Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

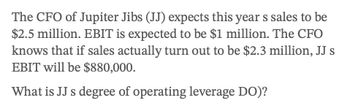

Transcribed Image Text:The CFO of Jupiter Jibs (JJ) expects this year s sales to be

$2.5 million. EBIT is expected to be $1 million. The CFO

knows that if sales actually turn out to be $2.3 million, JJ s

EBIT will be $880,000.

What is JJ s degree of operating leverage DO)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The CFO of Jupiter Jibs (JJ) expects this year’s sales to be $2.5 million. EBIT is expected to be $1 million. The CFO knows that if sales actually turn out to be $2.3 million, JJ’s EBIT will be $880,000. What is JJ’s degree of operating leverage (DOL)?arrow_forwardThe Blazer Company's EPS last year, EPSo, was $1.50. Blazer expects sales to increase by 15% during the coming year. If Blazer has a degree of operating leverage equal to 1.25 and a degree of financial leverage equal to 3.50, then what is its expected EPS or EPS₁? Hint: First, find DTL where DTL= DOL x DFL. Note: This is a web appendix 14A topic. O $2.48 O $2.87 O $2.02 O $1.66arrow_forwardThe CFO of Ink Imagination (II) wants to calculate next year's EPS using different leverage ratios. II's total assets are $5 million, and its marginal tax rate is 40 percent. The company has estimated next year's EBIT for three possible economic states: $1.2 million with a 0.2 probability, $800,000 with a 0.5 probability, and $500,000 with a 0.3 probability. (1) Calculate II's expected EPS, standard deviation, and coefficient of variation for each of the following capital structure. (2) What capital structure should the firm choose to lower the firm's risk? Leverage (Debt/Assets) 20% Shares of Stock Outstanding 300,000 200,000 Interest Rate 6% 50 10arrow_forward

- Unit sales are expected to reach 30,000 per year, the price per unit is expected to be $90, variable costs are $40 per unit and fixed costs are $80,000 per year. The company pays $250,000 in interest per year. What is the degree of financial leverage at the expected levels? Using the degree of financial leverage, what is the expected percentage change in earnings per share (EPS) if EBIT turns out to be 12% lower than expected?arrow_forwardUnit sales are expected to reach 30,000 per year, the price per unit is expected to be $60, variable costs are $40 per unit and fixed costs are $90,000 per year. The company pays $250,000 in interest per year. What is the degree of operating leverage at the expected levels? What is the degree of financial leverage at the expected levels? What is the degree of total leverage at the expected levels? What is the expected percentage change in EPS if unit sales turn out to be 10,000 lower than expected?arrow_forwardYour business plan for your proposed start-up firm envisions first-year revenues of $120,000, fixed costs of $30,000, and variable costs equal to one-third of revenue.a. What are expected profits based on these expectations?b. What is the degree of operating leverage based on the estimate of fixed costs and expected profits?c. If sales are 10% below expectation, what will be the decrease in profits?d. Show that the percentage decrease in profits equals DOL times the 10% drop in sales.e. Based on the DOL, what is the largest percentage shortfall in sales relative to original expectations that the firm can sustain before profits turn negative?f. What are break-even sales at this point?g. Confirm that your answer to (f) is correct by calculating profits at the break-even level of sales.arrow_forward

- cont. Skunk Products' EBIT is $1000, its tax rate is 35%, depreciation is $100, capital expenditures are $200, accounts receivable increase by $100, and accounts payable decrease by $100. What is the free cash flow to the firm? The FCFF will grow at 3%, WACC is 10%. What is the value of the company's assets? V = $arrow_forwardDyrdek Enterprises has equity with a market value of $1.8 million and the market value of debt is $3.55 million. The company is evaluating a new project that has more risk than the firm. As a result, the company will apply a risk adjustment factor of 1.6 percent. The new project will cost $2.20 million today and provide annual cash flows of $576,000 for the next 6 years. The company's cost of equity is 11.07 percent and the pretax cost of debt is 4.88 percent. The tax rate is 21 percent. What is the project's NPV?arrow_forwardInc. has a total asset turnover of 0.45, an equity multiplier of 2.5 and a profit margin of 10.2. The CFO thinks that he can double the return on equity by making some changes. The new profit margin would be boosted to 10% and an additional 1 dollar of sales revenue would be generated by every dollar of asset. By how much does she decrease the debt ratio in order to double the return on equity?arrow_forward

- Ohio Steel has a degree of operating leverage of 2.9. The company predicted EBIT of $332,000 and EPS of $5.7 for the year. Actual EBIT were $284,000 and EPS were $2.42. What is the degree of financial leverage? What is the degree of total leverage? What were earnings before taxes (EBIT - Interest)? What was the company's gross profit (sales - variable costs)?arrow_forwardUnit sales are expected to reach 30,000 per year, the price per unit is expected to be $80, variable costs are $40 per unit and fixed costs are $80,000 per year. The company pays $250,000 in interest per year. What is the degree of total leverage at the expected levels? Using the degree of total leverage, what is the expected percentage change in earnings per share (EPS) if sales turn out to be 16% lower than expected?arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%?a. What are the projected sales in Years 1 and 2?b. What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? c. What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2?d. What is the projected FCF for Year 2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT