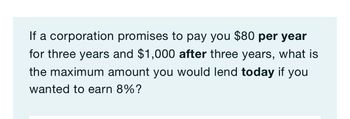

Transcribed Image Text:If a corporation promises to pay you $80 per year

for three years and $1,000 after three years, what is

the maximum amount you would lend today if you

wanted to earn 8%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much will you have to pay at the end of one year on these financial accounting question?arrow_forwardIf you invest $18,000 at 6% interest, how much will you have in 15 years? Use Appendix A to calculate the answer. a) $25,506 b) $43,146 c) $7,506 d) $97,918arrow_forwardHow much will you have in 12 years on these financial accounting question?arrow_forward

- How much will you have in 11 years?? General accountingarrow_forwardIf you borrow $1,000 and pay back $1,728 in three years, what annual rate of interest are you paying?arrow_forward2) You decide to buy a house costing $6,000,000. You pay $1,000,000 down, and the remainder will be paid inmonthly installments over 25 years at 3.9% compounded monthly. a) What is the monthly payment?b) What is the outstanding balance after making the 100the payment?c) What is the equity after making the 100the payment?d) How much of the 100the payment will go to the principal and how much to interest?e) How much interest will be paid over the entire length of the loan? TVM SOLVERarrow_forward

- Suppose you currently have $2,000 and plan to purchase a 3-year certificate ofdeposit (CD) that pays 4% interest compounded annually. How much will you havewhen the CD matures? How would your answer change if the interest rate were 5% or6% or 20%? ($2,249.73, $2,315.25, $2,382.03, $3,456.00. Hint: With a calculator,enter N 5 3, I/YR 5 4, PV 5 22000, and PMT 5 0; then press FV to get 2,249.73.Enter I /YR 5 5 to override the 4%, and press FV again to get the second answer.In general, you can change one input at a time to see how the output changes.)arrow_forward1. What is the amount you would have to deposit today to be able to take out $2070 a year for 2 years from an account earning 14 percent. 2. If you desire to have $38300 for a down payment for a house in 11 years, what amount would you need to deposit today? Assume that your money will earn 4 percent.arrow_forwardYou want to have $67,000 in your savings account 10 years from now, and you're prepared to make equal annual deposits into the account at the end of each year. If the account pays 6.3 percent interest, what amount must you deposit each year? Group of answer choices $6,700.00 $5,011.98 $4,221.01 $4,220.99 $9,350.13arrow_forward

- What is the present value of $5,000 that will be paid to you eight years from today at 8% interest?arrow_forwardYou would like to have $1,000,000 when you retire in 35 years. How much should you invest each quarter if you can earn a rate of 6.1% compounded quarterly?a) How much should you deposit each quarter?$b) How much total money will you put into the account?$c) How much total interest will you earn?$arrow_forwardYou borrow $11,000 and promise to make payments of $3,359.50 at the end of each year for 5 years. What is the interest rate earned? Round your answers to the nearest whole numberarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT