Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

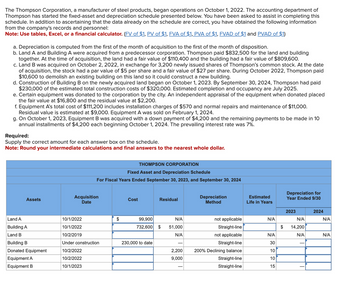

Transcribed Image Text:The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2022. The accounting department of

Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this

schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information

from the company's records and personnel:

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

a. Depreciation is computed from the first of the month of acquisition to the first of the month of disposition.

b. Land A and Building A were acquired from a predecessor corporation. Thompson paid $832,500 for the land and building

together. At the time of acquisition, the land had a fair value of $110,400 and the building had a fair value of $809,600.

c. Land B was acquired on October 2, 2022, in exchange for 3,200 newly issued shares of Thompson's common stock. At the date

of acquisition, the stock had a par value of $5 per share and a fair value of $27 per share. During October 2022, Thompson paid

$10,600 to demolish an existing building on this land so it could construct a new building.

d. Construction of Building B on the newly acquired land began on October 1, 2023. By September 30, 2024, Thompson had paid

$230,000 of the estimated total construction costs of $320,000. Estimated completion and occupancy are July 2025.

e. Certain equipment was donated to the corporation by the city. An independent appraisal of the equipment when donated placed

the fair value at $16,800 and the residual value at $2,200.

f. Equipment A's total cost of $111,200 includes installation charges of $570 and normal repairs and maintenance of $11,000.

Residual value is estimated at $9,000. Equipment A was sold on February 1, 2024.

g. On October 1, 2023, Equipment B was acquired with a down payment of $4,200 and the remaining payments to be made in 10

annual installments of $4,200 each beginning October 1, 2024. The prevailing interest rate was 7%.

Required:

Supply the correct amount for each answer box on the schedule.

Note: Round your intermediate calculations and final answers to the nearest whole dollar.

THOMPSON CORPORATION

Fixed Asset and Depreciation Schedule

For Fiscal Years Ended September 30, 2023, and September 30, 2024

Assets

Acquisition

Date

Cost

Residual

Depreciation

Method

Estimated

Depreciation for

Year Ended 9/30

Life in Years

2023

2024

Land A

10/1/2022

$

Building A

10/1/2022

99,900

732,600

N/A

not applicable

N/A

$

51,000

Straight-line

$

N/A

14,200

N/A

Land B

10/2/2019

N/A

Building B

Under construction

230,000 to date

not applicable

Straight-line

N/A

N/A

N/A

30

Donated Equipment

10/2/2022

2,200

200% Declining balance

10

Equipment A

10/2/2022

9,000

Straight-line

10

Equipment B

10/1/2023

Straight-line

15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance.3.What is the ethical dilemma you face? What are the ethical considerations? Consider your options and responsibilities as assistant controller.4.Identify the key internal and external stakeholders. What are the negative impacts that can happen if you do not follow the instructions of your supervisor?5.What are the…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forward

- You have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardYou have been recently hired as an assistant controller for XYZ Industries, a large, publically held manufacturing company. Your immediate supervisor is the controller who also reports directly to the VP of Finance. The controller has assigned you the task of preparing the year-end adjusting entries. In the receivables area, you have prepared an aging accounts receivable and have applied historical percentages to the balances of each of the age categories. The analysis indicates that an appropriate estimated balance for the allowance for uncollectible accounts is $180,000. The existing balance in the allowance account prior to any adjusting entry is a $20,000 credit balance. After showing your analysis to the controller, he tells you to change the aging category of a large account from over 120 days to current status and to prepare a new invoice to the customer with a revised date that agrees with the new category. This will change the required allowance for uncollectible accounts…arrow_forwardAs the recently appointed auditor for Cheyenne Corporation, you have been asked to examine selected accounts before the 6-month financial statements of June 30, 2020, are prepared. The controller for Cheyenne Corporation mentions that only one account is kept for intangible assets. The account is shown below. Jan. 4 Jan. 5 Jan. 31 Feb. 11 March 31 April 30 June 30 Intangible Assets Research and development costs Legal costs to obtain patent Payment of 7 months' rent on property leased by Cheyenne Premium on common stock Unamortized bond discount on bonds due March 31, 2040 Promotional expenses related to start-up of business Operating losses for first 6 months Debit 934,000 72,960 86,800 93,600 228,800 259,000 Credit 234,000 Balance 934,000 1,006,960 1,093,760 859,760 953,360 1,182,160 1,441,160 Prepare the entries necessary to correct this account. Assume that the patent has a useful life of 10 years. (Credit account titles are automatically indented when amount is entered. Do not…arrow_forward

- You have been asked by a client to review the records of Sheffield Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following information.1. Sheffield Company commenced business on April 1, 2018, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes. Year EndedMarch 31 IncomeBefore Taxes 2019 $83,772 2020 130,338 2021 121,189 2. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to: 2019 $7,605 2020 none 2021 6,540 Sales price was…arrow_forwardAs the recently appointed auditor for Bryan Corporation, you have been asked to examine selected accounts before the 6-month financial statements of June 30, 2020, are prepared. The controller for Bryan Corporation mentions that only one account is kept for intangible assets. The account is shown below. Intangible Assets Debit Credit Balance Jan. 4 Research and development costs 940,000 940,000 Jan. 5 Legal costs to obtain patent 75,000 1,015,000 Jan. 31 Payment of 7 months' rent on property leased by Bryan 91,000 1,106,000 Feb. 11 Premium on common stock 250,000 856,000 March 31 Unamortized bond discount on bonds due March 31, 2040 84,000 940,000 April 30 Promotional expenses related to start-up of business 207,000 1,147,000 June 30 Operating losses for first 6 months 241,000 1,388,000 Instructions Prepare the entry or entries necessary to correct this account. Assume that the patent has a useful life of 10…arrow_forwardPlease do not give image formatarrow_forward

- DONT GIVE ANSWER IN IMAGE FORMATarrow_forwardBronson Co.`s accounting department is implementing a new general ledger software package. The system provides definitions that enable it to automatically segregate between current and noncurrent assets. The company has no clearly defined operating cycle. Which section of the authoritative guidance should Bronson use to determine the appropriate time period to use as a basis for classifying current assetsarrow_forwardSuppose you were a financial analyst trying to compare the performance of two companies. Company A uses the double-declining- balance depreciation method. Company B uses the straight-line method. You have the following information taken from the 12/31/2021 year-end financial statements for Company B: Income Statement Depreciation expense Balance Sheet Assets: Plant and equipment, at cost Less: Accumulated depreciation Net You also determine that all of the assets constituting the plant and equipment of Company B were acquired at the same time, and that all of the $260,000 represents depreciable assets. Also, all of the depreciable assets have the same useful life and residual values are zero. Required: 1. In order to compare performance with Company A, estimate what B's depreciation expense would have been for 2021 if the double- declining-balance depreciation method had been used by Company B since acquisition of the depreciable assets. 2. If Company B decided to switch depreciation…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub