Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Please Help me

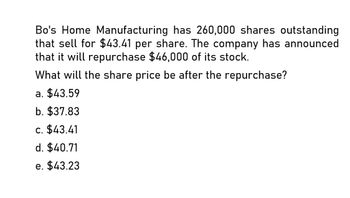

Transcribed Image Text:Bo's Home Manufacturing has 260,000 shares outstanding

that sell for $43.41 per share. The company has announced

that it will repurchase $46,000 of its stock.

What will the share price be after the repurchase?

a. $43.59

b. $37.83

c. $43.41

d. $40.71

e. $43.23

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What Will the share price ??arrow_forwardPlease Solve this Question i need answer what is the earning per share after the repurchase ?arrow_forwardBo's Home Manufacturing has 280,000 shares outstanding that sell for $43.87 per share. The company has announced that it will repurchase $48,000 of its stock. What will the share price be after the repurchase?arrow_forward

- The Cincinnati Chili Kitchen has just announced the repurchase of $155,000 of its stock. The company has 45,000 shares outstanding and earnings per share of $3.41. The company stock is currently selling for $76.87 per share. What is the price–earnings ratio after the repurchase? Multiple Choice 21.53 times 23.55 times 22.54 times 23.05 times 20.92 timesarrow_forwardSolve This Question and provide correct option from givenarrow_forwardStout Inc.'s perpetual preferred stock sells for $65.00 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 10.39% b. 13.62% c. 14.40% d. 14.28% e. 11.81%arrow_forward

- Hettenhouse Company's perpetual preferred stock sells for $103.00 per share, and it pays a $7.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 5.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? a. 7.28% b. 7.50% c. 7.66% Od. 8.23%arrow_forwardshow working with answerarrow_forwardprovide answerarrow_forward

- ABC Inc needs to raise $500 million, Current Stock price is $72.50, underwriter requirement 7.5%, underpricing requirement is 6.00% a. What is the spread? b. What is the underprice? c. How many shares must the company need to sell? d. If the net amount needed is $500 million what are the gross proceeds?arrow_forwardSilicone Systems Inc. shares are trading for $500. Analysts expect Silicone to generate net income of $41.7 billion. Silicone has 900 million shares outstanding. The average P/E ratio of Silicone's competitors is 18. What is the fair price for a share of Silicone Systems? O $463 $500 O $751 $834arrow_forwardA company has just paid an ordinary share dividend of 32 cents and expected to pay a dividend of 33.6 cents in one year’s time. The company has a cost of equity of 13%. What is the market price of the company’s shares to the nearest cent on an ex dividend basis? $3.20 $4.41 $2.59 $4.20 Use the following information to answer questions 18 and 19 Bill plans to open a service centre. The equipment will cost $50,000. Bill expects the after-tax cash inflows to be $15,000 annually for 8 years, after which he plans to scrap the equipment and retire. What is the project’s regular payback period? 2.67 years 3.33 years 3.67 years 4.33 years Assume the required return is 10%. What is the project’s discounted payback period? 4.25 years 5.25 years 6 years the project does not payback on discounted basis.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning