FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:le Chrome File Edit View

Gbjs - Google Search

History

Bookmarks

Profiles

Tab Window Help

M Chapter 2 Quiz - Connect

× WiConnect - Home

x M Question 11- Chapter 2 Home

Content

C

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe...

Chapter 2 Homework i

Saved

Tue May 28 8:1

New Chrome available

Help

Save & Exit

Submit

11

24.85

points

eBook

Ask

Print

References

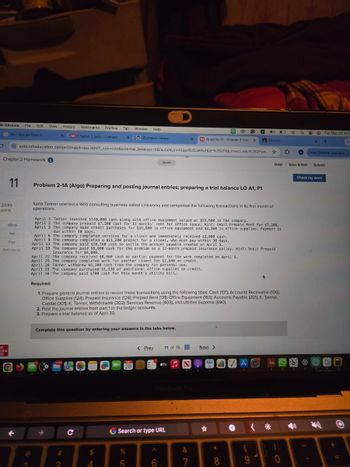

Problem 2-1A (Algo) Preparing and posting journal entries; preparing a trial balance LO A1, P1

Karla Tanner opened a Web consulting business called Linkworks and completed the following transactions in its first month of

operations.

April 1 Tanner invested $140,000 cash along with office equipment valued at $33,600 in the company.

April 2 The company prepaid $7,200 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for $7,200.

April 3 The company made credit purchases for $16,800 in office equipment and $3,360 in office supplies. Payment is

due within 10 days.

April 6 The company completed services for a client and immediately received $2,000 cash.

April 9 The company completed a $11,200 project for a client, who must pay within 30 days.

April 13 The company paid $20,160 cash to settle the account payable created on April 3.

April 19 The company paid $6,000 cash for the premium on a 12-month prepaid insurance policy. Hint: Debit Prepaid

Insurance for $6,000.

April 22 The company received $8,960 cash as partial payment for the work completed on April 9.

April 25 The company completed work for another client for $2,640 on credit.

April 28 Tanner withdrew $6,200 cash from the company for personal use.

April 29 The company purchased $1,120 of additional office supplies on credit.

April 30 The company paid $700 cash for this month's utility bill.

Required:

1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106);

Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); K. Tanner,

Capital (301); K. Tanner, Withdrawals (302); Services Revenue (403); and Utilities Expense (690).

2. Post the journal entries from part 1 to the ledger accounts.

3. Prepare a trial balance as of April 30.

Complete this question by entering your answers in the tabs below.

Mc

raw

ill

MAY

28

< Prev 11 of 15

Next >

tv N

MacBook Pro

A

Aa b

->

C

G Search or type URL

☆

$

%

&

1

4

5

6

7

8

66

9

0

Check my work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- hrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forward

- AutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forwardFile Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forwardQuestion 3arrow_forward

- chrome File Edit View History Objs- Google Search × Bookmarks Profiles Tab Window Help M Inbox (227) - abigailoforiwaa x | Verify Your Email Address-d x QuickLaunchSSO:: Single Sig x M Question 3 - Chapter 4 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... hapter 4 Homework i 3 Saved Help Save & Exit On April 1, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's first month. 0.31 ints April 2 Nozomi invested $34,000 cash and computer equipment worth $35,000 in the company. eBook Ask Print References April 3 The company rented furnished office space by paying $2,700 cash for the first month's (April) rent. April 4 The company purchased $1,100 of office supplies for cash. April 10 The company paid $2,900 cash for a 12-month insurance policy. Coverage begins on April 11. April 14 The company paid $1,800 cash for two weeks' salaries earned by…arrow_forward-Homework #9 -Co X ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser=0&launchUrl=https%253A%252F%252Fnewlearn.govst.edu%252Fwebapps%252Fport... My Shelf Brytewav. Lumen Learning E Google Docs E Ch 9-Google Docs earn EReading list mework #9 i) Saved Help Save & Exit Submit 其 You received no credit for this question in the previous attempt. View previous attempt 16 TB MC Qu. 13-79 (Algo) Ari, Inc. Is working on its cash budget... Ari, Inc. is working on its cash budget for December. The budgeted beginning cash balance is $27,00O. Budgeted cash receipts total $140,000 and budgeted cash disbursements total $139,000. The desired ending cash balance is $66.000. To attain its desired ending cash balance for December, the company needs to borrow: ints Any borrowing is in multiples of $1,000 and interest is paid in the month following the borrowing. eBook To attain its desired ending cash balance for December, the company needs to borrow: References Multiple Choice $66,000.…arrow_forwardhow do I do thisarrow_forward

- e File Edit View History Bookmarks Profiles Tab Window Help G ox (270) - abigailo x MACC101 Principles of A X (4726) IFRS vs. GAAP x M Question 15 - Chapter X WiConnect-Home 1545 x M Qu ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... pter 6 Homework i 15 Saved Help Part 3 of 4 10.34 points Required information Problem 6-2AA (Algo) Periodic: Alternative cost flows LO P3 [The following information applies to the questions displayed below.] Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Activities Beginning inventory Purchase Units Acquired at Cost 110 units $45 per unit 410 units @$50 per unit 140 units @$55 per unit 220 units @$57 per unit 430 units @$80 per unit Totals 880 units eBook Ask Print Date March 1 March 5 March 9 March 18 March 25 March 29 Sales Purchase Purchase Sales References 180 units @ $90 per unit…arrow_forwardD Chrome View Edit File Bookmarks History Profiles Tab Window Help bjs-Google Search x C The following financial statem × 0 xiConnect - Home M Question 18 - Chapter 1 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 1 Homework Saved 18 [Ine following information applies to the questions displayed below.j The following financial statement information is from five separate companies. Company A Part 5 of 5 Beginning of year Assets Liabilities $ 36,000 29,520 Company B $ 28,080 Company C Company D Company E $ 23,040 $ 64,080 $ 98,280 19,656 12,441 44,215 ? End of year Assets 41,000 4.03 points 29,520 ? 74,620 113,160 Liabilities ? 20,073 13,460 35,817 89,396 Changes during the year Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 eBook Owner withdrawals 8,608 3,500 2,000 5,875 0 11,000 Ask Print References Mc Graw Hill Problem 1-2A (Algo) Part 5 5. Compute the amount of liabilities…arrow_forwardAutoSave a Ch13Homework_Question5 OFF Home Insert Draw Page Layout Formulas Data Review View Tell me A Share Comments A^ A KA Insert v Liberation Sans 12 22 Wrap Text v Custom Delete v В I U A $ v % 9 .00 Conditional Format Cell Find & Select Analyze Data Paste Merge & Center v Sort & Sensitivity 00 Formatting as Table Styles Format v Filter С32 fx K L 0 P A В C D E G H J M N R S U V W X Formula: Divide; Cell Referencing 1 2 3 Using Excel to Perform Vertical Analysis PROBLEM Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to this work area. 4 5 Data from the comparative balance sheets of Rollaird Company is 6 presented here. 7 December 31, December 31, Using these data from the comparative balance sheets of Rollaird Company, perform vertical analysis. 8. 9. 2022 2021 Accounts receivable (net) $ 460,000 $ 780,000 400,000 650,000 10 11 Inventory December 31, 2022 December 31, 2021 12 Total assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education