Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

provide correct answer general accenting

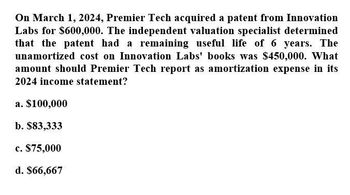

Transcribed Image Text:On March 1, 2024, Premier Tech acquired a patent from Innovation

Labs for $600,000. The independent valuation specialist determined

that the patent had a remaining useful life of 6 years. The

unamortized cost on Innovation Labs' books was $450,000. What

amount should Premier Tech report as amortization expense in its

2024 income statement?

a. $100,000

b. $83,333

c. $75,000

d. $66,667

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardFor each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a ten-year remaining legal life was purchased for $300,000. The patent will be usable for another eight years. B. A patent was acquired on a new smartphone. The cost of the patent itself was only $24,000, but the market value of the patent is $600,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forwardFor each of the following unrelated situations, calculate the annual amortization expense and prepare a journal entry to record the expense: A. A patent with a seventeen-year remaining legal life was purchased for $850,000. The patent will be usable for another six years. B. A patent was acquired on a new tablet. The cost of the patent itself was only $12,000, but the market value of the patent is $150,000. The company expects to be able to use this patent for all twenty years of its life.arrow_forward

- Calico Inc. purchased a patent on a new drug. The patent cost $21,000. The patent has a life of twenty years, but Calico only expects to be able to sell the drug for fifteen years. Calculate the amortization expense and record the journal for the first-year expense.arrow_forwardCalico Inc. purchased a patent on a new drug it created. The patent cost $12,000. The patent has a life of twenty years, but Calico expects to be able to sell the drug for fifty years. Calculate the amortization expense and record the journal for the first years expense.arrow_forwardhow to record the 2020 amortization expense of Jan.2? why the solution says use 45,000 *1/9 instead of *1/10arrow_forward

- On December 31, 2020, Zari Company acquired the following intangible assets:• A trademark for P3,000,000. The trademark has 8 years remaining in its legal life. It is anticipated that the trademark will be renewed in the future, indefinitely, without problem. ,• A patent for P2,000,000. Because of market conditions, it is expected that the patent will have economic life for just 5 years, although the remaining legal life is 10 years.Because of a decline in the economy, the trademark is now expected to generate cash flows of just P120,000 per year. The useful life of the trademark still extends beyond the foreseeable horizon. The cash flows expected to be generated by the patent are P500,000 in 2022, P600,000 in 2023, P400,000 in 2024 and P500,000 in 2025. The appropriate discount rate for all intangible assets is 6%. The present value of 1 at 6% for one period is 0.94, for two periods is 0.89, for three periods is…arrow_forward(17). Tahir Industries has the following patents on its December 31, 2021, balance sheet. Patent Item Initial Cost Date Acquired Useful Life at Date Acquired Patent A $ 48,000 3/1/18 20 years $ 19,200 $ 16,800 Patent B 7/1/19 10 years Patent C 9/1/20 8 years The following events occurred during the year ended December 31, 2022. (1). Research and development costs of $347,000 were incurred during the year. (2). Patent D was purchased on July 1 for $10,800. This patent has a useful life of 12 years. (3). As a result of reduced demands fo certain products protected by Patent B, a possible im airment of Patent B's value may have occurred at Decem ber 31, 2022. The controller for Tahir estimates the future cash flows from Patent B will be as follows. Year Expected Future Cash Flows 2023 $2,500 2024 2,500 2025 2,500 The prop discount rate to be used for these cash flows is 8%. (Assume that the cash flows occur at the end of the year.) (Annuity Factor @ 8% for 3 yrs = $2.57710) Instructions…arrow_forwardOn January 1, 2020, Ella Company acquired the following intangible assets: • A trademark for P2,000,000. The trademark has 8 years remaining in its legal life. It is anticipated that the trademark will be renewed in the future, indefinitely, without a problem. • A patent for P4,000,000. Because of market condition, it is expected that the patent will have economic life for just 5 years, although the remaining legal life is 10 years. On December 31, 2020, the intangible assets are assessed for impairment. Because of a decline in the economy, the trademark is expected to generate cash flows of just P120,000 per year. The useful life of the trademark still extends beyond the foreseeable horizon. The cash flows expected to be generated by the patent are P500,000 annually for each of the next four years. The appropriate discount rate for all intangible assets is 8%. Ella Company shall recognized a total impairment loss in 2020 at a. P2,045,000 b. P1,545,000 c. P2,845,000 d. P1,980,000…arrow_forward

- how to record the 2020 amortization expense of Jan.2?( please explain why use 45,000 divided by 9 instead of 10)arrow_forwardOn January 1, 2022, Irwin company purchased the copyright to quick computer tutorials for $120,000. it is estimated that the copyright will have a useful life of 5 years. The amount of amortization expense recognized for the year 2022 would be. a. $0 b. $24,000 c. $60,000 d. $120,000arrow_forwardOn March 1, 2020, Peggy's Cafe acquired equipment for $220.000. The estimated life of the equipment is 5 years or 80,000 hours. The estimated residual value is $20.000. What is the depreciation for 2020), if Peggy's Cafe uses the asset 14,200 hours and uses the activity based depreciation method? (round to the nearest dollar) $29.583 $32.542 Ⓒ$35.500 $39.050 None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College