Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

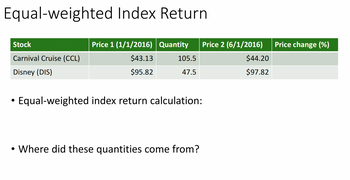

Transcribed Image Text:Equal-weighted Index Return.

Stock

Carnival Cruise (CCL)

Disney (DIS)

●

Price 1 (1/1/2016) Quantity Price 2 (6/1/2016)

$43.13

$95.82

105.5

47.5

Equal-weighted index return calculation:

• Where did these quantities come from?

●

$44.20

$97.82

Price change (%)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- А ABC Po 91 51 102 Rate of return Q0 100 200 200 P1 96 46 112 Rate of return 3.78 % b. An equally weighted index Required: Calculate the first-period rates of return on the following indexes of the three stocks: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A market value-weighted index 91 100 200 200 % P2 96 46 56 92 100 200 400arrow_forwardUse the following tables to assess the worthiness of Verticon stock as an investment. Verticon Stock Data (Current and Historical) 3:45PM EDT Aug 16, 2011 Price 18.85 USD Change +0.64 (+3.51%) Mkt cap 147.1B Div/yield 0.20/4.24 Shares 8,012 Beta 0.70 Book/share 11.335 EPS 1.11 12/2010 12/2009 12/2008 (Millions of Dollars) Total Assets 195,014 195,949 111,148 Total Liabilities 107,201 122,935 53,592 Preferred Shareholders’ Equity 52 61 73 Common Shareholders’ Equity 87,761 72,953 57,483 Shares Outstanding 8,012 8,070 6746 Book/Share ? 9.040 8.521 Q1 (Mar ’11) 2010 Net profit margin 15.24% 12.24% Return on equity 11.60% 9.30% Which one in bold? One of the most important features of a stock is its book value. The book value per share of Verticon’s stock for the year 2010 was equal to (10.954, 13.693, 11.502). Looking at the (Market cap, EPS, change in price, beta value, ROE) ,…arrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Div Yld PE Close Net Ratio Price Chg Hi Lo Stock (Div) % 77.40 10.43 Palm Coal .36 2.6 6 13.90 .24 55.81 33.42 Lake Lead Grp 1.54 3.8 10 40.43 -.01 130.93 69.50 SIR 2.00 2.2 10 88.97 3.07 50.24 13.95 DR Dime .80 5.2 6 15.43 -.26 .18 35.30 20.77 Candy Galore 0.35 1.5 28 ?? a. Using the dividend yield, calculate the closing price for Candy Galore on this day. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Assume the actual closing price for Candy Galore was $23.02. Your research projects a 4.75 percent dividend growth rate for Candy Galore. What is the required return for the stock using the dividend discount model and the actual stock price? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock price b. Required return %arrow_forward

- What is the answer for these? and how do we find them k. Return on common stockholders' equity % %l. Price-earnings ratio, assuming that the market price was $72.12 per share on May 29, 2018, and $53.06 per share on May 30, 2017.arrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardConsider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. A B C с D Date Stock A Prices (in $) Market Index Value Risk Free Rate (in %) 2 Period 1 119 3 Period 2 100 11829 11843 9639 88 131 12854 9580 11640 8469 11412 9115 10682 NOSAWNH 1 4 Period 3 Period 4 6 Period 5 7 Period 6 8 Period 7 9 Period 8 10 Period 9 11 Period 10 12 O 1.1 13 What is the value of CAPM beta for stock A? O 1.4666 O 1.8333 O2.0533 82 113 O 0.3666 65 109 95 113 1.48 1.76 1.64 1.2 1.43 1.36 1.3 1.72 1.71 1.77arrow_forward

- Estimating Share Value Using the DCF Model Following are forecasts of sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 31, 2018, for Humana. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Forecast Horizon Period Terminal $ millions Sales NOPAT NOA 2021 2022 2020 2018 2019 $57,472 $58,326 $59,192 $60,072 $60,964 3,179 3,218 3,140 3,052 3,102 4,844 4,657 4,718 4,781 4,592 Period $61,568 3,244 4,887 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate 1% Discount rate (WACC) 7.8% Common shares outstanding 135.60 million Net nonoperating obligations (NNO) $(5,569) million Noncontrolling interest $0 million NNO is negative because Humana's nonoperating assets exceed its nonoperating liabilities. (a) Estimate the value of a share of Humana's common stock using the…arrow_forwardThe Bloomberg screen below shows the Nasdaq Index price over the last year. Describe the technical indicator used from the chartist and what trade signal it may suggest. CCMP €T On 03 CCMP Index 11/04/2020 Study RSI 1D 3D 1M 6M YTD 1Y 5Y Max Daily Volume 1.000B IRSI (14) on Close (CCMP) 75.3572 Nov C 15811.58 +161.98 Nov 0 15658.52 H 15821.58 L 15616.44 Prev 15811.58 94) Suggested Charts 96) Actions 97) Edit 11/04/2021 Last Px Local CCY Mov Avgs Period 14 Overbought 70 Oversold 30 1 Table + Compare ▾ Add Data Track Annotate News Zoom Key Events 2020 Dec Jan Feb Mar Apr May Jun 06/03/21 Jul Aug Relative Strength Index ไปได้ Sep Edit Chart * Oct 15811.5801 15013.0596 14198.1699 Last Price THigh on 11/03/21 Average 15811.5801 15821.5801 12000 13839.5049 Z-VOU 1 Low on 11/04/20 11394.21 11075.4473 ISMAVG (50) on Close 15013.0596 SMAVG (100) on Close 14805.082 SMAVG (200) on Close 14198.1699 13000 10000 3B 2B 1.000B -0 100 75.3572 -50 -0arrow_forwardrehensive Problem 2- St of Cash Flows and Ratios Algo C. Klein Inc. C. Klein Inc. Income Statement Comparative Balance Sheets December 31, 2018 and 2017 For years ended December 31, 2017 and 2018 2018 2017 Change 2018 2017 $469,000 $422,000 (303,000) (248,000) 166,000 174,000 Current assets: Sales (all on credit) Cost of goods sold Gross margin Cash $52.260 34,000 $37,900 $14,360 Accounts receivable (net) 28,000 6,000 Inventory Prepaid expenses 44,000 42,000 2100 2,000 -1,200 900 Depreciation expense Other operating 5631 36,000 51,000 Other current assets 1310 2000 -690 102,000 85,000 Totol current assets 132,470 112,000 20,470 expenses Total operating 138,000 136,000 expenses ok Operating income 28.000 38,000 Long-term Investments 75,000 52,000 23,000 Other income (expenses) Plant assets 302,000 253,000 49,000 nces Interest expense (4,700) (3,500) Less: accumulated (76,800) (51,000) 25,800 depreciation Gain on sale of 4,900 3,400 Total plant assets 225,200 202,000 23,200 investments…arrow_forward

- Nonearrow_forwardWhat is the Financial Analysis of each year?arrow_forwardCostco Costco Historical Annual Stock Price Data Costco Historical Annual Stock Price Data Year Average Stock Price Year Open Year High Year Low Year Close Annual % Change 2021 391.1370 380.1500 467.7500 311.4200 451.8500 19.92% 2020 329.6114 291.4900 391.7700 279.8500 376.7800 28.19% 2019 262.1953 204.7600 305.2100 200.4200 293.9200 44.28% 2018 208.8144 188.3200 244.2100 178.6100 203.7100 9.45% 2017 167.4075 159.7300 192.7300 150.4400 186.1200 16.25% 2016 154.3535 159.5400 169.0400 141.2900 160.1100 -0.86% 2015 147.8352 141.6100 168.8700 132.7100 161.5000 13.93% 2014 121.5830 117.8100 144.1500 110.1800 141.7500 19.10% 2013 111.7984 101.4500 125.4300 99.4500 119.0200 20.55% 2012 92.0556 84.6000 105.9483 79.0100 98.7300 18.49% 2011 78.7433 72.4700 88.0600 69.7600…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education