FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:gle Chrome

File

Edit

View History

Bookmarks

Profiles

Tabl

Window Help

X

M Inbox (231)- abigailof X

M Verify Your Email Addra

×

The following unadjus! X

iConnect - Home

×

M Question 5 - Chap

C

bis- Google Search

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

Chapter 4 Homework

5

Saved

Help

Save & Ex

12.89

points

eBook

Ask

Print

References

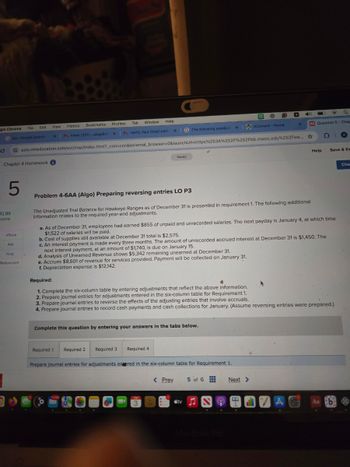

Problem 4-6AA (Algo) Preparing reversing entries LO P3

The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional

information relates to the required year-end adjustments.

a. As of December 31, employees had earned $855 of unpaid and unrecorded salaries. The next payday is January 4, at which time

$1,522 of salaries will be paid.

b. Cost of supplies still available at December 31 total is $2,575.

c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,450. The

next interest payment, at an amount of $1,740, is due on January 15.

d. Analysis of Unearned Revenue shows $5,342 remaining unearned at December 31.

e. Accrues $8,601 of revenue for services provided. Payment will be collected on January 31.

f. Depreciation expense is $12,142.

Required:

1. Complete the six-column table by entering adjustments that reflect the above information.

2. Prepare journal entries for adjustments entered in the six-column table for Requirement 1.

3. Prepare journal entries to reverse the effects of the adjusting entries that involve accruals.

4. Prepare journal entries to record cash payments and cash collections for January. (Assume reversing entries were prepared.)

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3 Required 4

Prepare journal entries for adjustments entered in the six-column table for Requirement 1.

JUN

M

3

< Prev

5 of 6

Next >

tv♫

MacBook Pro

Aa b

Che

Transcribed Image Text:Google Chrome

File

Edit

View

History

Bookmarks

Profiles

Tab Window

Help

0

bis- Google Search

X

Inbox (231) abigailof: x | Verify Your Email Addre

x The following unadjust x IConnect - Home

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252F

Chapter 4 Homework

1.11

points

6

Saved

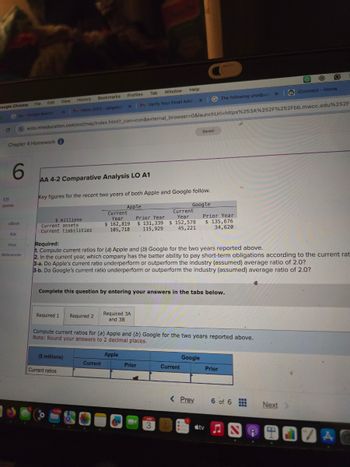

AA 4-2 Comparative Analysis LO A1

Key figures for the recent two years of both Apple and Google follow.

Apple

Google

eBook

$ millions

Current assets

Current

Year

$ 162,819

Current liabilities

105,718

Current

Year

Prior Year

$131,339 $ 152,578

115,929 45,221

Prior Year

$ 135,676

34,620

Ask

Required:

Print

References

1. Compute current ratios for (a) Apple and (b) Google for the two years reported above.

2. In the current year, which company has the better ability to pay short-term obligations according to the current rat

3-a. Do Apple's current ratio underperform or outperform the industry (assumed) average ratio of 2.0?

3-b. Do Google's current ratio underperform or outperform the industry (assumed) average ratio of 2.0?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3A

and 3B

Compute current ratios for (a) Apple and (b) Google for the two years reported above.

Note: Round your answers to 2 decimal places.

Apple

Google

($ millions)

Current

Prior

Current

Prior

Current ratios

11768

2

3

< Prev

6 of 6

Next>

tv♫

4

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forwardquestion 2,3,4arrow_forwardrome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forward

- me File Edit View History Bookmarks Profiles Tab Window Help box (231) - abigailofe x M Gmail Warning! Due to inactiv x M Question 9 - Mid-Term x Connect Getting to K x wiL4 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Σ -Term Exami 9 Saved Help After the success of the company's first two months, Santana Rey continues to operate Business Solutions. The November 30, 2021, unadjusted trial balance of Business Solutions (reflecting its transactions for October and November of 2021) follows. Number Account Title 101 Cash 106 Accounts receivable Ask 126 Computer supplies 128 Prepaid insurance 131 Prepaid rent 163 Office equipment 164 167 Computer equipment 168 Accumulated depreciation-office equipment Accumulated depreciation-Computer equipment 201 Accounts payable 210 Wages payable 236 Unearned computer services revenue 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 Computer services revenue 612 613 623 Wages…arrow_forwardestkentucky.kctcs.edu - Yahc X ube Maps Maps News News Translate M SmartBook 2.0 M SmartBook 2.0 ter 10 Homework i Book Hint Gradebook / ACC 202: Manage X M Question 6 - Chapter 10 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Ask 5 Surf Company can sell all of the two surfboard models it produces, but it has only 476 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $276 for Glide and $452 for Ultra. Print erences W 1 Q (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Required A Complete this question by entering your answers in the tabs below. MyPath - Home Compute the contribution margin per direct labor hour for each product. F1 Contribution margin per direct labor hour…arrow_forwardCurren Qu x Acct 2 New T Conter Conter bnc An eas Untitle New TP wild fa AAOL New T New T education.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity 19, 20 i Saved Help Save C Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,110 in assets in exchange for its common stock to launch the business. On December 31, the company's records show the following items and amounts. Cash $ 14,550 Cash dividends Accounts receivable 12,940 Consulting revenue Rent expense office supplies office equipment 2,400 17,020 45, 860 $ 1,120 12,940 2, 640 5,920 800 Salaries expense Land Telephone expense Accounts payable , 620 7,820 Miscellaneous expenses 83, 110 Common stock Exercise 1-18 (Algo) Preparing an income statement LO P2 Using the…arrow_forward

- o Mail O Launc - Proble O Cours O Quest C Get H Bb Join L O Cisco Onel X - ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activi.. O Microsoft Office Ho.. E My Shelf | Brytewav. 国Rea >> 0 Mail - Soares, Marc. 6 Massbay Nav OneLogin D ADP ail O YouTube 6 MassBay Curriculum Saved Help Save & Exit Submit - quick study Check my work QS 1-10 Identifying effects of transactions using accounting equation-Revenues and Expenses LO P1 The following transactions were completed by the company. a. The company completed consulting work for a client and immediately collected $7,000 cash earned. b. The company completed commission work for a client and sent a bill for $5,500 to be received within 30 days. c. The company paid an assistant $2,150 cash as wages for the period. d. The company collected $2,750 cash as a partial payment for the amount owed by the client in transaction b. e. The company paid $1,000 cash for…arrow_forwardHomework x a ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%=D0&launchUrl%=https%253A%252F%252Ffaytechcc.blackboard.c A User Management,... I https://outlook.offi. e FES Protection Plan System 7 - North C.. ework Exercises A Saved Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate On April 1, Moloney Meat Distributors sold merchandise on account to Fronke's Franks for $3,630 on Invoice 1001, terms 1/10, n/30. The cost of merchandise sold was $2.260. Payment was received in full from Fronke's Franks, less discount, on April 10. Required: Record the transactions for Moloney Meat Distributors on April 1and April 10. The company uses the perpetual inventory system. (Round final answers to the nearest whole dollar value.)arrow_forwardhrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forward

- sm1arrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forwardAutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education