Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

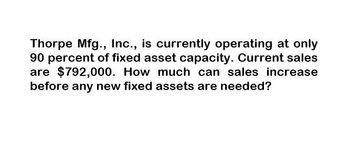

How much can sales increase before any new fixed assets are needed on these general accounting question?

Transcribed Image Text:Thorpe Mfg., Inc., is currently operating at only

90 percent of fixed asset capacity. Current sales

are $792,000. How much can sales increase

before any new fixed assets are needed?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Allen Mfg., Inc., is currently operating at only 92 percent of fixed asset capacity. Current sales are $780,000. How fast can sales grow before any new fixed assets are needed? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Maximum sales growth %arrow_forwardBuzzy Manufacturing Company has P2 billion in sales and P0.6 billion in fixed assets. Currently, the company’s fixed assets are operating at 80% of capacity. What level of sales could Buzzy have obtained if it have been operating at full capacity? What is Buzzy’s target fixed assets to sales ratio? If Buzzy’s sales increased by 30%, how large is the increase in fixed assets will the company need to meet its target fixed assets to sales?arrow_forwardWilliamson Industries has $3 million in sales and $2.838 million in fixed assets. Currently, the company's fixed assets are operating at 90% of capacity. a. What level of sales could Williamson Industries have obtained if it had been operating at full capacity? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Round your answer to the nearest cent. 2$ b. What is Williamson's target fixed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % c. If Williamson's sales increase 14%, how large of an increase in fixed assets will the company need to meet its target fixed assets/sales ratio? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Gandi Mfg., Inc., is currently operating at only 80% fixed asset capacity. Current sales are $610,000. How fast sales can grow before any new fixed asset are needed? а. 30% b. 40% c. 25% d. 15%arrow_forwardI want solutionarrow_forwardLast year Wei Guan Inc. had $275 million of sales, and it had $270 million of fixed assets that were used at 65% of capacity. In millions, by how much could Wei Guan's sales increase before it is required to increase its fixed assets? Question options: $137.71 $159.92 $115.50 $155.48 $148.08arrow_forward

- Earleton Manufacturing Company has $3 billion in sales and $661,000,000 in fixed assets. Currently, the company's fixed assets are operating at 80% of capacity. a. What level of sales could Earleton have obtained if it had been operating at full capacity? Write out your answers completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar.$ ____ b. What is Earleton's target fixed assets/sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % ____ c. If Earleton's sales increase 30%, how large of an increase in fixed assets will the company need to meet its target fixed assets/sales ratio? Write out your answer completely. Do not round intermediate calculations. Round your answer to the nearest dollar.$ ____arrow_forwardAusel's Cabinets has $27,600 in net fixed assets and is operating at 96 percent of capacity. Sales are $36,200 currently. What is the required increase in fixed assets if sales are projected to increase by 14 percent? Multiple Choice$2,605 $6,833 $4,205 $3,400, $0arrow_forwardFinally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level of fixed assets as follows: Required level of fixed assets = (Target fixed assets/Sales) × Projected sales Mitchell Manufacturing Company has $1,000,000,000 in sales and $230,000,000 in fixed assets. Currently, the company's fixed assets are operating at 75% of capacity. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar.$ What is Mitchell's Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to two decimal places. % If Mitchell's sales increase by 50%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round intermediate calculations. Round your answer to the nearest dollar.$arrow_forward

- A company is trying to ascertain the selling price per unit for their product. They know the OCF is €170,654, interest expense is €21,300, and fixed costs are €116,900. Variable costs are €25.89 per unit with 20,000 units expected to be sold. The tax rate is 34%. Fixed assets total €759,500 and are being depreciated straight-line to zero over seven years. What is the selling price per unit given this information? €40.26 €40.67 €41.32 €42.78 None of the above.arrow_forwardThe Thompson Corporation projects an increase in sales from 1.5 million to 2 million, but it needs an additional 300,000 of current assets to support this expansion. Thompson can finance the expansion by no longer taking discounts, thus increasing accounts payable. Thompson purchases under terms of 2/10, net 30, but it can delay payment for an additional 35 dayspaying in 65 days and thus becoming 35 days past duewithout a penalty because its suppliers currently have excess capacity. What is the effective, or equivalent, annual cost of the trade credit?arrow_forwardJC Goods, Inc. has a total assets turnover of 0.30 and a profit margin of 10percent. The president is unhappy with the current return on assets, and he thinks it could be doubled. This could be accomplished (1) by increasing the profit margin to 15 percent and (2) by increasing the total assets turnover.What new asset turnover ratio, along with the 15 percent profit margin, isrequired to double the return on assets?a. 35%b. 45%c. 40%d. 50%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning