Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

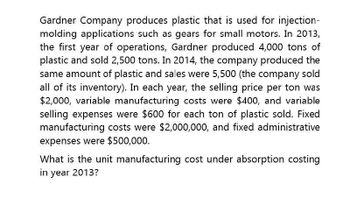

Transcribed Image Text:Gardner Company produces plastic that is used for injection-

molding applications such as gears for small motors. In 2013,

the first year of operations, Gardner produced 4,000 tons of

plastic and sold 2,500 tons. In 2014, the company produced the

same amount of plastic and sales were 5,500 (the company sold

all of its inventory). In each year, the selling price per ton was

$2,000, variable manufacturing costs were $400, and variable

selling expenses were $600 for each ton of plastic sold. Fixed

manufacturing costs were $2,000,000, and fixed administrative

expenses were $500,000.

What is the unit manufacturing cost under absorption costing

in year 2013?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gardener company produces plastic that is used provide answer accounting questionsarrow_forwardCarney Company manufactures cappuccino makers. For the first eight months of 2010, the company reported the following operating results while operating at 80% of plant capacity: Sales (500,000 units) Cost of goods sold Gross profit Operating expenses Net income Revenues Cost of Goods Sold Operating Expense $90,000,000 54,000,000 36,000,000 An analysis of costs and expenses reveals that variable cost of goods sold is $95 per unit and variable operating expenses are $35 per unit. In September, Carney Company receives a special order for 30,000 machines at $135 each from a major coffee shop franchise. Acceptance of the order would result in $10,000 of shipping costs but no increase in fixed expenses. Prepare an incremental analysis for the special order Reject Order Net Income 24,000,000 $12,000,000 Accept Orderarrow_forwardCullumber Company manufactures toasters. For the first 8 months of 2022, the company reported the following operating results while operating at 75% of plant capacity: Sales (358,400 units) Cost of goods sold Gross profit Operating expenses Net income (a) Cost of goods sold was 70% variable and 30% fixed; operating expenses were 80% variable and 20% fixed. In September, Cullumber receives a special order for 24.500 toasters at $8.38 each from Luna Company of Ciudad Juarez. Acceptance of the order would result in an additional $2,900 of shipping costs but no increase in fixed costs. Revenues Prepare an incremental analysis for the special order. (Round computations for per unit cost to 2 decimal places, e.g. 15.25 and all other computations and final answers to the nearest whole dollar, e.g. 5,725. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cost of goods sold Operating expenses $4,377.000 2,590,720 1,786.280 837.760 Net…arrow_forward

- Sheffield Corp. sells its product for $75 per unit. During 2016, it produced 70,000 units and sold 55000 units (there was no beginning inventory). Costs per unit are: direct materials $16, direct labor $15, and variable overhead $4. Fixed costs are: $910,000 manufacturing overhead, and $93,000 selling and administrative expenses. The per-unit manufacturing cost under absorption costing is__.arrow_forwardCrane Company manufactures toasters. For the first 8 months of 2022, the company reported the following operating results while operating at 75% of plant capacity: Sales (364,000 units) Cost of goods sold Gross profit Operating expenses Net income Cost of goods sold was 70% variable and 30% fixed; operating expenses were 80% variable and 20% fixed. In September, Crane receives a special order for 18,600 toasters at $7.95 each from Luna Company of Ciudad Juarez. Acceptance of the order would result in an additional $3,000 of shipping costs but no increase in fixed costs. (a) Prepare an incremental analysis for the special order. (Round computations for per unit cost to 2 decimal places, eg. 15.25 and all other computations and final answers to the nearest whole dollar, eg. 5,725. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg (45)) Revenues Prepare an incremental analysis for the special order. (Round computations for per unit cost to 2…arrow_forwardCan you please solve thisarrow_forward

- Jaroni Inc. produces specialty quilts and blankets using a partly manual, partly automated manufacturing process. Total sales for the previous period were $60,000. Wages, materials, and variable manufacturing overhead totaled $10,200. Salaries, depreciation, rent, and other fixed expenses amounted to $14,940. Jaroni charges $500 per customized blanket.What is Jaroni's break-even point in Sales Dollars?arrow_forwardSheffield Corp. sells its product for $70 per unit. During 2016, it produced 60,000 units and sold 50,000 units (there was no beginning inventory). Costs per unit are: direct materials $15, direct labor $12, and variable overhead $1. Fixed costs are: $720,000 manufacturing overhead, and $90,000 selling and administrative expenses. The per-unit manufacturing cost under absorption costing is: a. $41 b. $28 c. $40 d. $27arrow_forwardNorthwood Company manufactures basketballs. The company has a ball that sells for $25. At present, the ball Is manufactured In a small plant that relles heavly on direct labor workers. Thus, varlable expenses are high, totallng $15.00 per ball, of which 60% Is direct labor cost. Last year, the company sold 58,000 of these balls, with the following results: $ 1,450,000 Sales (58,800 balls) variable expenses Contribution margin Fixed expenses 870,000 580,000 374,000 Net operating income 206,000 Required: 1. Compute (a) last year's CM ratio and the break-even polnt in balls, and (b) the degree of operating leverage at last year's sales level. 2. Due to an Increase in labor rates, the company estimates that next year's varlable expenses will Increase by $3.00 per ball. If this change takes place and the selling price per ball remalns constant at $25.00, what will be next year's CM ratio and the break-even polnt in balls? 3. Refer to the data in (2) above. If the expected change in varlable…arrow_forward

- Stanczyk Inc. started operations in January 2025. The company produces and sells cabinets for $5,200 each. The following information pertains to the cost and sales of the cabinets each year: Variable manufacturing costs $2,300 per unit Variable operating costs $65 per unit Fixed manufacturing costs $25,000 Fixed operating costs $12,000 The company produced 25 units per year for 2025, 2026, and 2027. The company sold 22 units in 2025, 20 units in 2026, and 26 units in 2027. It reported no volume variances for the three-year period. For 2025, Question options: a) the operating income for absorption costing may be greater than, equal to or less than operating income under variable costing. b) the operating income for absorption costing equaled operating income for variable costing. c) variable costing operating income exceeded absorption costing operating income by $3,000.…arrow_forwardCeder Company has compiled the following data for the upcoming year: Sales are expected to be 14,500 units at $50.00 each. Each unit requires 3 pounds of direct materials at $2.60 per pound. Each unit requires 1.4 hours of direct labor at $17.00 per hour. Manufacturing overhead is $3.60 per unit. Beginning direct materials inventory is $4,100.00. Ending direct materials inventory is $5,000.00. Selling and administrative costs totaled $136,770. Required: 1. Determine Ceder's budgeted cost of goods sold. (do not round intermediate values) 2. Complete Ceder's budgeted income statement.arrow_forwardRogers Rods & Reels Ltd. manufactures and sells various types of fishing equipment. At the end of 2011, Rogers had estimated for the production and sale of 15,000 bass fishing rods. Each rod has a standard calling for 1.5 pounds of direct material at a standard rate of $800 per pound and 15 minutes of direct labor time at a standard rate of $.18 per minute. During 2012, Rogers actually produced and sold 16,000 rods. These 16,000 rods had an actual direct materials cost of $179,200 (25,600 pounds at $7.00 per pound) and an actual direct labor cost of $44,800 (224,000 minutes at $.20 per minute). Each rod sells for $50. Refer to the Rogers Rods & Reels Ltd. information above. What is Rogers' flexible budget variance? О 11,200 F О011,200 U 3,500 F 3,500 Uarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College