FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:D

e Chrome

File Edit

View

History

Bookmarks

Profiles Tab Window Help

bjs- Google Search

x |

iConnect Home

x

M Question 5 Chapter X

M Inbox (221) - abigailof X|M Verify Your Email Addr

Q

x G Google Account

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... ☆

Saved

A

Help Save & E

Chapter 3 Homework i

5

9.25

points

Skipped

eBook

Hint

Ask

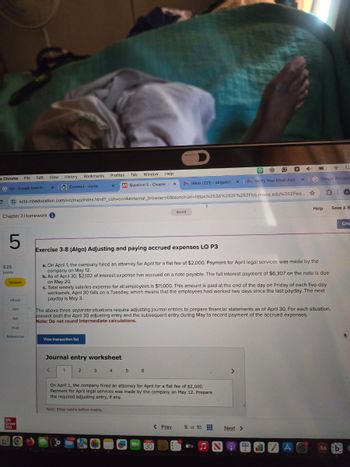

Exercise 3-8 (Algo) Adjusting and paying accrued expenses LO P3

a. On April 1, the company hired an attorney for April for a flat fee of $2,000. Payment for April legal services was made by the

company on May 12.

b. As of April 30, $2,102 of interest expense has accrued on a note payable. The full interest payment of $6,307 on the note is due

on May 20.

c. Total weekly salaries expense for all employees is $11,000. This amount is paid at the end of the day on Friday of each five-day

workweek. April 30 falls on a Tuesday, which means that the employees had worked two days since the last payday. The next

payday is May 3.

The above three separate situations require adjusting journal entries to prepare financial statements as of April 30. For each situation,

present both the April 30 adjusting entry and the subsequent entry during May to record payment of the accrued expenses.

Note: Do not round intermediate calculations.

Print

References

View transaction list

Mc

Graw

Hill

Journal entry worksheet

<

1

2

3 4 5

6

On April 1, the company hired an attorney for April for a flat fee of $2,000.

Payment for April legal services was made by the company on May 12. Prepare

the required adjusting entry, if any.

Note: Enter debits before credits.

MAY

30

Che

< Prev

5 of 10

Next >

tv

Aa bd

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D Google Chrome File Edit View History Bookmarks Profiles Tab Window Help bjs-Google Search X M Chapter 2 Quiz - Connect x QuickLaunchSSO:: Single Siç x M Question 13 - Chapter 2 Hom + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 2 Homework i 13 Part 2 of 3 1.38 points Saved [The following information applies to the questions displayed below.] The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. December 31 Cash Accounts receivable Office supplies Year 1 $ 49,570 26,907 4,244 Year 2 $ 8,765 21,096 3,109 138,786 Office equipment 130,293 Trucks 50,986 59,986 Building 0 169,963 Land 0 42,411 Accounts payable 70,740 35,085 0 112,374 eBook Ask Note payable Print Problem 2-5A (Algo) Part 2 References Mc Graw Hill He 2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the following…arrow_forwardgle Chrome File Edit View History Bookmarks Profiles Inbox (229) - abigailo x M Gmail Tab Window Help xiConnect - Home X M Question 13 - Mid-Terr Connect Getting to K x | wiL47988 с ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... ☆ □ I Mid-Term Exam i Saved Help Save Mc Graw Hill 13 Refer to Apple's financial statements in Appendix A to answer the following. Ask 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary 3. Balance in income summary account @ 2 # 3 $ Λ 6 76 % O > tv♫ MacBook Pro & Aa )arrow_forwardpogle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (264)-abic x MACC101 Principle: x (4724) IFRS vs. G X M Chapter 6 Home X M Question 14 - Cha x iConnect - Home × M esc ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 6 Homework Saved 2 Part 1 of 2 Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date 14.25 points March 14. March 15 July 30 October 5 October 26 Sales Purchase Sales January 1 January 10 Activities. Beginning inventory Units Acquired at Cost 260 units @$12.40= Units Sold at Retail $ 3,224 215 units @ $42.40 420 units Purchase Sales Purchase Totals 460 units @ $17.40 = @ $22.40 = 7,308 380 units @ $42.40 10,304 425 units @ $42.40 160 units 1,300 units @ $27.40 = 4,384 $ 25,220 1,020 units 1…arrow_forward

- Chrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forwardrome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forwardestkentucky.kctcs.edu - Yahc X ube Maps Maps News News Translate M SmartBook 2.0 M SmartBook 2.0 ter 10 Homework i Book Hint Gradebook / ACC 202: Manage X M Question 6 - Chapter 10 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Ask 5 Surf Company can sell all of the two surfboard models it produces, but it has only 476 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $276 for Glide and $452 for Ultra. Print erences W 1 Q (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Required A Complete this question by entering your answers in the tabs below. MyPath - Home Compute the contribution margin per direct labor hour for each product. F1 Contribution margin per direct labor hour…arrow_forward

- o Mail O Launc - Proble O Cours O Quest C Get H Bb Join L O Cisco Onel X - ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activi.. O Microsoft Office Ho.. E My Shelf | Brytewav. 国Rea >> 0 Mail - Soares, Marc. 6 Massbay Nav OneLogin D ADP ail O YouTube 6 MassBay Curriculum Saved Help Save & Exit Submit - quick study Check my work QS 1-10 Identifying effects of transactions using accounting equation-Revenues and Expenses LO P1 The following transactions were completed by the company. a. The company completed consulting work for a client and immediately collected $7,000 cash earned. b. The company completed commission work for a client and sent a bill for $5,500 to be received within 30 days. c. The company paid an assistant $2,150 cash as wages for the period. d. The company collected $2,750 cash as a partial payment for the amount owed by the client in transaction b. e. The company paid $1,000 cash for…arrow_forwardFile Edit View History Bookmarks Profiles Tab Window Help Netflix 118 Inbox (2 x MACC101 X Account X Account X M Question X QuickLa x M Question x M Qu ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.e al Exami 10 Mc Graw Hill Saved Number 101 Cash 106.1 Alex's Engineering Company 106.2 Wildcat Services 106.3 Easy Leasing 106.4 IFM Company 106.5 Liu Corporation Account Title Debit $ 48,472 0 0 0 3,080 0 2,858 0 0 0 0 780 1,855 Accumulated depreciation-office equipment Computer equipment Accumulated depreciation-Computer equipment Accounts payable 106.7 106.6 Gomez Company Delta Company 106.8 KC, Incorporated 106.9 Dream, Incorporated 119 Merchandise inventory 126 Computer supplies 128 Prepaid insurance 131 Prepaid rent 163 Office equipment 164 167 168 201 210 Wages payable 236 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 413 Sales 414 415 502 Cost of goods sold 612 613 623 Wages expense 637 640 Rent expense 652 655 676…arrow_forward1 You x O File: X A File X Ass X Q App x 202 x Rev X O Que x [Th O ISB X - Can x .mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%2E Tube A Maps + Login - Rowan Uni. A My Drive - Google.. ID ID.me | Simple, Se.. 9 Division of Unemp.. Class Principles of. Alied C mework- Assignment 1 i Saved Help On June 30, Sharper Corporation's stockholders' equity section of its balance sheet appears as follows before any stock dividend or split. Sharper declares and immediately distributes a 50% stock dividend. Common stock-$10 par value, 60,000 shares issued and outstanding Paid-in capital in excess of par value, common stock $ 600,000 250,000 685,000 $ 1,535,000 Retained earnings Total stockholders' equity (1) Prepare the updated stockholders' equity section after the distribution is made. (2) Compute the number of shares outstanding after the distribution is made. Complete this question by entering your answers in the tabs…arrow_forward

- Chrome File Edit View History Bookmarks Profiles Tab Window Help Wed Dec 1 5:52 PM Pre-Lectur X NWP Asse X My Questi X C Get Home X C On Januar x On Januar X C Shown Bel X M Uh-oh! Th X Shown bel X | + New Tab education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=0f58f312-a099-40d2-900a-bb5ccf4dc4f8#/question/3 Q : Apps How to Partition a... My Videos - Cal P... * Bookmarks New Tab Betsy Stewart's P... Reading List E Pre-Lecture Assignment #2: Chapter 9 Question 4 of 4 - / 25 View Policies Current Attempt in Progress Suppose during 2022 that Federal Express reported the following information (in millions): net sales of $35,000 and net income of $80. Its balance sheet also showed total assets at the beginning of the year of $24,700 and total assets at the end of the year of $23,300. How to Partition and Format a WD Drive on Wi. e the asset turnover and return on assets. (Round asset turnover to 2 decimal places, e.g. 6.25 and return on assets to 1 decimal…arrow_forwardW es D Edit View History Bookmarks Profiles Tab Window Help earch × ①QuickLaunchSSO :: Single Sig X M Question 5-Chapter 2 Home X M Chapter 2 Quiz - Connect + heducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%25... mework i Saved The transactions of Spade Company appear below. a. K. Spade, owner, invested $14,250 cash in the company. b. The company purchased supplies for $413 cash. c. The company purchased $7,880 of equipment on credit. d. The company received $1,682 cash for services provided to a customer. e. The company paid $7,880 cash to settle the payable for the equipment purchased in transaction c. f. The company billed a customer $3,021 for services provided. g. The company paid $510 cash for the monthly rent. h. The company collected $1,269 cash as partial payment for the account receivable created in transaction f. i. K. Spade withdrew $1,100 cash from the company for personal use. Exercise 2-13 (Algo) Recording effects…arrow_forwardnework E x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A 52F%252Ffaytechcc.blackboard.co.. - User Management,.. H https://outlook.off.. FES Protection Plan System 7 - North C.. work Exercises Soved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate ce Purchased merchandise on credit from O'Rourke Fabricators, Invoice 885, $1,600, terms 2/10, n/30; freight of $32 prepaid by O'Rourke Fabricators and added to the invoice (total invoice amount, $1,632). Paid amount due to O'Rourke Fabricators for the purchase of April 1, less the 2 percent discount, Check 457. Purchased merchandise on credit from Kroll Company, Invoice 145, $1,050, terms 2/10, n/30; freight of $55 prepaid by Kroll and added to the invoice. Returned damaged merchandise purchased on April 15 from Kroll Company; received Credit Memorandum 332 for $50. Paid the amount due to Kroll Company for the purchase of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education