FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:人

es

Total cash receipts

Total cash disbursements

1st Quarter

$ 320,000

$ 372,000

2nd Quarter

$ 440,000

$ 342,000

3rd Quarter

$ 370,000

4th Quarter

$ 390,000

$ 332,000

$ 352,000

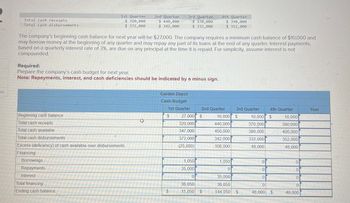

The company's beginning cash balance for next year will be $27,000. The company requires a minimum cash balance of $10,000 and

may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments,

based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not

compounded.

Required:

Prepare the company's cash budget for next year.

Note: Repayments, interest, and cash deficiencies should be indicated by a minus sign.

Beginning cash balance

Total cash receipts

Total cash available

Total cash disbursements

Excess (deficiency) of cash available over disbursements

Financing:

Borrowings

Repayments

Interest

Total financing

Ending cash balance

L

Garden Depot

Cash Budget

1st Quarter

2nd Quarter

3rd Quarter

4th Quarter

Year

$

27,000 $

10,000 $

10,000 $

10,000

320,000

440,000

370,000

390,000

347,000

450,000

380,000

400,000

372,000

342,000

332,000

352,000

(25,000)

108,000

48,000

48,000

1,050

1,050

0

0

35,000

0

0

0

35,000

0

0

36,050

36,050

0

0

$

11,050 $

144,050

$

48,000 $

48,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Don't provide answers in image formatarrow_forwardIndarrow_forwardCCC practice exercise: The COGS of a company is 600,000. Opening inventory is 15,000 and the closing inventory is 85,000. Particular 2018 Annual Credit Sales 500,000 Annual credit purchases 300,000 Creditors in the beginning 65000 Creditors at the end 45000 Debtors in the beginning 80,000 Debtors at the end 100,000 You are requested to calculate the cash conversion cyclearrow_forward

- Striker Company estimates its expected cash receipts for the period to be $80,000 and its expected cash disbursements to be $70,000. The beginning cash balance for the period was $5,000. The management wants to maintain a minimum cash balance of $40,000. Knowledge Check 01 How much cash will the company need to borrow? O $15,000 O $25,000 O $30,000 O $40,000arrow_forwardHere is a forecast of sales by National Bromide for the first four months of 2022 (figures in $ thousands): Month 1 Month 2 Month 3 Month 4 Cash sales 35 44 38 34 Sales on credit 300 320 290 270 On average, 45% of credit sales are paid for in the current month, 25% are paid in the next month, and the remainder are paid in the month after that. What is the expected cash inflow from operations in months 3 and 4? Note: Do not round intermediate calculations. Enter your answers in thousands and rounded to one decimal place.arrow_forward6. Smith Company was organized on August 1 of the current year. Projected sales for the next three months are: August $250,000 September 200,000 October 275,000 The company expects to sell 50% of its merchandise for cash and 50% for sales on account. Of the sales on account, 30% are expected to be collected in the month of the sale and the remainder in the following month. Prepare a schedule indicating cash collections from cash and accounts receivable for the three months.arrow_forward

- Ramon Manufacturing has a cash balance of P8,000 on August 1 of the current year.The company’s controller forecast the following cash receipts and cash disbursementsfor the upcoming two months of activity.Receipts PaymentsAugust P 45,000 P 57,000September 66,000 56,000Management desires to maintain a minimum cash balance of P8,000 at all times. If necessary, additional financing can be obtained in P1,000 multiples at a 12% interest rate. All borrowings are made at the beginning of the month; debt retirement, on the otherhand, occurs at the end of the month. Interest is paid at the time of repaying loan principal and is computed on the portion of debt repaid. 1. Determine the ending cash balance in August both before and after anynecessary financing or debt retirement.arrow_forwardThe Morning Jolt Coffee Company has projected the following quarterly sales amounts for the coming year: Q1 Q2 Q3 Q4 Sales $ 750 $ 810 $ 890 $ 980 Accounts receivable at the beginning of the year are $335. The company has a 45-day collection period. a. Calculate cash collections in each of the four quarters by completing the following: Q1 Q2 Q3 Q4 Beginning receivables Sales 750.00 810.00 890.00 980.00 Cash collections Ending receivablesarrow_forwardHere is a forecast of sales by National Bromide for the first four months of 2019 (figures in $ thousands): Month 1 Month 2 Month 3 Month 4 Cash sales 17 26 20 16 Sales on credit 120 140 110 90 On the average 52% of credit sales are paid for in the current month, 32% are paid in the next month, and the remainder are paid in the month after that. What is the expected cash inflow from operations in months 3 and 4? (Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest whole number.)arrow_forward

- prepare debtors collection schedule for April and May 2022 prepare the cash budget for April and May 2022arrow_forwardHarrah Company provided the following information for the month of October: Beginning cash balance $ 35,000 Cash receipts 460,000 Cash disbursements 485,000 Harrah's policy is to keep a minimum end of the month cash balance of $30,000. How much will Harrah's need to borrow during October?arrow_forwardHelp me pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education