EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

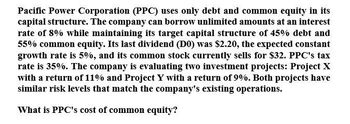

Transcribed Image Text:Pacific Power Corporation (PPC) uses only debt and common equity in its

capital structure. The company can borrow unlimited amounts at an interest

rate of 8% while maintaining its target capital structure of 45% debt and

55% common equity. Its last dividend (DO) was $2.20, the expected constant

growth rate is 5%, and its common stock currently sells for $32. PPC's tax

rate is 35%. The company is evaluating two investment projects: Project X

with a return of 11% and Project Y with a return of 9%. Both projects have

similar risk levels that match the company's existing operations.

What is PPC's cost of common equity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 11% as long as it finances at its target capital structure, which calls for 45% debt and 55% common equity. Its last dividend (D) was $2.35, its expected constant growth rate is 6%, and its common stock sells for $29. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 12%, and Project B's return is 9%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % c. Which projects should Empire accept? -Select-arrow_forwardEmpire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 11% as long as it finances at its target capital structure, which calls for 40% debt and 60% common equity. Its last dividend (Do) was $1.75, its expected constant growth rate is 3%, and its common stock sells for $26. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 14%, and Project B's return is 8%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. .66 % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % c. Which projects should Empire accept? Project A Varrow_forwardAntonio's is analyzing a project with an initial cost of $39,000 and cash inflows of $25,000 a year for 2 years. This project is an extension of the firm's current operations and thus is equally as risky as the current firm. The firm uses only debt and common stock to finance their operations and maintains a debt-equity ratio of 0.8. The pre-tax cost of debt is 7.8 percent and the cost of equity is 11.4 percent. The tax rate is 34 percent. What is the projected net present value of this project? Multiple Choice $3.435.10 $5,204.70arrow_forward

- Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of ra = 10% as long as it finances at its target capital structure, which calls for 40% debt and 60% common equity. Its last dividend (Do) was $1.85, its expected constant growth rate is 5%, and its common stock sells for $22. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 15%, and Project B's return is 9%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. -Select- % c. Which projects should Empire accept?arrow_forwardEmpire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 10% as long as it finances at its target capital structure, which calls for 40% debt and 60% common equity. Its last dividend (Do) was $2.60, its expected constant growth rate is 4%, and its common stock sells for $30. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 11%, and Project B's return is 10%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. -Select- % c. Which projects should Empire accept?arrow_forwardEmpire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 10% as long as it finances at its target capital structure, which calls for 25% debt and 75% common equity. Its last dividend (D 0) was $2.55, its expected constant growth rate is 3%, and its common stock sells for $ 22. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 14%, and Project B's return is 8%. These two projects are equally risky and about as risky as the firm's existing assets. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 11% as long as it finances at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (D0) was $3.35, its expected constant growth rate is 3%, and its common stock sells for $24. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 15%, and Project B's return is 8%. These two projects are equally risky and about as risky as the firm's existing assets. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. % Which projects should Empire accept?arrow_forwardEmpire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of ra E 11% as long as it finances at its target capital structure, which calls for 40% debt and 60% common equity. Its last dividend (Do) was $2.70, its expected constant growth rate is 4%, and its common stock sells for $30. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 14%, and Project B's return is 11%. These two projects are equally risky and about as risky as the firm's existing assets. a. What is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. What is the WACC? Do not round intermediate calculations. Round your answer to two decimal places. -Select- -Select- Project A Project B % c. Which projects should Empire accept? 4arrow_forwardes Edsel Research Labs has $26.40 million in assets. Currently half of these assets are financed with long-term debt at 6 percent and ha with common stock having a par value of $10. Ms. Edsel, the Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E). The company earns a return on assets before interest and taxes of 8 percent. The tax rate is 30 percent. Under Plan D, a $6.60 million long-term bond would be sold at an interest rate of 8 percent and 660,000 shares of stock would be purchased in the market at $10 per share and retired. Under Plan E, 660,000 shares of stock would be sold at $10 per share and the $6,600,000 in proceeds would be used to reduce long-term debt. a-1. Compute earnings per share considering the current plan and the two new plans. Note: Round your answers to 2 decimal places. Current Plan D Plan E Earnings per Share $ $ $ 0.42 0.20 1.26 a-2. Which plan(s) would produce the highest EPS? Note that…arrow_forward

- Empire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd = 11% as long as it finances at its target capital structure, which calls for 50% debt and 50% common equity. Its last dividend (D0) was $3.25, its expected constant growth rate is 3%, and its common stock sells for $22. EEC's tax rate is 40%. Two projects are available: Project A has a rate of return of 13%, and Project B's return is 10%. These two projects are equally risky and about as risky as the firm's existing assets. A. What is its cost of common equity? Round your answer to two decimal places. Do not round your intermediate calculations. B. What is the WACC? Round your answer to two decimal places. Do not round your intermediate calculationsarrow_forwardEmpire Electric Company (EEC) uses only debt and common equity. It can borrow unlimited amounts at an interest rate of rd=9% as long as it finances at its target capital structure, which calls for 35% debt and 65% common equity. Its last dividend (D0) was $2.20, its expected constant growth rate is 6%, and its common stock sells for $26. EEC's tax rate is 25%. Two projects are available: Project A has a rate of return of 12.5% and Project B's return is 11.5%. These two projects are equally risky and about as risky as the firm's existing assets. A) What is its cost of common equity? B) What is the WACC? C) Which projects should Empire accept?arrow_forwardEdsel Research Labs has $28.20 million in assets. Currently half of these assets are financed with long-term debt at 5 percent and half with common stock having a par value of $10. Ms. Edsel, the Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E). The company earns a return on assets before interest and taxes of 5 percent. The tax rate is 30 percent. Under Plan D, a $7.05 million long-term bond would be sold at an interest rate of 7 percent and 705,000 shares of stock would be purchased in the market at $10 per share and retired. Under Plan E, 705,000 shares of stock would be sold at $10 per share and the $7,050,000 in proceeds would be used to reduce long-term debt. a-1. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. (Round your answers to 2 decimal places.) Earnings per Share Current Plan D Plan E a-2. Which…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT