Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please answer fast I give you upvote

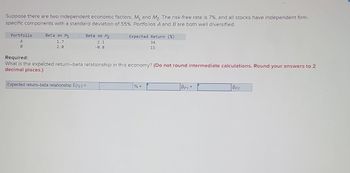

Transcribed Image Text:Suppose there are two independent economic factors, M₁ and M₂. The risk-free rate is 7%, and all stocks have independent firm-

specific components with a standard deviation of 55%. Portfolios A and B are both well diversified.

Portfolio

A

B

Beta on M1

1.7

2.0

Beta on M₂

2.1

-0.8

Expected Return (%)

34

15

Required:

What is the expected return-beta relationship in this economy? (Do not round intermediate calculations. Round your answers to 2

decimal places.)

Expected return-beta relationship E(rp) = C

% +

Bp1 +

BP2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- W es D Edit View History Bookmarks Profiles Tab Window Help earch × ①QuickLaunchSSO :: Single Sig X M Question 5-Chapter 2 Home X M Chapter 2 Quiz - Connect + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%25... mework i Saved The transactions of Spade Company appear below. a. K. Spade, owner, invested $14,250 cash in the company. b. The company purchased supplies for $413 cash. c. The company purchased $7,880 of equipment on credit. d. The company received $1,682 cash for services provided to a customer. e. The company paid $7,880 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,021 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,269 cash as partial payment for the account receivable created in transaction f. i. K. Spade withdrew $1,100 cash from the company for personal use. Exercise 2-13 (Algo) Recording effects…arrow_forwardAnswer the question and show work plzarrow_forwardCan someone check and tell me if my answer is correct?arrow_forward

- nework E x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A 52F%252Ffaytechcc.blackboard.co.. - User Management,.. H https://outlook.off.. FES Protection Plan System 7 - North C.. work Exercises Soved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate ce Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $1,600, terms 2/10, n/30; freight of $32 prepaid by O'Rourke Fabricators and added to the invoice (total invoice amount, $1,632). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 2 percent discount, Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $1,050, terms 2/10, n/30; freight of $55 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $50. Paid the amount due to Kroll Company for the purchase of…arrow_forwardgle Chrome File Edit View History Bookmarks Profiles Tabl Window Help X M Inbox (231)- abigailof X M Verify Your Email Addra × The following unadjus! X iConnect - Home × M Question 5 - Chap C bis- Google Search ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 4 Homework 5 Saved Help Save & Ex 12.89 points eBook Ask Print References Problem 4-6AA (Algo) Preparing reversing entries LO P3 The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required year-end adjustments. a. As of December 31, employees had earned $855 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,522 of salaries will be paid. b. Cost of supplies still available at December 31 total is $2,575. c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,450. The…arrow_forwardFile Edit View History Bookmarks Profiles Tab Window Help ogle Search x QuickLaunchSSO :: Single Sig x M Question 8 - Chapter 2 Home X M Chapter 2 Quiz - Connect x + to.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... K Homework nces Saved Required information Use the following information for Exercises 17-18 below. (Algo) [The following information applies to the questions displayed below.] The transactions of Belle Company's appear below. 1. D. Belle created a new business and invested $5,400 cash, $6,900 of equipment, and $12,000 in web servers. 2. The company paid $4,000 cash in advance for prepaid insurance coverage. 3. The company purchased $700 of supplies on credit. 4. The company paid $900 cash for selling expenses. 5. The company received $5,400 cash for services provided. 6. The company paid $700 cash toward accounts payable. 7. The company paid $2,500 cash for equipment. H Exercise 2-17 (Algo) Entering…arrow_forward

- AutoSave Off File Home Module ThreeProblem Set Question3 ⚫ Saved to this PC Search Insert Page Layout Formulas Data Review View Automate Help ✗Cut Calibri 12 Α' Α' ab Wrap Text Text Copy ▾ Paste B I U ~A~ Merge & Center $ % 9 +0.00 Format Painter Clipboard √☑ Font Б Alignment √☑ Number Г A1 A B C D E F G H Accent3 Accent4 Accent5 Conditional Format as Formatting Accent6 Comma Comma [0] Table ▾ Styles Katherine Apuzzo KA Comments Share ☐☐ > AutoSum ✓ ĄT பப Fill Insert Delete Format Sort & Find & Add-ins > Clear Filter Select Cells Editing Analyze Data Add-ins J K L M N о P Q R S T U V W X Y ✓ ✓ ✓ fx Function: MAX; Formulas: Subtract; Divide; Cell Referencing 1 Function: MAX; Formulas: Subtract; Divide; Cell Referencing 2 3 BE5.7 - Using Excel to Determine Profitability Given a Constrained Reso 4 PROBLEM 5 Rachel wants to use her knitting skills to make a little extra money so she 6 can enjoy a theatre weekend with her besties. She's got the pattern down 7 for a hat, scarf, and mittens,…arrow_forwardMy Drive - Google Drive X 4 My Drive - Google Drive Front Desk Operations 2020 - Go X + ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3Dfalse Tp Netflix 0z TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login * Login Readin- Darby Company, operating at full capacity, sold 114,800 units at a price of $108 per unit during the current year. Its income statement is as follows: Sales $12,398,400 Cost of goods sold 4,392,000 Gross profit $8,006,400 Expenses: Selling expenses $2,196,000 Administrative expenses 1,332,000 Total expenses 3,528,000 Income from operations $4,478,400 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 60% 40% Selling expenses 50% 50% Administrative 30% 70% expenses Management is considering a plant expansion program for the following year that will permit an increase of $972,000 in yearly sales. The expansion will increase fixed costs by…arrow_forwardSafari File Edit View History Bookmarks Window Help uLink - Student... W 1. 2. uLink - Student... 3. 4. learn-eu-central-1-prod-fleet01-xythos.content.blackboardcdn.com uLink - Student... 21 445 Entity A enters into the following transactions. You are required to show the impact of the transactions below on the accounting equation. e Content 9 Bb https://learn-eu-... Entity A purchased 1 000 bags of cement from K Ltd on credit. K Ltd normally sells a bag for R45. Entity A received a 10% discount for the 1 000 bags. Entity A returned 150 bags of cement, as they were defective. On the same day, the outstanding balance was settled through an online payment. This transaction did not affect the discount offered to Entity A. Select the correct values from the dropdown menus in the table provided in the Blackboard activity. MAR 7 In an attempt to assist the business, the owner of Entity A deposited R100 000 into the entity's bank account. A quarter of the amount is payable to the owner and…arrow_forward

- AutoSave C. Home Insert Draw Page Layout Formulas Data Review X Times New Roman v 10 A A == Paste B I U v V A > Chapter 15 Build A Model.xlsx Automate General $%9 Read-Only Tell me Conditional Formatting Insert v Format as Table Delete v 00 20 .00 <-→0 Editing Cell Styles v Format View B C D E F G H I 0% 10% 20% 30% 40% 50% 60% 70% 80% 175 65 Xvfx A 66 67 68 69 Additional: using the (hypothetical) free cash flow stream below, calcuate and graph the NPVs (y-axis) against the various 70 Debt/Value Ratios (x-axis) in the space below (similar to Figure 15-8): 71 72 Time 73 FCF 74 0 1 2 3 4 5 -1200500 200000 350000 425000 350000 265000 Debt/Value WACC (from NPV (aka 75 Ratio above table) Firm Value) 76 0% 8.900% 77 10% 8.640% 78 20% 8.488% 79 30% 8.462% 80 40% 8.796% 81 50% 9.520% 82 60% 10.724% 83 70% 12.078% 84 85 86 $1.20 Build a Model + Ready Accessibility: Investigate MAY 6 44 Warrow_forwardLutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forward- Homework A ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co... E User Management,.. H https://outlook.offi.. O FES Protection Plan System 7- North C.. 用Re mework Exercises i Soved Help Save & Exit Submit Check my work Required: Record the following transactions of Fashion Park in a general journal, Fashion Park must charge 6 percent sales tax on all sales. The company uses the perpetual inventory system. (Round your intermediate calculations and final answers to the nearest whole dollar value.) DATE TRANSACTIONS 20X1 Sold merchandise for cash, $2,540 plus sales tax. The cost of merchandise sold was $1,540. The customer purchasing merchandise for cash on April 2 returhed $270 of the merchandise; provided a cash refund to the customer. The cost of returned merchandise was $170. Sold merchandise on credit to Jordan Clark; issued Sales Slip 908 for $1,090 plus tax, terms n/30. The cost of the merchandise sold was…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education