Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

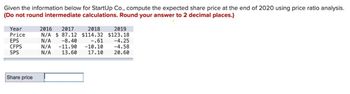

Transcribed Image Text:Given the information below for StartUp Co., compute the expected share price at the end of 2020 using price ratio analysis.

(Do not round intermediate calculations. Round your answer to 2 decimal places.)

Year

Price

EPS

CFPS

SPS

Share price

2016 2017

N/A $87.12

N/A

N/A

N/A

-8.40

-11.90

13.60

2018

2019

$114.32 $123.18

-.61

-10.10

17.10

-4.25

-4.58

20.60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume General Motors announced a quarterly profit of $119 million for 4th quarter 2019. Below is a portion of its balance sheet. Conduct a horizontal analysis of the following line items. (Negative answers should be indicated by a minus sign. Round the "percent" answers to the nearest hundredth percent.) 2019 (dollars in millions) 2018 (dollars in millions) Difference % CHG Cash and cash equivalents $ 15,980 $ 15,499 Marketable securities 9,222 16,148 Inventories 13,642 14,324 Goodwill 1,278 Total liabilities and equity $ 103,249 $ 144,603arrow_forwardYearEPSDividendChange 20130.75 20140.78 20150.81 20160.82 20170.85 20180.90 Payout Ratio:30% Required Rate of Return: 10% Current Stock Price P0:$5.00 1) Dividend amount in 2013: 2) Dividend CAGR: 3) 2019 Dividend: 4) Intrinsic value: 5) Compared to P0: 6) Required rate of return (solver or goal seek): The following table contains the six-year EPS history for Corporation X. The dividend payout ratio is 30%. 1) What is the dividend amount paid in 2013? 2) What is the compound growth rate (CAGR) of the dividend based on the dividend paid from 2013 - 2018? 3) Assume dividend is growing at the the compound growth rate of the dividend in 2019, what is the dividend per share paid in 2019? 4) Use dividend constant growth model, calculate the intrinsic value of the stock using a 10% required rate of return. 5) How does the calculated intrinsic value compare to the current stock price of $5? Use IF statement. 6) Use the Goal Seek or Solver option to find the required rate…arrow_forwardi. Use the following simplified 2019 balance sheet to show, in general terms, how an improvement in one of the ratios—say, the DSO—would affect the stock price. For example, if the company could improve its collection procedures and thereby lower the DSO from 38.1 days to 27.8 days, how would that change “ripple through” the financial statements (shown in thousands below) and influence the stock price? Accounts receivable $ 402 Debt $ 965 Other current assets 888 Net fixed assets 361 Equity 686. Total assets $1,651 Total liabilities and equity $1,651 j. Although financial statement analysis can provide useful information about a company’s operations and its financial condition, this type of analysis does have some potential problems and limitations, and it must be used with care and judgment. What are some problems and limitations?arrow_forward

- Faux Corp Stock Over the Last 10 years - Beta = 1.1 - Market Risk premium = 10% - Current risk-free rate 3% - Last dividend $5 - Current Stock Price $30 Dividend History 2016 - $4.20 2017 - $4.40 2018 - $4.55 2019 - $4.75 2020 - $5.00 1. Calculate the cost of equity using SMLarrow_forwardes Given the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price 2016 $ 97.60 2017 $ 103.50 2018 $ 102.20 2019 $ 99.70 2020 $ 121.20 2021 $ 136.60 EPS CFPS 2.80 8.22 3.51 4.31 5.01 7.95 8.95 9.00 9.28 11.07 12.37 13.48 SPS 52.60 57.60 57.00 60.50 71.70 79.70 Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forwardGiven the information below for Seger Corporation, compute the expected share price at the end of 2022 using price ratio analysis. Assume that the historical (arithmetic) average growth rates will remain the same for 2022. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Year Price EPS CFPS SPS 2016 $61.10 Using PE ratio Using P/CF ratio Using P/S ratio 3.35 8.12 31.20 2017 $67.00 4.06 8.92 36.20 $ $ 2018 $ 65.70 4.86 9.22 35.60 Share Price 0.17 0.11 2019 2020 $ 63.20 $ 84.70 5.56 7.85 10.97 12.31 39.10 50.30 2021 $100.10 8.85 13.44 58.30arrow_forward

- Please no hand writing solutionarrow_forwardRaghubhaiarrow_forward17. Based on the following table, if you invest $15,000 into AAPL stock at the beginning of the period, what would be the dollar value of your investment at the end of the time period? AAPL Date 2/1/2023 13.33% 3/1/2023 -13.99% 4/1/2023 6.53% 5/1/2023 -3.68% 6/1/2023 9.01% 7/1/2023 1.81% 8/1/2023 7.13% 9/1/2023 0.43% 10/1/2023 -2.66% 11/1/2023 5.33% 12/1/2023 4.77% 1/1/2024 12.89% Average Variance St. Dev. A. $15,512 B. $16,154 C. $19,467 D. $21,725 E. $22,831 3.41% 0.005910 7.69%arrow_forward

- Roundall dollar answers to 2 decimal places and record all interest rate, coupon rate and growth rate answers as a percentrounded to one decimal place. 26. The historical stock returns for GAF, Inc. are listed below: Year -Annual Stock Return2013 -12%2014 14%2015 35%2016 2%2017 -16%2018 8%2019 0%2020 34%2021 12%2022 6% What is the standard deviation of returns for GAF, Inc. stock over the 10-year time period? (Compute the standard deviation assuming this is a population of returns, not a sample – that is, use the procedure describedin the textbook for calculating the standard deviation of a series of stock returns).27. The end of year stock price and the dividend paid each year for Maxwell, Inc. stock for years 0 through 6 arelisted in the table below: Year -End of Year Stock Price- Dividend0 $12.00 $ 01 $14.86 $1.802 $7.95 $1.883 $8.00…arrow_forwardOn 13th November 2019, Marks & Spencer’s CEO buys 100,000 shares of MKS at £185.5. Outline the key steps if you are using the market model to estimate the cumulative abnormal returns CAR (0, 60) event window related to this event.arrow_forwardStock price of ABC company at the end of 2018 was $85. In 2019 the quarter end stock prices are $94, $80, $75, and $70 for the 1st, 2nd, 3rd, and 4th quarters respectively. If company pays $4.8 dividend at the end of each quarter what is the annual return for 2019?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education