Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this general accounting question

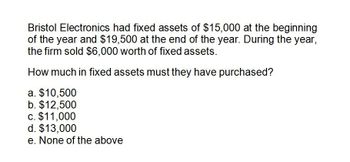

Transcribed Image Text:Bristol Electronics had fixed assets of $15,000 at the beginning

of the year and $19,500 at the end of the year. During the year,

the firm sold $6,000 worth of fixed assets.

How much in fixed assets must they have purchased?

a. $10,500

b. $12,500

c. $11,000

d. $13,000

e. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide the Correct answer.. I need this answer with Correct optionarrow_forwardTalbot Enterprises recently reported an EBITDA of $8 million and net income of $2.4 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?arrow_forwardGive the Correct answer of what is the right optionarrow_forward

- Thank you for helping, please show step bys teparrow_forwardA firm purchased $62,800 of fixed assets two years ago. The company no longer needs these assets so it is going to sell them today for $28,500. The assets are classified as five-year property for MACRS. The MACRS rates are .2, .32, .192, .1152, .1152, .0576, for Years 1 to 6, respectively. What is the net cash flow from this sale if the firm's tax rate is 23 percent and no bonus depreciation is taken? $29,281.04 $26,576.00 $28.878.12 $27,516.60 O $29,648.12arrow_forwardThis year, Industrial Consolidated reported depreciation expense of $85,000 on its income statement while reporting Net Fixed Assets of $1,200,000 on its balance sheet. Last year, it reported depreciation expense of $110,000 and net fixed assets of $1,350,000. What was Net Capital Spending this year? Question 6 options: ($40,000) $70,000 $45,000 $260,000 ($65,000)arrow_forward

- In the Wall Bricks, Inc.’s balance sheet lists net fixed asset as $12 million. The fixed assets could currently be sold for $10 million. Wall Bricks’ current balance sheet shows current assets of $6 million and current liabilities of $3 million. If all the current accounts were liquidated today, the company would receive $4 million cash after paying the $1 million in liabilities. What is the book value of Wall Bricks’ assets today? What is the market value of these assets?arrow_forwardA chemical company has a total income of 1.94 million per year and total expenses of 567347 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.39with a MACRS recovery period of 4 years, and a straight-line recovery period of 12.4 years.Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the ?straight-line methodarrow_forwardA chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forward

- A firm purchased fixed assets 3 years ago for $4,000. The fixed assets can be sold today for $3,000. The balance sheet shows fixed assets of $850, no long-term debt, current liabilities of S750, and net working capital of $600. If all the current accounts were liquidated today, the firm would receive $1,250. Find the book value of the firm's assets. Find the market value of the firm's equity.arrow_forwardIn January 2010 the Status Quo Company was formed. Total assets were $500,000, of which $300,000 consisted of capital assets. Status Quo uses straight-line amortization, and in 2010 it estimated its capital assets to have useful lives of 10 years. Aftertax income has been $26,000 per year each of the last 10 years. Other assets have not changed since 2010. a. Compute ROA at year-end for 2010, 2012, 2015, 2017, and 2019. (Round the final answers to 2 decimal places.) 2010 2012 2015 2017 2019 Return on assets % % de de % % % b. This part of the question is not part of your Connect assignment. c. This part of the question is not part of your Connect assignment.arrow_forwardThe following data are given on MNL Corp. Cost of sales per annum P2,200,000Operating expenses (including depreciation Expense) 800,000The company books further reveal that MNL was able to sell an equipment amounting to P250,000 with gain of P50,000. The asset was acquired at P650,000 five year ago. How much should the corporation’s minimum cash balance be if it is to be equal to 15 days’ requirement?5. What is the average age of inventory for Patsy if it has sales of P320,000, an average inventory of P5,333, and cash conversion cycle of 20 days ? Assume that the cost of sales is 55% of Sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning