Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

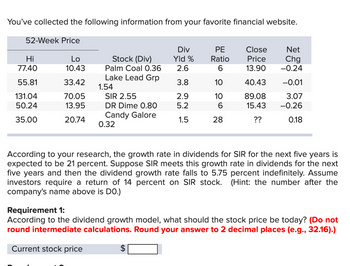

Transcribed Image Text:You've collected the following information from your favorite financial website.

52-Week Price

Div

PE

Close

Net

Hi

Lo

Stock (Div)

Yld %

Ratio

Price

Chg

77.40

10.43

Palm Coal 0.36

2.6

6

13.90

-0.24

Lake Lead Grp

55.81

33.42

3.8

10

40.43

-0.01

1.54

131.04

70.05

SIR 2.55

2.9

10

89.08

3.07

50.24

13.95

DR Dime 0.80

5.2

6

15.43

-0.26

Candy Galore

35.00

20.74

1.5

28

??

0.18

0.32

According to your research, the growth rate in dividends for SIR for the next five years is

expected to be 21 percent. Suppose SIR meets this growth rate in dividends for the next

five years and then the dividend growth rate falls to 5.75 percent indefinitely. Assume

investors require a return of 14 percent on SIR stock. (Hint: the number after the

company's name above is DO.)

Requirement 1:

According to the dividend growth model, what should the stock price be today? (Do not

round intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).)

Current stock price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 12 images

Knowledge Booster

Similar questions

- naranarrow_forwardUse the following tables to assess the worthiness of Verticon stock as an investment. Verticon Stock Data (Current and Historical) 3:45PM EDT Aug 16, 2011 Price 18.85 USD Change +0.64 (+3.51%) Mkt cap 147.1B Div/yield 0.20/4.24 Shares 8,012 Beta 0.70 Book/share 11.335 EPS 1.11 12/2010 12/2009 12/2008 (Millions of Dollars) Total Assets 195,014 195,949 111,148 Total Liabilities 107,201 122,935 53,592 Preferred Shareholders’ Equity 52 61 73 Common Shareholders’ Equity 87,761 72,953 57,483 Shares Outstanding 8,012 8,070 6746 Book/Share ? 9.040 8.521 Q1 (Mar ’11) 2010 Net profit margin 15.24% 12.24% Return on equity 11.60% 9.30% Which one in bold? One of the most important features of a stock is its book value. The book value per share of Verticon’s stock for the year 2010 was equal to (10.954, 13.693, 11.502). Looking at the (Market cap, EPS, change in price, beta value, ROE) ,…arrow_forwardaa.3arrow_forward

- How would I complete this?arrow_forwardConsider the following information on two stocks: P(State) Stock A Stock B Boom 20% 30% 20% Normal 50% 12% -5% Slow 15% 4% 8% Recession 15% -10% 10% $Investment Beta Asset A $35,000 1.45 Asset B $15,000 0.85 Q1. Calculate the weight of A in the portfolio. (Enter percentages as decimals and round to 4 decimals) Q2. Calculate the expected return on the portfolio. (Enter percentages as decimals and round to 4 decimals) Q3. Calculate the standard deviation of the portfolio. (Enter percentages as decimals and round to 4 decimals).arrow_forwardYou've collected the following information from your favorite financial website. 52-Week Price Hi 77.40 55.81 131.08 50.24 35.00 Lo 10.43 33.42 70.25 13.95 20.74 Stock (Div) Palm Coal 0.36 Lake Lead Grp Overvalued 1.54 SIR 2.75 DR Dime 0.80 Candy Galore 0.32 Div PE Yld % Ratio 2.6 6 10 10 6 28 3.8 3.1 5.2 1.5 Close Net Price Chg 13.90 -0.24 40.43 -0.01 89.12 15.43 ?? 3.07 -0.26 0.18 According to your research, the growth rate in dividends for SIR for the next five years is expected to be 21 percent. Suppose SIR meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 5.75 percent indefinitely. Assume investors require a return of 15 percent on SIR stock. Requirement 1: According to the dividend growth model, what should the stock price be today? (Do not round intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16).) Current stock price Requirement 2: Based on these assumptions, is the stock currently overvalued,…arrow_forward

- Review the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardThe Bloomberg screen below shows the Nasdaq Index price over the last year. Describe the technical indicator used from the chartist and what trade signal it may suggest. CCMP €T On 03 CCMP Index 11/04/2020 Study RSI 1D 3D 1M 6M YTD 1Y 5Y Max Daily Volume 1.000B IRSI (14) on Close (CCMP) 75.3572 Nov C 15811.58 +161.98 Nov 0 15658.52 H 15821.58 L 15616.44 Prev 15811.58 94) Suggested Charts 96) Actions 97) Edit 11/04/2021 Last Px Local CCY Mov Avgs Period 14 Overbought 70 Oversold 30 1 Table + Compare ▾ Add Data Track Annotate News Zoom Key Events 2020 Dec Jan Feb Mar Apr May Jun 06/03/21 Jul Aug Relative Strength Index ไปได้ Sep Edit Chart * Oct 15811.5801 15013.0596 14198.1699 Last Price THigh on 11/03/21 Average 15811.5801 15821.5801 12000 13839.5049 Z-VOU 1 Low on 11/04/20 11394.21 11075.4473 ISMAVG (50) on Close 15013.0596 SMAVG (100) on Close 14805.082 SMAVG (200) on Close 14198.1699 13000 10000 3B 2B 1.000B -0 100 75.3572 -50 -0arrow_forwardVijayarrow_forward

- Given the following stock quotation, find the highest price during the last year. (Refer to Exhibit 20–3.) Pfizer PFE 15.52 16.22 15.67 15.83 0.50 3.26 38,228,171 19.95 13.72 0.73 4.61 14.8 −12.00 A. $15.83 B. $16.22 C. $19.95 D. $38.23arrow_forwardWhat is the most you should be willing to pay for the stock in the table? Expected Expected Price in 1Dividend in 1 year Required Current Return Price Year $376.29 $3.91 5.80% $89.00arrow_forward1 You've collected the following information from your favorite financial website. 52-Week Price Lo 10.43 Acevedo .36 Hi 77.40 55.81 130.93 50.42 35.00 Stock (Dividend) Required retum 33.42 Georgette, Incorporated 1.54 YBM 2.00 69.50 14.13 Manta Energy .98 20.74 Winter Sports.32 Dividend PE Ratio. Yield % 2,65 3.8 2.2 6.3 1.5 6 10 10 6 28 Close Price: Net Change 13.90 40.43 88.97 15.61 77 According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 13 percent. If investors feel this growth rate will continue, what is the required return for the stock? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. -24 -.01 3.07 -.26 18arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education