FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:D

e Chrome File

Edit

View

History

Bookmarks

Profiles

Tab

Window

Help

bjs-Google Search

xiConnect - Home

X

M Question 10 - Chapter

x

M Inbox (221) abigailof XM Verify Your Email Addr

x G Goo

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

Σ

Chapter 3 Homework i

Saved

Help

10

28.47

points

eBook

Ask

Print

References

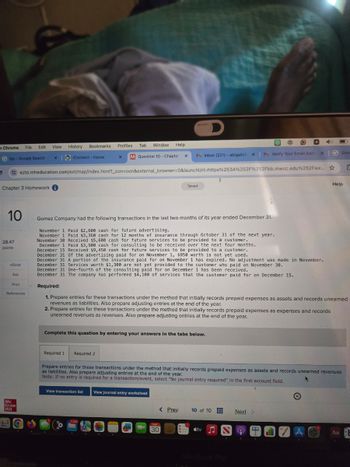

Gomez Company had the following transactions in the last two months of its year ended December 31.

November 1 Paid $2,600 cash for future advertising.

November 1 Paid $3,360 cash for 12 months of insurance through October 31 of the next year.

November 30 Received $5,600 cash for future services to be provided to a customer.

December 1 Paid $3,900 cash for consulting to be received over the next four months.

December 15 Received $9,450 cash for future services to be provided to a customer.

December 31 of the advertising paid for on November 1, $950 worth is not yet used.

December 31 A portion of the insurance paid for on November 1 has expired. No adjustment was made in November.

December 31 Services worth $1,300 are not yet provided to the customer who paid on November 30.

December 31 One-fourth of the consulting paid for on December 1 has been received.

December 31 The company has performed $4,100 of services that the customer paid for on December 15.

Required:

1. Prepare entries for these transactions under the method that initially records prepaid expenses as assets and records unearned

revenues as liabilities. Also prepare adjusting entries at the end of the year.

2. Prepare entries for these transactions under the method that initially records prepaid expenses as expenses and records

unearned revenues as revenues. Also prepare adjusting entries at the end of the year.

Complete this question by entering your answers in the tabs below.

Mc

Graw

Hill

Required 1 Required 2

Prepare entries for these transactions under the method that initially records prepaid expenses as assets and records unearned revenues

as liabilities. Also prepare adjusting entries at the end of the year.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

View journal entry worksheet

< Prev

10 of 10

Next >

11,688

MAY

30

tv

A

Aa

MacBook Pro

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- hrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forwardsignments: X M Question 7-C X work i FILE Paste ducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmg A1 Clipboard G 5 6 L EB- 7 HOME 8 9 10 11 12 13 Calibri B IU • INSERT : Font READY Attempt(s) X 11 Q Accounting Ex x PAGE LAYOUT Accounts Payable Accounts Receivable Cash Equipment Insurance Expense Operating Expense *** T A A Tutoring Revenue Unearned Revenue Y A. Other Expenses Other Revenues Rent Expense Salaries Expense Short-term Notes Payable Test Prep Revenue 5 B C D 1 The list below shows select accounts for Reading Readiness Company as of January 31, 20X1. Accounts are in alphabetical order.) 2 3 4 M Week 3 Anno X FORMULAS Saved S DATA % Alignment Number Conditional Format as Cell Formatting Table Styles Styles REVIEW ✓ fx The list below shows select accounts for Reading Readiness Company as of o Mail - Pedro X E # Editing m F + Sign In ▶ 100% Hint Help Sa A + Y CAarrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forward

- Edit View History Bookmarks Profiles Tab Window Help t Fridays - Become a w x sp MyPath - Home Gradebook / ACC 202: Manage X M Question 7 - Chapter 11 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Maps News Translate M SmartBook 2.0 M SmartBook 2.0 Homework i t Perez Company is considering an investment of $28,245 that provides net cash flows of $9,300 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A What is the internal rate of return of this investment? Present value factor Internal rate of return FI Required B @ 2 F2 # 3 APR…arrow_forwardChrome File Edit View History Bookmarks People Window Help 52% !), Wed 3:48 PM d : The Charge Flas Sigma Chi-Initi My Questions l l (7) YouTube | Bb] Syllabus-ROST G where to find sc X x Х Χ Chapter 1 Home ← → C https://newconnect.mheducation.com/flow/connect.html?returnUrl=https%3A%2F%2Fconnect.mheducation.com%2Fpaamweb%2Findex.html%.··d-☆ . Chapter 1 Homework - Graded Saved Help Save & Exit Submit Check my work 4 Required: Use only the appropriate accounts to prepare an income statement. 7 points COWBOY LAW FIRM Income Statement For the Period Ended December 31 eBook etained earnings Hint ervice revenue Ask Expenses Salaries expense Print References Total expenses Mc Graw Hill KPrev4 of 11 Next>arrow_forwardFile Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forward

- 1 ← → C M Gmail of 4 Book rences Assignments: ACC 211 A F Prin X esc ! YouTube Maps M Question 7 - Chapter 5, Assign X M Connect ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252F... January 1 April 1 October 1 O Porter's Five Forc... Required information [The following information applies to the questions displayed below.] The following information pertains to the inventory of Parvin Company during Year 2. Beginning Inventory Purchased Purchased Parvin Company Cash Flows from Operating Activities FIFO Cash flows from operating activities: Cash inflow from customers Cash outflow for inventory Cash outflow for operating expenses Cash outflow for income tax expense Net cash flow from operating activities During Year 2, Parvin sold 3,500 units of inventory at $80 per unit and incurred $46,000 of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All…arrow_forwardchrome File Edit View History Objs- Google Search × Bookmarks Profiles Tab Window Help M Inbox (227) - abigailoforiwaa x | Verify Your Email Address-d x QuickLaunchSSO:: Single Sig x M Question 3 - Chapter 4 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... hapter 4 Homework i 3 Saved Help Save & Exit On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. 0.31 ints April 2 Nozomi invested $34,000 cash and computer equipment worth $35,000 in the company. eBook Ask Print References April 3 The company rented furnished office space by paying $2,700 cash for the first month's (April) rent. April 4 The company purchased $1,100 of office supplies for cash. April 10 The company paid $2,900 cash for a 12-month insurance policy. Coverage begins on April 11. April 14 The company paid $1,800 cash for two weeks' salaries earned by…arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help G ox (270) - abigailo x MACC101 Principles of A X (4726) IFRS vs. GAAP x M Question 15 - Chapter X WiConnect-Home 1545 x M Qu ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... pter 6 Homework i 15 Saved Help Part 3 of 4 10.34 points Required information Problem 6-2AA (Algo) Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Activities Beginning inventory Purchase Units Acquired at Cost 110 units $45 per unit 410 units @$50 per unit 140 units @$55 per unit 220 units @$57 per unit 430 units @$80 per unit Totals 880 units eBook Ask Print Date March 1 March 5 March 9 March 18 March 25 March 29 Sales Purchase Purchase Sales References 180 units @ $90 per unit…arrow_forward

- D Chrome View Edit File Bookmarks History Profiles Tab Window Help bjs-Google Search x C The following financial statem × 0 xiConnect - Home M Question 18 - Chapter 1 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 1 Homework Saved 18 [Ine following information applies to the questions displayed below.j The following financial statement information is from five separate companies. Company A Part 5 of 5 Beginning of year Assets Liabilities $ 36,000 29,520 Company B $ 28,080 Company C Company D Company E $ 23,040 $ 64,080 $ 98,280 19,656 12,441 44,215 ? End of year Assets 41,000 4.03 points 29,520 ? 74,620 113,160 Liabilities ? 20,073 13,460 35,817 89,396 Changes during the year Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 eBook Owner withdrawals 8,608 3,500 2,000 5,875 0 11,000 Ask Print References Mc Graw Hill Problem 1-2A (Algo) Part 5 5. Compute the amount of liabilities…arrow_forwardAutoSave a Ch13Homework_Question5 OFF Home Insert Draw Page Layout Formulas Data Review View Tell me A Share Comments A^ A KA Insert v Liberation Sans 12 22 Wrap Text v Custom Delete v В I U A $ v % 9 .00 Conditional Format Cell Find & Select Analyze Data Paste Merge & Center v Sort & Sensitivity 00 Formatting as Table Styles Format v Filter С32 fx K L 0 P A В C D E G H J M N R S U V W X Formula: Divide; Cell Referencing 1 2 3 Using Excel to Perform Vertical Analysis PROBLEM Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to this work area. 4 5 Data from the comparative balance sheets of Rollaird Company is 6 presented here. 7 December 31, December 31, Using these data from the comparative balance sheets of Rollaird Company, perform vertical analysis. 8. 9. 2022 2021 Accounts receivable (net) $ 460,000 $ 780,000 400,000 650,000 10 11 Inventory December 31, 2022 December 31, 2021 12 Total assets…arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education