Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

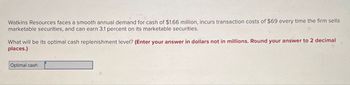

Transcribed Image Text:Watkins Resources faces a smooth annual demand for cash of $1.66 million, incurs transaction costs of $69 every time the firm sells

marketable securities, and can earn 3.1 percent on its marketable securities.

What will be its optimal cash replenishment level? (Enter your answer in dollars not in millions. Round your answer to 2 decimal

places.)

Optimal cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- a) What is the optimal transaction size? b) What should be Rosal's average cash balance? c) What is the total cost?arrow_forwardHollywood Shoes would like to maintain their cash account at a minimum level of $67,000, but expect the standard deviation in net daily cash flows to be $5,700; the effective annual rate on marketable securities to be 6.50 percent per year; and the trading cost per sale or purchase of marketable securities to be $270 per transaction. What will be their optimal cash return point? (Round your answer to 2 decimal places.)arrow_forwardOptimal cash balance. The Madatung Corporation plans to have P 1 million in steady cash outlays for next year. The firm believes that it will face an opportunity interest rate of 15% and will incur a cost of P 200 each time it borrows (or withdraws). Required: Using the Baumol Model: 1. Determine the transactions demand for cash (the optimal borrowing or withdrawal lot size) for Madatung Company. 2. What will be the cash cycle for the firm (in days)? 3. What would be the average cash balance for the firm? 4. Compute the total relevant cost of cash balance. Jorarrow_forward

- National Co. would like to maintain its cash account at a minimum level of P25,000, but expect the standard deviation in net daily cash flows to be P2,000; the effective annual rate on marketable securities to be 7.5% per year, and the trading cost per sale or purchase of marketable securities to be P200 per transaction. What will be their optimal cash return point?arrow_forwardHollywood Shoes would like to maintain their cash account at a minimum level of $64,000, but expect the standard deviation in net daily cash flows to be $5,400; the effective annual rate on marketable securities to be 7.00 percent per year, and the trading cost per sale or purchase of marketable securities to be $240 per transaction. What will be their optimal upper cash limit? Note: Round your answer to the nearest dollar amount. Multiple Choice $69,400 $83,546 $155.437 $86,922arrow_forwardHotFoot Shoes would like to maintain its cash account at a minimum level of $39,000, but expects the standard deviation in net daily cash flows to be $5,400, the effective annual rate on marketable securities to be 6.1 percent per year, and the trading cost per sale or purchase of marketable securities to be $160 per transaction. What will be its optimal cash return point? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

- HotFoot Shoes would like to maintain its cash account at a minimum level of $33,000, but expects the standard deviation in net daily cash flows to be $4,800, the effective annual rate on marketable securities to be 7.3 percent per year, and the trading cost per sale or purchase of marketable securities to be $280 per transaction. What will be its optimal cash return point? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.) Optimal cash return point 60 $arrow_forwardStellar Shoes would like to maintain their cash account at a minimum level of $25,000, but expects the standard deviation in net dally cash flows to be $2,000; the effective annual rate on marketable securities to be 5 percent per year, and the trading cost per sale or purchase of marketable securities to be $100 per transaction. What will be their optimal upper cash limit? Multiple Choice $114,277.02 $38,092.34 $27,000 $64,27702arrow_forwardNeed help with this accounting Questionarrow_forward

- Hollywood Shoes would like to maintain their cash account at a minimum level of $51,000, but expect the standard deviation in net daily cash flows to be $4,100; the effective annual rate on marketable securities to be 6.25 percent per year; and the trading cost per sale or purchase of marketable securities to be $110 per transaction. What will be their optimal upper cash limit? (Round your answer to the nearest dollar amount.) $55,100 $72,328.32 $111,859.83 $74,575.50arrow_forwardces Veggie Burgers, Inc. would like to maintain its cash account at a minimum level of $263,000 but expects the standard deviation in net daily cash flows to be $13,800, the effective annual rate on marketable securities to be 3.9 percent per year, and the trading cost per sale or purchase of marketable securities to be $36.50 per transaction. What will be its optimal cash return point? (Use 365 days a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) Optimal cash return point 631,400.00 Darrow_forwardA firm needs a total P30 million in new cash for transaction purposes. The annual interest rate on marketable securities is 12% and the brokerage fee cost per transaction of selling securities to replenish cash is P1,000. Which of the following is closest to the firm’s optimal average cash balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College