FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:×

M Question 3 - Chap

File Edit

View

History

Google Search

Bookmarks

Profiles

Tab Window Help

x Inbox (234) - abigailof x | Verify Your Email Addr x The following unadjust xiConnect - Home

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

r 4 Homework i

Saved

Help

Save & Exit

ok

t

ces

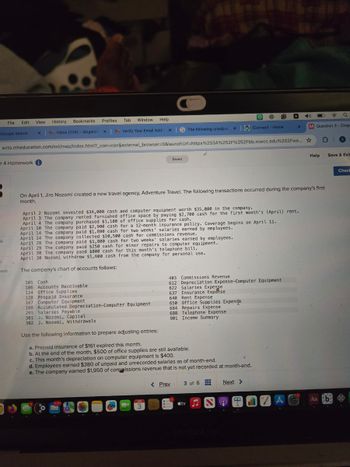

On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first

month.

April 2 Nozomi invested $34,000 cash and computer equipment worth $35,000 in the company.

April 3 The company rented furnished office space by paying $2,700 cash for the first month's (April) rent.

April 4 The company purchased $1,100 of office supplies for cash.

April 10 The company paid $2,900 cash for a 12-month insurance policy. Coverage begins on April 11.

April 14 The company paid $1,800 cash for two weeks' salaries earned by employees."

April 24 The company collected $10,500 cash for commissions revenue.

April 28 The company paid $1,800 cash for two weeks' salaries earned by employees.

April 29 The company paid $250 cash for minor repairs to computer equipment.

April 30 The company paid $800 cash for this month's telephone bill.

April 30 Nozomi withdrew $1,600 cash from the company for personal use.

The company's chart of accounts follows:

101 Cash

106 Accounts Receivable.

124 Office Supplies

128 Prepaid Insurance

167 Computer Equipment

168 Accumulated Depreciation-Computer Equipment

209 Salaries Payable

301 J. Nozomi, Capital

302 J. Nozomi, Withdrawals

Use the following information to prepare adjusting entries:

a. Prepaid insurance of $161 expired this month.

403 Commissions Revenue

612 Depreciation Expense-Computer Equipment

622 Salaries Expense

637 Insurance Expensel

640 Rent Expense

650 Office Supplies Expense

684 Repairs Expense

688 Telephone Expense.

901 Income Summary

b. At the end of the month, $500 of office supplies are still available.

c. This month's depreciation on computer equipment is $400.

d. Employees earned $380 of unpaid and unrecorded salaries as of month-end.

e. The company earned $1,950 of commissions revenue that is not yet recorded at month-end.

JUN

3

< Prev

3 of 6

Next >

tv N

4

MacBook Pro

Aa b

Check

Transcribed Image Text:W

rome

File

Edit

View

History

bjs- Google Search

Bookmarks

Profiles Tab

Window Help

WiConnect - Home

X

M Question

The following unadjust x

xM Inbox (234) - abigailof x | M Verify Your Email Addr x |

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

apter 4 Homework i

3

Saved

Help

Sa

31

ts

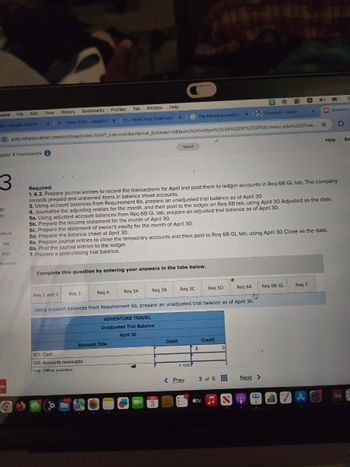

Required:

1. & 2. Prepare journal entries to record the transactions for April and post them to ledger accounts in Req 6B GL tab. The company

records prepaid and unearned items in balance sheet accounts.

3. Using account balances from Requirement 6b, prepare an unadjusted trial balance as of April 30.

4. Journalize the adjusting entries for the month, and then post to the ledger on Req 6B tab, using April 30 Adjusted as the date.

5a. Using adjusted account balances from Req 6B GL tab, prepare an adjusted trial balance as of April 30.

5b. Prepare the income statement for the month of April 30.

5c. Prepare the statement of owner's equity for the month of April 30.

eBook

5d. Prepare the balance sheet at April 30.

Ask

Print

eferences

6a. Prepare journal entries to close the temporary accounts and then post to Req 6B GL tab, using April 30 Close as the date.

6b. Post the journal entries to the ledger.

7. Prepare a post-closing trial balance.

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Req 3

Req 4.

Req 5A

Req 5B

Req 5C

Req 5D

Req 6A

Req'6B GL

Req 7

Using account balances from Requirement 6b, prepare an unadjusted trial balance as of April 30.

ADVENTURE TRAVEL

Unadjusted Trial Balance

April 30

Account Title

101: Cash

106: Accounts receivable

124: Office sunnlies

11,771

JUN

3

Debit

Credit

$

0

1 100

< Prev

3 of 6

Next >

⚫tv

A

Aa

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- me File Edit View History Bookmarks Profiles Tab Window Help box (231) - abigailofe x M Gmail Warning! Due to inactiv x M Question 9 - Mid-Term x Connect Getting to K x wiL4 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Σ -Term Exami 9 Saved Help After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November 30, 2021, unadjusted trial balance of Business Solutions (reflecting its transactions for October and November of 2021) follows. Number Account Title 101 Cash 106 Accounts receivable Ask 126 Computer supplies 128 Prepaid insurance 131 Prepaid rent 163 Office equipment 164 167 Computer equipment 168 Accumulated depreciation-office equipment Accumulated depreciation-Computer equipment 201 Accounts payable 210 Wages payable 236 Unearned computer services revenue 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 Computer services revenue 612 613 623 Wages…arrow_forwardo Mail O Launc - Proble O Cours O Quest C Get H Bb Join L O Cisco Onel X - ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activi.. O Microsoft Office Ho.. E My Shelf | Brytewav. 国Rea >> 0 Mail - Soares, Marc. 6 Massbay Nav OneLogin D ADP ail O YouTube 6 MassBay Curriculum Saved Help Save & Exit Submit - quick study Check my work QS 1-10 Identifying effects of transactions using accounting equation-Revenues and Expenses LO P1 The following transactions were completed by the company. a. The company completed consulting work for a client and immediately collected $7,000 cash earned. b. The company completed commission work for a client and sent a bill for $5,500 to be received within 30 days. c. The company paid an assistant $2,150 cash as wages for the period. d. The company collected $2,750 cash as a partial payment for the amount owed by the client in transaction b. e. The company paid $1,000 cash for…arrow_forward1 You x O File: X A File X Ass X Q App x 202 x Rev X O Que x [Th O ISB X - Can x .mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%2E Tube A Maps + Login - Rowan Uni. A My Drive - Google.. ID ID.me | Simple, Se.. 9 Division of Unemp.. Class Principles of. Alied C mework- Assignment 1 i Saved Help On June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock $ 600,000 250,000 685,000 $ 1,535,000 Retained earnings Total stockholders' equity (1) Prepare the updated stockholders' equity section after the distribution is made. (2) Compute the number of shares outstanding after the distribution is made. Complete this question by entering your answers in the tabs…arrow_forward

- nework E x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A 52F%252Ffaytechcc.blackboard.co.. - User Management,.. H https://outlook.off.. FES Protection Plan System 7 - North C.. work Exercises Soved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate ce Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $1,600, terms 2/10, n/30; freight of $32 prepaid by O'Rourke Fabricators and added to the invoice (total invoice amount, $1,632). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 2 percent discount, Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $1,050, terms 2/10, n/30; freight of $55 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $50. Paid the amount due to Kroll Company for the purchase of…arrow_forwardhrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forward

- signments: X M Question 7-C X work i FILE Paste ducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmg A1 Clipboard G 5 6 L EB- 7 HOME 8 9 10 11 12 13 Calibri B IU • INSERT : Font READY Attempt(s) X 11 Q Accounting Ex x PAGE LAYOUT Accounts Payable Accounts Receivable Cash Equipment Insurance Expense Operating Expense *** T A A Tutoring Revenue Unearned Revenue Y A. Other Expenses Other Revenues Rent Expense Salaries Expense Short-term Notes Payable Test Prep Revenue 5 B C D 1 The list below shows select accounts for Reading Readiness Company as of January 31, 20X1. Accounts are in alphabetical order.) 2 3 4 M Week 3 Anno X FORMULAS Saved S DATA % Alignment Number Conditional Format as Cell Formatting Table Styles Styles REVIEW ✓ fx The list below shows select accounts for Reading Readiness Company as of o Mail - Pedro X E # Editing m F + Sign In ▶ 100% Hint Help Sa A + Y CAarrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forwardU Portal Assignments: Corp Fin Reprtnx OQuestlon 21 - E&P Set #4 (Lea X (no subject)- ellse.patipewe@ x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser3D0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... 4 (Leases) 6 Saved Help Save & Exit Submit Check my work Exercise 15-3 (Static) Finance lease; lessee; balance sheet and income statement effects [L015-2] On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $562,907 over a three-year lease term, payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 10%, the same rate IC uses to calculate lease payment amounts. Amortization is recorded on a straight-line basis at the end of each fiscal year. The fair value of the equipment is $3 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 (Use…arrow_forward

- gle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (229) - abigailof X MGmail x iConnect - Home x Question 5 Mid-Term x Connect Getting to K wiL47988 xapp ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 5 Part 4 of 4 Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Ask Land Office equipment Accounts payable Owner investments $ 12,040 Cash withdrawals by owner 13,720 Consulting revenue 2,990 Rent expense 45,940 Salaries expense 17,710 Telephone expense 8,230 Miscellaneous expenses. 83,660 $ 1,760 13,720 3,210 6,690 870 680 Mc Graw Hill 一口 Help Save & E Also assume the following: a.…arrow_forwardFile Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forwardne File Edit View History Bookmarks Profiles Tab Window Help M Inbox (2 x MACC101 x (4726) || X Account x| Account X WiConnec× M Question X Content c ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 7 Quiz i 7 7.58 points Ask Mc Graw Hill Saved QS 7-13 (Algo) Indicating journals used for posting LO P1, P2, P3, P4 The following T-accounts show postings of selected transactions. Indicate the journal used in recording each of these postings a through e. Cash Accounts Receivable Inventory Debit (d) 700 Credit (e) Debit 340 (b) 1,700 Credit (d) Debit Credit 700 (a) 1,520 (c) 1,040 Accounts Payable Sales Debit (e) 340 Credit (a) Debit 1,520 Credit (b) Cost of Goods Sold Credit Debit 1,700 (c) 1,040 Transaction a. b. C. d. e. Journal 12.020 ANE 18 tv Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education