Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please provide this question solution general accounting

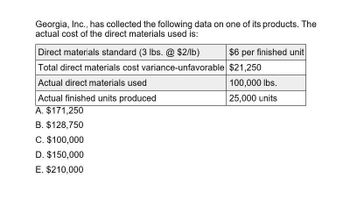

Transcribed Image Text:Georgia, Inc., has collected the following data on one of its products. The

actual cost of the direct materials used is:

Direct materials standard (3 lbs. @ $2/lb)

$6 per finished unit

Total direct materials cost variance-unfavorable $21,250

Actual direct materials used

Actual finished units produced

A. $171,250

B. $128,750

C. $100,000

D. $150,000

E. $210,000

100,000 lbs.

25,000 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardPlease need answerarrow_forwardExplainarrow_forward

- A company reports the following for one of its products. Direct materials standard (3 pounds @ $3 per pound) Actual direct materials used (AQ) Actual units produced Actual cost of direct materials used AQ Actual Quantity SQ = Standard Quantity AQ AP Actual Price SP Standard Price Compute the direct materials price and quantity variances and identify each as favorable or unfavorable. Actual Cost AP 0 $ 0 $ AQ 0 $ 9 per unit 250,000 pounds 60,000 units X $ 687,500 SP $ 0 SQ Standard Cost x SParrow_forwardLarry's Woodworks has collected the following data for its cutting board line of products: K Direct materials standard Direct materials standard cost Actual Direct Materials Used (AQU) Actual finished goods purchased What is the direct materials quantity variance? 10 pounds per unit $0.54 per pound 40,000 pounds 4,100 units OA. $17,860 unfavorable OB. $17,860 favorable OC. $540 unfavorable OD. $540 favorablearrow_forwardSunny Corporation has collected the following data for one of its products: Direct materials standard (3 pounds per unit @ $0.40/lb.) Actual direct materials purchased Actual Direct Materials Used (AQU) Actual Price (AP) paid per pound How much is the direct materials price variance? O A. $1,610 unfavorable B. $2,240 favorable C. $1,610 favorable O D. $2,240 unfavorable $1.20 per finished good 32,000 pounds 23,000 pounds $0.47arrow_forward

- Tercer reports the following for one of its products. Direct materials standard (4 lbs. @ $2 per lb.) $ 8 per finished unit Actual direct materials used (AQ) 360,000 lbs. Actual finished units produced 76,000 units Actual cost of direct materials used $ 648,000 AQ = Actual QuantitySQ = Standard QuantityAP = Actual PriceSP = Standard Price Compute the direct materials price and quantity variances and classify each as favorable, unfavorable or no variance.arrow_forwardGeorgia, Inc. has collected the following data on one of its products. The actual cost of direct materials used is: Direct materials standard (2 lbs @ $3/lb) $6 per finished unit Total direct materials cost variance—unfavorable $17,750 Actual direct materials used 60,000 lbs. Actual finished units produced 20,000 units $102,250. $60,000. $137,750. $120,000. $153,250.arrow_forwardTercer reports the following for one of its products. Compute the direct materials price and quantity variances and classify each as favorable or unfavorable. Direct materials standard (4 lbs. @ $2 per lb.). $8 per finished unit Actual finished units produced. 60,000 units Actual direct materials used . 300,000 lbs. Actual cost of direct materials used. $540,000arrow_forward

- Can you answer both of these questionsarrow_forwardA company reports the following for one of its products. Direct materials standard (4 pounds @ $3 per pound) Actual direct materials used (AQ) Actual units produced Actual cost of direct materials used $12 per unit 330,000 pounds 64,000 units Actual Cost $ 924,000 AQ - Actual Quantity SQ - Standard Quantity = AP = Actual Price SP Standard Price Compute the direct materials price and quantity variances and Identify each as favorable or unfavorable. Standard Costarrow_forwardA company reports the following for one of its products. Direct materials standard (4 pounds @ $2 per pound) Actual direct materials used (AQ) Actual units produced Actual cost of direct materials used AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Actual Cost Compute the direct materials price and quantity variances and identify each as favorable or unfavorable. X X X $ 8 per unit 340,000 pounds 72,000 units X $ 612,000 Standard Cost X Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning