Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Page 41 of 41

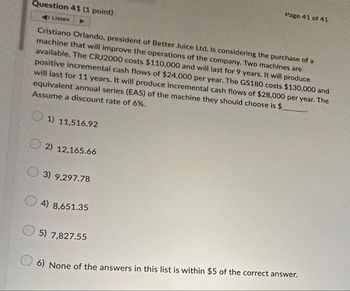

Question 41 (1 point)

Listen

Cristiano Orlando, president of Better Juice Ltd, is considering the purchase of a

machine that will improve the operations of the company. Two machines are

available. The CRJ2000 costs $110,000 and will last for 9 years. It will produce

positive incremental cash flows of $24,000 per year. The GS180 costs $130,000 and

will last for 11 years. It will produce incremental cash flows of $28,000 per year. The

equivalent annual series (EAS) of the machine they should choose is $

Assume a discount rate of 6%.

1) 11,516.92

2) 12,165.66

3) 9,297.78

4) 8,651.35

5) 7,827.55

6) None of the answers in this list is within $5 of the correct answer.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce net cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million, and will produce net cash flows of $25 million per year. Shao plans to serve the route for only 10 years. Inflation in operating costs, airplane costs, and fares are expected to be zero, and the company’s cost of capital is 12%. By how much would the value of the company increase if it accepted the better project (plane)? What is the equivalent annual annuity for each plane?arrow_forward5. Bullock Gold Mining is evaluating a new gold mine in South Dakota. All of the analysis has been done and the CFO has forecast some of the relevant cash flow information. If BGM opens the mine, it will cost S635 million today (Time 0) and it will have a cash outflow nine years from today (Time 9) of $45 million in costs related to closing the mine and reclaiming the area around. Of the initial costs, BGM will depreciate $500 million over 8 years using straight line method. Expected earnings before taxes for the eight years of operation are shown below. BGM has a required rate of return for all of its gold mines of 12%. Earnings before taxes (in $1,000s): 0 1 37,857.14 60,714.29 96,428.57 157,857.1 203,571.4 132,142.9 117,857.1 85,000.00 2 3 4 6 7 8 a) Find the relevant cash flows for each of the relevant periods (Time 0 – Time 9). Operating cash flows for Time 1-8 should include: - Earnings before taxes Taxes (30%) Net Income Depreciation Free Cash flows b) Calculate the NPV, IRR and…arrow_forwardJS er st un gs Sunland, Inc. management is considering purchasing a new machine at a cost of $4,370,000. They expect this equipment to produce cash flows of $791,390, $796,950, $866,730, $1,116,300, $1,212,360, and $1,300,900 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is tA $arrow_forward

- Salt Lake Potash is considering a project with the following cash flows. An initial investment of $1.025bn is required for the project. The discount rate is 9%. The company wants to calculate how long it would take investors to recover their initial investment. The company does not want to ignore the effects of time value of money and the discount rate. Year O CF ($mn) -$1,025 1.83 years 2.26 years What is your best estimate of the time to recovery? $159.79mn 1 2 $650 $450 19.9% 3 $250 4 $50arrow_forward20. Blue Run Snowboards makes snowboards. The company wants to add a new machine that would cost $80,000 and have a useful life of 5 years and no residual value. The company expects the machine will generate $24,000 annual cash inflows for 5 years. The discount rate is 10%. What is the net present value of the investment? Present Value of $1 Periods 10% 12%1 0.909 0.8932 0.826 0.7973 0.751 0.7124 0.683 0.6365 0.621 0.567 Present Value of Annuity of $1 Periods 10% 12%1 0.909 0.8932 1.736 1.6903 2.487 2.4024 3.170 3.0375 3.791 3.605 ⦁ $10,984⦁ $ 6,520⦁ $14,904⦁ $13,608arrow_forwardCan I get the answers to 10.2-10.4arrow_forward

- I want the answer for this Questionarrow_forwardhelp solving the question below?arrow_forwardZencorp is considering buying a $220,000 production machine. It would be depreciated (simplified straight line) for 10 years. This investment would allow the firm to increase sales by $130,000 per year. Operating expenses would increase by $80,000 per year also. The corporate tax rate is 21%. What is the annual cash flow for the project? O $75,720 O $44,120 O $170,520 O $71,100 O $53,720arrow_forward

- 1. Primus Corp. is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45 percent. The cost of this project will be $7,125,000. It will result in additional cash flows of $1,875,000 for the next eight years. The company uses a discount rate of 12 percent. What is the payback period? What is the NPV for the project? What is the IRR for the project?arrow_forwardA firm is considering a project with an annual cash flow of $200,000. The project would have a 7-year life, and the company uses a discount rate of 10 percent. Ignoring income taxes, what is the maximum amount the company could invest in the project and have the project still be acceptable? a. $973,600 b. $718,200 c. $200,000 d. $1,400,000 Please donot give answer in image format and it should be in step by step format and provide fast solutionarrow_forwardAnswer with calculation and explanation plsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning