Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Sunset Beauty Salon

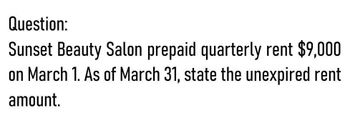

Transcribed Image Text:Question:

Sunset Beauty Salon prepaid quarterly rent $9,000

on March 1. As of March 31, state the unexpired rent

amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepaid Rent—Quarterly Adjustments On September 1, Northhampton Industries signed a six-month lease for office space, which is effective September 1. Northhampton agreed to prepay the rent and mailed a check for $12,000 to the landlord on September 1. Assume that Northhampton prepares adjusting entries only four times a year: on March 31, June 30, September 30, and December 31. Required Compute the rental cost for each full month. Prepare the journal entry to record the payment of rent on September 1. Prepare the adjusting entry on September 30. Assume that the accountant prepares the adjusting entry on September 30 but forgets to record an adjusting entry on December 31. Will net income for the year be understated or overstated? by what amount?arrow_forwardAccrued Vacation Pay A business provides its employees with varying amounts of vacation per year, depending on the length of employment. The estimated amount of the current year’s vacation pay is $77,400. Journalize the adjusting entry required on January 31, the end of the first month of the current year, to record the accrued vacation pay. If an amount box does not require an entry, leave it blank. fill in the blank db942400303a02e_2 fill in the blank db942400303a02e_3 fill in the blank db942400303a02e_5 fill in the blank db942400303a02e_6 b. How is the vacation pay reported on the company's balance sheet? When is this amount removed from the company's balance sheet?arrow_forwardAn invoice dated November 25 for $2600 had the terms 3/15, 1.5/30, n/45 E.O.M. What is the last day for taking the 1.5% discount? O A. December 30 O B. December 15 O c. December 10 O D. December 25arrow_forward

- invoice may 15 date goods are received june 05 terms 3/10,n/30,ROG last day of discount period_______ final day bill is due (end of credit period)arrow_forwardDoes a customer earn a cash discount with terms 5/15, net 60 on an invoice dated April 27 that is paid on May 13arrow_forwardOn June 20, 2021, Amy Smith, owner of Amy's Floral Shop, Inc., signed a contract to rent a retail store. As part of the contract, Amy paid four months of rent in advance. The rental rate is $3,000 per month, thus she paid $12,000 cash in advance when she signed the contract on June 20. Amy will move into the retail store on July 1, 2021, which is the start of her rental period. The company has the accounting policy that all prepaid assets are initially recorded in asset accounts. The following is a partial list of the accounts in Amy's General Ledger. These are the only accounts you need for this problem. D Cash D Prepaid Rent (asset account) D Rent Expense roblem 11 to in the Requirement 1 Prepare the General Journal entry to record the $12,000 payment made when the rental contract was signed on June 20, 2021. Requirement 2 Fill-in the amounts on the Prepaid Rent timeline. The boxes above the timeline show the amount of Prepaid Rent still remaining at various dates during the four…arrow_forward

- Chris Phillip financial year end is December 31 each year. The following information and transactions for 2023 are as follows: Feb 1. Paid fourteen (14) months’ rent on a lease rental contract at $35,000 per month. 1. Prepare the Journal entry and general ledger account for the above transaction. 2. Prepare the adjusting jounral entry and update general ledger account for the following transaction - Rent NOT expired on December 31, 2023, $70,000arrow_forwardAn invoice for furniture for $1, 210.88 with terms of 2/10, n/60 is dated October 3. A. What is the last day on which cash discount may be taken? B. If paid within discount period, how much is the cash discount? C. If the discount is missed, on what day does the credit period end?arrow_forwardA credit sale of $1,400 is made on July 15, terms 2/10, n/30, on which a return of $100 is granted on July 18. What amount is received as payment in full on July 24? $1,400 16. $1,274 c. $1,350 d. $1,372 Assume that you are the seller. Prepare the journal entry for the July 24th payment received.arrow_forward

- 10.4 Jelly Co has sublet part of its offices and in the year ended 30 November 20X3 the rent receivable was: Until 30 June 20X3 $8,400 per year $12,000 per year From 1 July 20X3 Rent was paid quarterly in advance on 1 January, April, July, and October each year. What amounts should appear in Jelly Co's financial statements for the vear ended 30 November 20X3? Rent receivable Statement of financial position $2,000 in sundry payables $1,000 in sundry payables $1,000 in sundry payables $2,000 in sundry receivables A $9,900 $9,900 B $10,200 $9,900 Carrow_forwardh. Vacation pay expense for December, $10,500. Description Debit Credit i. A product warranty was granted beginning December 1 and covering a one-year period. The estimated cost is 4% of sales, which totaled $1,900,000 in December. Description Debit Credit j. Interest was accrued on the note receivable received on October 17. Assume 360 days per year. sem: Description Debit Creditarrow_forwardCalculate Little Pear Administration Pty Ltd’s superannuation expense for the month of September using the following information: (Show your workings for superannuation). For month of September Employee Salary Annual Leave Sick Leave Overtime Allowance Superannuation (Show your workings) David Reed $6,100 $469 $300 $600 $180 dry cleaning Carol Wright $3,732 - $144 $250 $50 first aid Debra Foy $2,180 - - $445 - Michael Green $4,920 $378 - - $250 car allowance John Mills $11,600 $892 $446 $125 $350 travel allowance Peter Black $400 - $15 - - Totalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT