Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

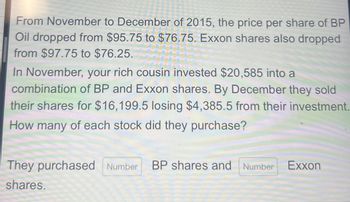

Transcribed Image Text:From November to December of 2015, the price per share of BP

Oil dropped from $95.75 to $76.75. Exxon shares also dropped

from $97.75 to $76.25.

In November, your rich cousin invested $20,585 into a

combination of BP and Exxon shares. By December they sold

their shares for $16,199.5 losing $4,385.5 from their investment.

How many of each stock did they purchase?

They purchased Number BP shares and Number Exxon

shares.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Need help on how to solve for the Earnings per share ( EPS )arrow_forwardOn December 24, 2007, the common stock of Google Inc. was trading for $700.73. one year later the shares sold for only $298.02. Google has never paid a common stock dividend. What rate of return would you have earned on your investment had you purchased the shares on December 24, 2007?arrow_forwardLast year, Luka Dončić paid $40.71 for shares of BioSteel. Afterward, he received a dividend of $1.47 per share. What is Luka Dončić’s dividend yield if, at the end of the year, BioSteel shares closed at $46.21? a. 3.61% b. 17.12% c. 13.51% d. 4.33% e. 3.97%arrow_forward

- Facebook Inc. (now Meta Platforms Inc.) issued 421.2 million class A common shares for $38 per share, on average, in its IPO on 5/18/2012. The par value of the stock was $0.000006 per share. Assume Facebook kept exactly $16 billion of the proceeds from the issue, with the rest being spent on stock issue costs. Record Facebook's entry for the issue of the shares. NOTE: Round dollar amounts to the nearest thousands of dollars.arrow_forwardWhen Rodeo went public in September 2016, the offer price was $22.00 per share and the closing price at the end of the first day was $23.80. The firm issued 5.2 million shares. What was the loss to the company due to underpricing? Loss to the company $arrow_forwardRemington, Inc., has $800,000 of 4% preferred stock and $1,200,000 of common stock outstanding, each having a par value of $10 per share. No dividends have been paid or declared during 2017 and 2018. As of December 31, 2019, it is desired to distribute $270,000 in dividends. Can you please explain how much will the preferred and common stockholders receive under each of the following assumptions: (a) The preferred is noncumulative and nonparticipating. (b) The preferred is cumulative and nonparticipating.arrow_forward

- Rachel’s Designs has 1,100 shares of 7%, $50 par value cumulative preferred stock issued at the beginning of 2016. All remaining shares are common stock. Due to cash flow difficulties, the company was not able to pay dividends in 2016 or 2017. The company plans to pay total dividends of $13,000 in 2018. How much of the $13,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders?arrow_forwardGeneral accountingarrow_forwardHello, How do I solve the 3 for 1 stock split?arrow_forward

- Please help answer this question.arrow_forwardLast year, Damian Lillard paid $39.25 for shares of Gatorade. Afterwards, he received a dividend of $1.39 per share. What is Damian Lillard’s capital gains yield if, at the end of the year, Gatorade shares closed at $44.65? a. 13.76% b. 12.09% c. 17.30% d. 3.54% e. 11.49%arrow_forwardOne year ago, your friend purchased 87shares of PantherCo. stock for $2,049.32. The stock does not pay any regular dividends but it did pay a special dividend of $0.56 a share last week. This morning, she sold her shares for $30.92 a share. What was the total percentage return on this investment? Answer as a percentage (e.g. 0.01 is 1.0%) but without the percentage (%) symbol.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College