FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

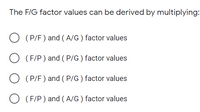

Transcribed Image Text:The F/G factor values can be derived by multiplying:

(P/F ) and ( A/G ) factor values

(F/P) and ( P/G ) factor values

(P/F ) and ( P/G ) factor values

(F/P) and ( A/G ) factor values

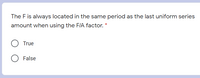

Transcribed Image Text:The F is always located in the same period as the last uniform series

amount when using the F/A factor.

True

False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Consider the generalised linear regression model: y = Xẞ + e, with E[e] = 0 and E[ee] = 022. Let the model be estimated using both OLS and GLS, and let the OLS estimator of ẞ be denoted as BOLS and its GLS estimator as BGLS. Which of the following statements are incorrect about the OLS and GLS estimators? (a) BOLS is BLUE (b) BGLS is BLUE (c) The variance of BOLS cannot be less than that of BGLS (d) BGLS is more efficient that BOLSarrow_forwardRequired information Consider the following factors. 1. (FIP,21%,34) 2. (A/G,21%,45) Find the numerical values of the factors using the appropriate formula. The numerical value of factor 1 is The numerical value of factor 2 isarrow_forwardd. Perpetual system, LIFO cost flow. e. Periodic system, weighted-average cost flow. f. Perpetual system, moving-average cost flow.arrow_forward

- CM ratio = 1 ______ the Variable expense ratio. minus plus divided by multiplied byarrow_forwardConsider the generalised linear regression model: y = Xẞ + e, with E[e] = 0 and E[ee] = 022. Let the model be estimated using both OLS and GLS, and let the OLS estimator of ẞ be denoted as BOLS and its GLS estimator as BGLS. Which of the following statements are incorrect about the OLS and GLS estimators? (a) BOLS is BLUE (b) BGLS is BLUE (c) The variance of BOLS cannot be less than that of BGLS (d) BGLS is more efficient that BOLSarrow_forwardHow do you know when to use the formula FV=PV(1+i)n vs. FV=PV(1+r/m)mtarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education