Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

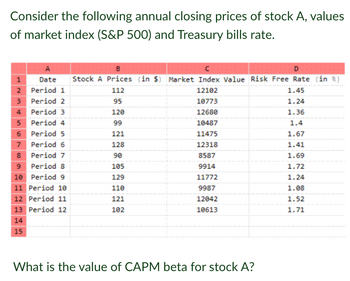

Transcribed Image Text:Consider the following annual closing prices of stock A, values

of market index (S&P 500) and Treasury bills rate.

1

2

3

45678

A

B

C

D

Date Stock A Prices (in $) Market Index Value Risk Free Rate (in %)

Period 1

112

12102

Period 2

95

10773

120

12680

99

10487

121

11475

128

12318

90

8587

105

9914

129

11772

110

9987

121

12042

102

10613

Period 3

Period 4

Period 5

Period 6

Period 7

9

Period 8

10 Period 9

11 Period 10

12 Period 11

13 Period 12

14

15

What is the value of CAPM beta for stock A?

1.45

1.24

1.36

1.4

1.67

1.41

1.69

1.72

1.24

1.08

1.52

1.71

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Review the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardConsider the following annual closing prices of stock A, values of market index (S&P 500) and Treasury bills rate. A B C с D Date Stock A Prices (in $) Market Index Value Risk Free Rate (in %) 2 Period 1 119 3 Period 2 100 11829 11843 9639 88 131 12854 9580 11640 8469 11412 9115 10682 NOSAWNH 1 4 Period 3 Period 4 6 Period 5 7 Period 6 8 Period 7 9 Period 8 10 Period 9 11 Period 10 12 O 1.1 13 What is the value of CAPM beta for stock A? O 1.4666 O 1.8333 O2.0533 82 113 O 0.3666 65 109 95 113 1.48 1.76 1.64 1.2 1.43 1.36 1.3 1.72 1.71 1.77arrow_forwardIntro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Probability E(rA.s) E(rB,s) -0.1 0.04 0.08 0.05 0.13 0.07 Recession 0.2 Normal 0.5 Expansion 0.3 Part 1 What is the expected return for stock A? 3+ decimals Submitarrow_forward

- Stocks A and B have the following historical returns: 2017 2018 2019 2020 Year Stock A's Returns, "A Stock B's Returns, r 2016 (23.80%) 22.50 (17.70%) 24.50 ITT 14.25 (2.25) 25.00 24.00 (9.70) 14.60 % a. Calculate the average rate of return for each stock during the period 2016 through 2020. Round your answers to two decimal places. Stock A: Stock B: % b. Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would the realized rate of return on the portfolio have been each year? Round your answers to two decimal places. Negative values should be Indicated by a minus sign. Year Portfolio 2016 % 2017 % 2018 % 2019 % 2020 % What would the average return on the portfolio have been during this period? Round your answer to two decimal places. % c. Calculate the standard deviation of returns for each stock and for the portfolio. Round your answers to two decimal places. Standard Deviation Stock A % Stock B % Portfolio % d. Calculate the coefficient of…arrow_forwardWhat is the expected return of the following portfolio? Stock Price Per Share Number of Shares Security Expected Return A $ 16 1509.01 B $ 13 175 10.53arrow_forwardBhupatbhaiarrow_forward

- An index consists of the following securities. What is the value-weighted index return? Value-weighted Stock Shares Outstanding Beginning Share Price Ending Share Price L 4,000 $ 18 $ 26 M 3,000 $ 35 $ 41 Multiple Choice 22.03% 22.85% 25.25% 28.25% 30.00%arrow_forwardThe common stock of XMen Inc. had the following historic prices. Time 3/01/1999 3/01/2000 3/01/2001 3/01/2002 3/01/2003 3/01/2004 Price of X-Tech 50.00 47.00 76.00 80.00 85.00 90.00 A. What was your holding period return for the time period 3/1/1999 to 3/1/2004? B. What was your annual holding period yield (Annual HPY)? C. What was your arithmetic mean annual yield for the investment in XMen Industries. D. What was your geometric mean annual yield for the investment in XMen?arrow_forwardSuppose a market consists of four stocks. The number of shares outstanding for each stock as well as the stock prices in two consecutive days are as follows: Stock A Stock B Stock C Stock D Shares outstanding 200 1000 400 3000 I $5 $30 $100 $40 Ро $15 $25 $80 $50 a) Compute the percentage increase in the price-weighted index for this market. b) Compute the percentage increase in the value-weighted index for this market. P₁arrow_forward

- Year AT&T Stock Returns Market Index Returns 1 8 6 2 7 3 3 10 12 4 14 13 5 8 9 Compute the correlation coefficient between AT&T and the Market Index. Enter answer using 3 decimal places. Example 0.123arrow_forwardAssume these are the stock market and Treasury bill returns for a 5-year period: Year 2016 2017 2018 2019 2020 Stock Market Return (%) 33.30 13.20 -3.50 14.50 23.80 Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) 3 Required A Required B T-Bill Return Complete this question by entering your answers in the tabs below. Standard deviation (%) 0.12 0.12 0.12 0.07 0.09 x Answer is complete but not entirely correct. Required C What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. 13.69 X % घarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education