CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hii tutor please help

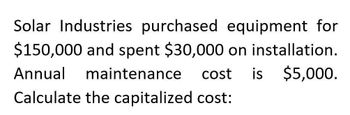

Transcribed Image Text:Solar Industries purchased equipment for

$150,000 and spent $30,000 on installation.

Annual maintenance

cost is $5,000.

Calculate the capitalized cost:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Capitalized cost:arrow_forwardLynda Inc. purchased a piece of equipment for $15,000. Additional costs include transportation, $300; installation, $700; test run, $1,000; and insurance from the date that the equipment begins productive output, $1,200. What is the capitalized amount of the equipment? $17,000 $18,200 $16,000 $15,000arrow_forwardThe table given below lists the relevant cost items for a specific system purchase. The operating expenses for the new system are $10,000 per year, and the useful life of the system is expected to be five years. The salvage value for depreciation purposes is equal to 25% of the hardware cost. Cost Item Cost Hardware $160,000 Training $15,000 Installation $15,000 a) What is the Book Value (BV) of the device at the end of year three if the Straight Line (SL) depreciation method is used? b) Suppose that after depreciating the device for two years with the SL method, the firm decides to switch to the double declining balance depreciation method for the remainder of the device's life (the remaining three years). What is the device's BV at the end of four years?arrow_forward

- A company purchased new equipment for $40,000. The company paid cash for the equipment. Other costs associated with the equipment were: transportation costs, $2,300; sales tax paid, $2,400; and installation cost, $2,300. The total capitalized cost reported for the equipment was: Multiple Choice $44,700. $47,000. $40,000. $42,300.arrow_forwardInformation for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $229,500. Project 2 requires an initial investment of $156,000. Annual Amounts Project 1 Project 2 Sales of new product $ 148,000 $ 128,000 Expenses Materials, labor, and overhead (except depreciation) 77,000 44,000 Depreciation—Machinery 32,000 30,000 Selling, general, and administrative expenses 20,000 32,000 Income $ 19,000 $ 22,000 (a) Compute each project’s annual net cash flow.(b) Compute payback period for each investment.arrow_forwardMortenson has purchased new equipment that initially costs$1,000,000. Setup costs are$100,000and delivery costs are$50,000. Calculate the year 3 MACRS depreciation of this equipment, which falls into the three-year asset class.arrow_forward

- Calculate the capitalized cost of an equipment maintained at a rate of 6% every year for $10,000, replaced every 3years for $25,000 at the same rate, and bought for $110,500.arrow_forwardNelson Company purchased equipment and incurred the following costs: Cash price = $55,000 Sales taxes = $4,400 Insurance during transit = $400 Site preparation, installation, and testing= $2,300What amount should be used as the cost basis of the equipment?arrow_forwardA contractor can buy dump trucks for ₱ 800,000 each or rent them for ₱ 1,200 per truck per day. The truck has a salvage value of ₱ 100,000 at the end of its useful life of 5 years. The annual cost of maintenance is ₱ 20,000. Using annual cost method and 14% interest rate, determine the number of days per year that a truck must be used to warrant its purchased. Use sinking fund method of depreciation.arrow_forward

- the furure dismantling , removal and restoration costs are 750 000. an appropriate discount rate (after tax) of 9% is determined. The estimated useful life of the building is 20years. calculate the present value.arrow_forwardA machine was bought for 500,000.00 with borrowed money at an interest rate of 14%. The annual cost of maintenance is estimated to be 25,000. What is the capitalized cost of this machine?arrow_forwardA manufacturing plant installed a new boiler at a total cost of P 150,000 and is estimated to have a useful life of 10 years. It is estimated to have a scrap value at the end of the useful life P 5,000. If interest is 15% compounded annually, determine the capitalized cost. P 318,867 P 218,867 P 197,610 P 497,710arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College