FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

prepare debtors collection schedule for April and May 2022

prepare the

Transcribed Image Text:Below is the transcription and detailed explanation of the provided document, suitable for an Educational website:

---

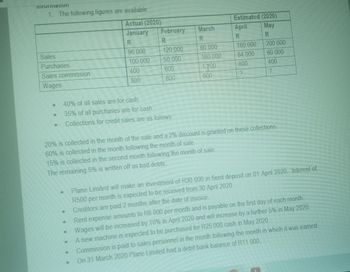

### Financial Information for Plane Limited

**The following figures are available:**

| | Actual (2020) | | Estimated (2020) | |

|-----------|---------------------|---------------|---------------------|--------------|

| | January | February | March | April | May |

| **Sales** | R 96,000 | R 120,000 | R 60,000 | R 160,000 | R 200,000 |

| **Purchases** | R 100,000 | R 50,000 | R 70,000 | R 84,000 | R 60,000 |

| **Sales commission** | R 400 | R 600 | R 1,200 | R 800 | R 400 |

| **Wages** | R 800 | R 800 | R 800 | ? | ? |

**Key Financial Policies and Information:**

- **Sales and Purchases**:

- 40% of all sales are conducted on a cash basis.

- 35% of all purchases are made in cash.

- **Collections for Credit Sales**:

- 20% is collected in the month of the sale, and a 2% discount is granted on these collections.

- 60% is collected in the month following the month of the sale.

- 15% is collected in the second month following the month of the sale.

- The remaining 5% is written off as bad debts.

**Additional Financial Assumptions and Activities**:

- Plane Limited will make an investment of R30,000 in a fixed deposit on 01 April 2020. Interest of R500 per month is expected to be received from 30 April 2020.

- Creditors are paid 2 months after the date of the invoice.

- Rent expense amounts to R6,000 per month and is payable on the first day of each month.

- Wages will be increased by 10% in April 2020 and will increase by a further 5% in May 2020.

- A new machine is expected to be purchased for R25,000 cash in May 2020.

- Commission is paid to sales personnel in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11. Calculating the Cash Budget Here are some important figures from the budget of Crenshaw, Inc., for the second quarter of 2019. LO 3 April May June $598,000 282,000 $689,000 $751,000 Credit sales 302,000 338,000 Credit purchases Cash disbursements 137,000 129,000 179,000 Wages, taxes, and expenses 15,600 15,600 15,600 Interest 53,500 6,600 248,000 Equipment purchases The company predicts that 5 percent of its credit sales will never be collected 35 percent of its sales will be collected in the month of the sale, and the re- maining 60 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2019, credit sales were $561,000. Using this information, com- plete the following cash budget: April May June $182,000 Beginning cash balance Cash receipts Cash collections from credit sales Total cash available Cash disbursements Purchases 289,000 Wages, taxes, and expenses Interest Equipment purchases Total cash disbursements…arrow_forwardSchedule of Cash Payments Select Physical Therapy Inc. is planning its cash payments for operations for the third quarter (July-September), 2017. The Accrued Expenses Payable balance on July 1 is $31,700. The budgeted expenses for the next three months are as follows: July August September Salaries $72,900 $88,800 $98,300 Utilities 6,000 6,700 7,900 Other operating expenses 55,400 60,400 66,500 Total $134,300 $155,900 $172,700 Other operating expenses include $4,000 of monthly depreciation expense and $900 of monthly insurance expense that was prepaid for the year on March 1 of the current year. Of the remaining expenses, 75% are paid in the month in which they are incurred, with the remainder paid in the following month. The Accrued Expenses Payable balance on July 1 relates to the expenses incurred in June. Prepare a schedule of cash payments for operations for July, August, and September. Select Physical Therapy Inc. Schedule of Cash Payments for Operations For the Three Months…arrow_forwardThe City of Bedford Falls debt service fund budgeted $150,000 (2 payments of $75,000) for interest and an annual principal payment of $500,000. Funding will be transferred from the general fund at the time payments are to be made. Interest payments will be December 15 and June 15. Principal will be paid on June 15. Journalize the budget for July 1 Journal any necessary December 15 entry(ies) What is the amount of accrued interest to be recorded in the Debt Service Fund at June 30?arrow_forward

- Today is November 1, 2021. A continuous budget for the period from November 1, 2021 through October 31, 2022 is more reflective of current operating conditions than an operating budget for calendar year 2021 that was compiled in November 2020. True or false?arrow_forwardMonth ($) Wages ($) From the following information, prepare a monthly cash budget for the three months ending 31st December 2019. Sales ($) Materials Other Expenses ($) Jun. (A) 3,000 1,800 650 385 Jul. (A) 3,250 2,000 750 385 Aug. (A) 3,500 2,400 750 425 Sep.(A) 3,750 2,250 .750 475 Oct. (E) 4,000 2,300 800 500 Nov. (E) 4,250 2,500 900 550 Dec. (E) 4,500 2,600 1,000 575 (A) Actual; (E) - Estimated. = The credit terms are as follows: • Sales -10% of sales are in cash. On average, 50% of credit sales are paid in the next month, while the other 50% are paid two months after the sale. • Creditors for material are paid 2 months after purchase. • Wages and other expenses are paid the same month. The cash and bank balance on 1st October is expected to be $1,500. Other information is given as follows: • Plant and machinery are to be installed in August at a cost of $24,000. This sum will be paid in monthly installments of $500 each from 1st October. • Dividends from investments amounting to…arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education