Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give correct calculation

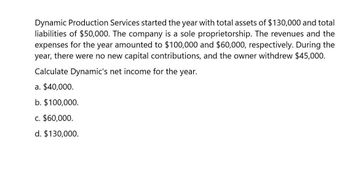

Transcribed Image Text:Dynamic Production Services started the year with total assets of $130,000 and total

liabilities of $50,000. The company is a sole proprietorship. The revenues and the

expenses for the year amounted to $100,000 and $60,000, respectively. During the

year, there were no new capital contributions, and the owner withdrew $45,000.

Calculate Dynamic's net income for the year.

a. $40,000.

b. $100,000.

c. $60,000.

d. $130,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardBrandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of goods sold was 240,000, its operating expenses were 50,000, its interest revenue was 2,000, and its interest expense was 12,000. Brandts income tax rate is 30%. Prepare Brandts multiple-step income statement for the current year.arrow_forwardMicro, Inc., started the year with net fixed assets of $76,175. At the end of the year, there was $97,925 in the same account, and the company's income statement showed depreciation expense of $13,935 for the year. What was the company's net capital spending for the year? Multiple Choice O $35,685 $43,580 $21,750 $41,170 $83,990arrow_forward

- In its first year of operations, Martha Enterprises Corp. reported the following information: a. Income before income taxes was $640,000. b. The company acquired capital assets costing $2,400,000; depreciation was $160,000, and CCA was $120,000. c. The company recorded an expense of $155,000 for the one-year warranty on the company's products; cash disbursements amounted to $79,000. d. The company incurred development costs of $77,000 that met the criteria for capitalization for accounting purposes. Development work was still ongoing at year-end. These costs could be immediately deducted for tax purposes. e. The company made a political contribution of $30,000 and expensed this for accounting purposes. f. The income tax rate was 28% and the year 2 tax rate was enacted, at 30%. In the second year, the company reported the following: a. Earnings before income tax were $1,700,000. b. Depreciation was $160,000; CCA was $360,000. c. The estimated warranty costs were $250,000, while the cash…arrow_forwardIn its first year of operations corporation Lauzer has the following results for the year: Gross income from operations $700,000 operating deductible expenses (200,000) short term capital gains 5,000 short term capital losses (14,000) long term capital gains 8,000 long term capital losses 3,000 What is the corporation's taxable income for the year?arrow_forwardA company had a gross income of $45,000 last year. The firm had cash expenses of $23,500. In addition to the cash expenses, the firm bought a piece of land for $10,000. Depreciation expences were $11,575. The taxable income in last year was: A. $12,555 B. $2,255 C. $1,125 D. $33,265 E. $11,125arrow_forward

- (Working with the income statement) At the end of its third year of operations, the Sandifer Manufacturing Co. had $4,522,000 in revenues, $3,362,000 in cost of goods sold, $458,000 in operating expenses which included depreciation expense of $140,000, and a tax liability equal to 34 percent of the firm's taxable income. Sandifer Manufacturing Co. plans to reinvest $52,000 of its earnings back into the firm. What does this plan leave for the payment of a cash dividend to Sandifer's stockholders? Complete the income statement for Sandifer Manufacturing Co.: (Round to the nearest dollar.) Revenues = Less: Cost of Goods Sold = Less: Operating Expenses Less: Interest Expense Less: Income Taxes = = $ $ $ $ Equals: Gross Profit = ... Equals: Net Operating Income = 0 Equals: Earnings before Taxes Equals: Net Income = = $ GA GA $arrow_forwardDuring the current year, Sparrow Corporation, a calendar year C corporation, had operating income of $425,000, operating expenses of $280,000, a short-term capital loss of $10,000, and a long-term capital gain of $25,000. How much is Sparrow's income tax liability for the year? a. $33,600 b. $32,700 c. $45,650 Od. $62,400arrow_forwardThis year, Sigma Inc. generated $636,000 income from its routine business operations. In addition, the corporation sold the following assets, all of which were held for more than 12 months: Initial Basis Acc. Depr.* Sale Price Marketable securities $ 157,600 $0 $ 74,000 Production equipment 115,600 92,480 36,000 Business realty: Land 235,500 0 241,750 Building 263,000 78,900 218,000 *Through date of sale. Required: Compute Sigma's taxable income assuming that it used the straight-line method to calculate depreciation on the building and has no nonrecaptured Section 1231 losses. Recompute taxable income assuming that Sigma sold the securities for $174,000 rather than $74,000. Note: I have part B correct with $705,430. It's part A I am having trouble witharrow_forward

- C Company had the following data for the last year (dollars in thousands): Net income = $700; EBIT = $1,200; Total assets = $3,500; and Total operating capital = $2,100. Information for the current year is as follows: Net income = $800; EBIT = $1,555; Total assets = $3,800; and Total operating capital = $2,500. The company's federal and state tax rate is 35%. How much free cash flow did the firm generate during the current year? Round your answer to the nearest dollar. (Hint: FCF = NOPAT - Net Investment in Operating Capital) Group of answer choices: $605 $617 $611 $608 $614arrow_forwardThe following information relates to Sustagoon Ltd. Profit before tax for the year ended 30 June 2020 was $504,400. The following items were used in determining that profit: Sales revenue 1,450,800 Cost of sales 608,400 Selling expenses 156,000 Administrative expenses 93,600 Other expenses 57,200 Interest expense 31,200 504,400 Other events which occurred during the year: Gain on revaluation of land 26,000 Assume the company’s taxation rate is 30c in the dollar. Required: Prepare a statement of profit or loss and other comprehensive income for the year ended 30 June 2020, in accordance with the requirements of AASB 101. Based on the information received determine whether to disclose by function or nature. Ignore comparatives as the information is not provided.arrow_forwardDuring the year, Pharr Corporation had sales of $459,000. Costs were $388,000 and depreciation expense was $102,800. In addition, the company had an interest expense of $79.250 and a tax rate of 21 percent. What is the operating cash flow for the year? Ignore any tax loss carry-forward provisions. Multiple Choice $72,733 $77,768 O $15,071arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning